How to profit from investing

In this back-to-basic video, you will learn why you should be investing. Whether it be in stocks, real estate, bonds or even crypto currencies investing

About You

You have built a successful accounting practice which took time, dedication and commitment to your clients’ best interests. Building an accounting practice is one of the most demanding professional practices to build which doesn’t leave any time or energy to worry about your investments as well. Working with professionals who understand your unique needs allows you to focus on what you do best.

We will help you plan and implement a strategy to move you from active business income or salary to passive investment income. Wealthy people have their money work for them, not them working for their money. You will have access to the decision makers in an environment where your needs are paramount.

Business exits come in many forms, but one constant is that business owners looking to sell their practice must plan ahead to ensure a solid framework is in place. Close consultations with professional services such as a lawyers, accountants and even a financial advisor is crucial to a successful transition. Complying with various federal and provincial laws is a big part of selling a practice. Instead of learning as you go or a trial-and-error process, this transition can be made much easier with the advice and experience of professionals.

Download the free ebook to find out the important things to consider when selling your business.

In this back-to-basic video, you will learn why you should be investing. Whether it be in stocks, real estate, bonds or even crypto currencies investing

Preferred Shares are often misunderstood and often misused The financial crisis of 2008-2009 cut significantly into the portfolio values of stock market investors in Canada

Recently I was gifted a book of fables. Although these stories are well over 300 years old, they are surprisingly relevant even today. Times may

Estate planning is not a task many look forward to with joy. It tends not to be viewed as a fun topic of conversation and

How do you measure whether or not your Portfolio Manager is doing a good job? Alternatively, if you are looking for a new PM, how

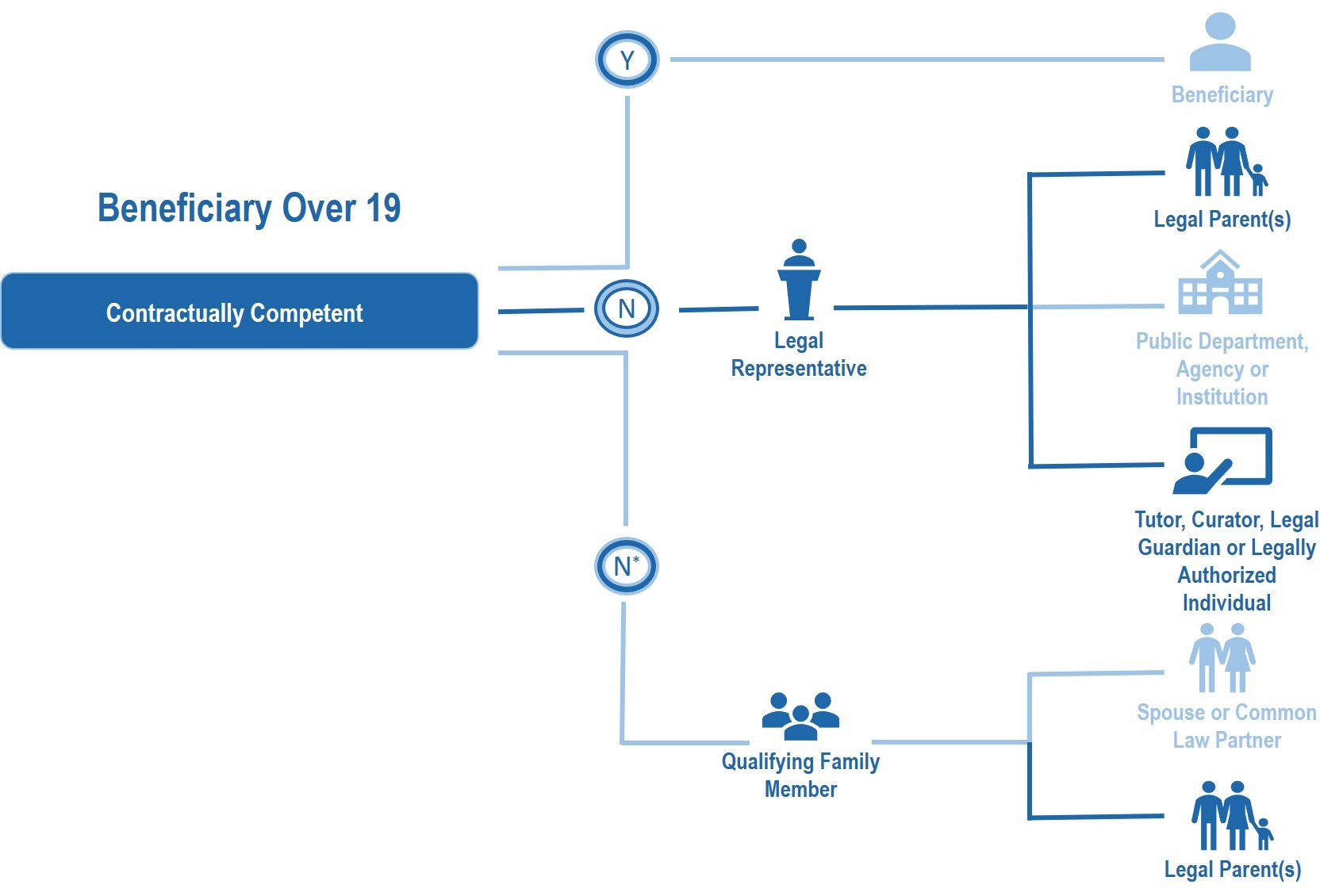

Registered Disability Savings Plans (RDSP) technically have three parties to the plan and each have their own eligibility requirements. There are three parties to an

Established in 2011 Exponent Investment Management is an independent wealth management firm servicing clients from coast to coast. We are not owned by a large bank or insurance company. What does that mean for you? Banks and insurance companies sell products that are designed to generate large fees for the corporation and their shareholders regardless of whether or not these products are the right fit for you. We are different. We listen to you and build simple, diversified portfolios that will help you reach your goals.

Using a proven process that works Exponent portfolios are designed to reduce volatility while providing long term consistent returns. A smoother ride is much more enjoyable and leads to better success overall.

Our fees are transparent and aligned with your interests. You know exactly what you are paying. For information about our fees and performance schedule a consultation here.