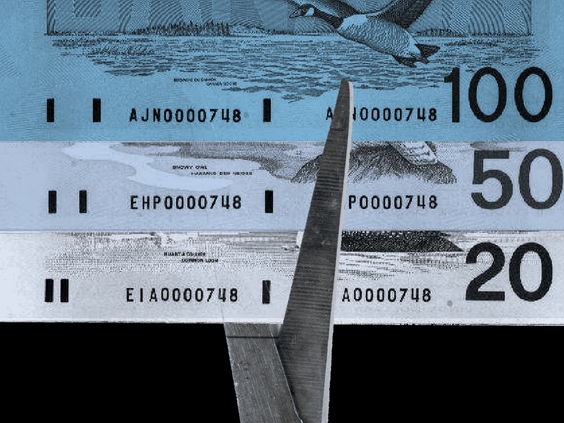

Wealthy on paper, couple with $2.9 million in assets needs to sell a property to finance retirement

With most of their money locked up in real estate and no pensions, B.C. couple must choose the right property to sell Situation: Couple has

Eliott is a regular contributor, in the National Post’s Family Finance column, providing financial advice to Canadians. Eliott specializes in retirement planning and understands that each retirement situation is unique and uses his expertise and a detailed process to create a personalized approach to retirement planning. Many factors are unique to each retirement, and his thorough financial planning process leads to long-term success, helping clients understand their options and achieve their dreams. The key is to plan for an efficient long-term retirement income from all sources and implement that plan in a way that is not going to be changed due to market conditions.

If you would like to have an initial consultation and explore potential solutions for your own needs please click below to book a consultation.

With most of their money locked up in real estate and no pensions, B.C. couple must choose the right property to sell Situation: Couple has

They also want to give their two children $30,000 each for weddings or a good start in adult life Situation: Couple in mid-30s wants to retire

The key to the discretionary spending she wants is three more years of work and boosting her investment returns Situation: Three years from retirement, woman needs

Home equity loan at 4% costs $9,000 a year for interest alone, with rates likely to rise. The loan could ultimately cost Hazel her home

Situation: Couple in costly market wants to know if they should buy or rent and effect on other goals Solution: Compare costs of rental and ownership assuming

"*" indicates required fields