What a year!

This year was one for the record books. Most pundits could not have imagined much less predicted the market events that unfolded in 2013.

It was a strong year in the Canadian equities market, with a 13 percent total return (S&P/TSX Composite), although it paled by comparison to the U.S. market, which posted a 41.7 percent total return in CAD terms and a 32.4 percent return in USD terms.

The Canadian Loonie slipped versus the U.S. dollar, depreciating by 7 percent relative to the USD.

It should come as no surprise that the Canadian Broad Composite Bond Index declined slightly in a volatile bond market, as market interest rates began to move up. The Canadian Broad Composite Bond Index turned in a negative 1.2 percent return while the S&P/TSX Canadian Preferred Share Index posted a negative 2.6% for the year.

Market Drivers

The results of the past year were largely based on two principles:

- The central banks intervened in the bond markets to artificially lower interest rates of longer term bonds and mortgage securities. The U.S. Federal Reserve and the Bank of Japan were the most active in the bond market.

- The artificially low rates contributed to inflation of asset prices. However, lower rates also stimulated the lending markets, returning lending activity to normal levels. It also fuelled additional consumer and industrial spending, as borrowers were motivated by the low interest rates. The housing and auto industries were among the biggest beneficiaries of lower rates, although other consumer good sales also benefitted, as did the industrial sector, which was able to increase capital investment due to lower borrowing rates.

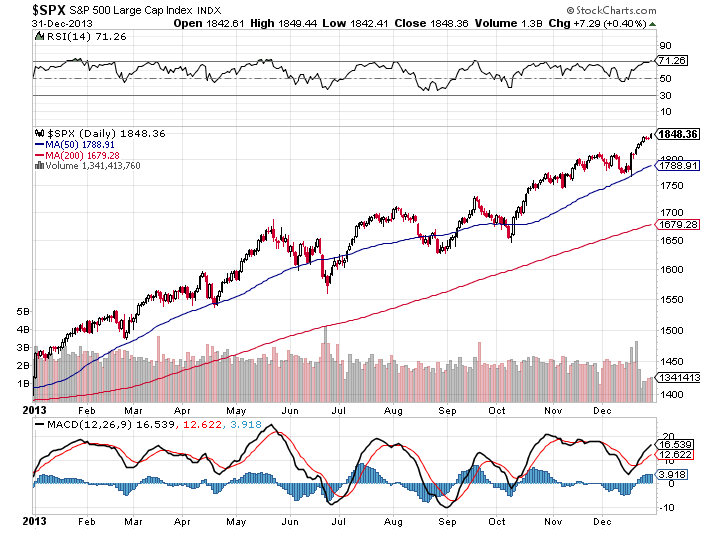

U.S. Market

With consumer and industrial spending levels remaining strong and the economy continuing to stabilize, the S&P 500, which is a proxy for the U.S. equity markets (illustrated on the left), continued to climb. It reached its highest level ever in the fourth quarter at 1848—eclipsing the high of 1772 attained during the third quarter of this year.

With economic data continuing to show slow but steady improvements, investors have turned their attention to Washington. With a new Federal Reserve chairman and the usual cryptic announcements from the Fed regarding future actions, investors were left to continue to speculate on how long the prevailing artificially low interest rates would remain in force.

Although the S&P 500 posted exceptional returns, with a 41.7 percent total return in CAD terms and a 32.4 percent return in USD terms, corporate sales and profit numbers must continue to rise in order to keep the stock market on its current upward path.

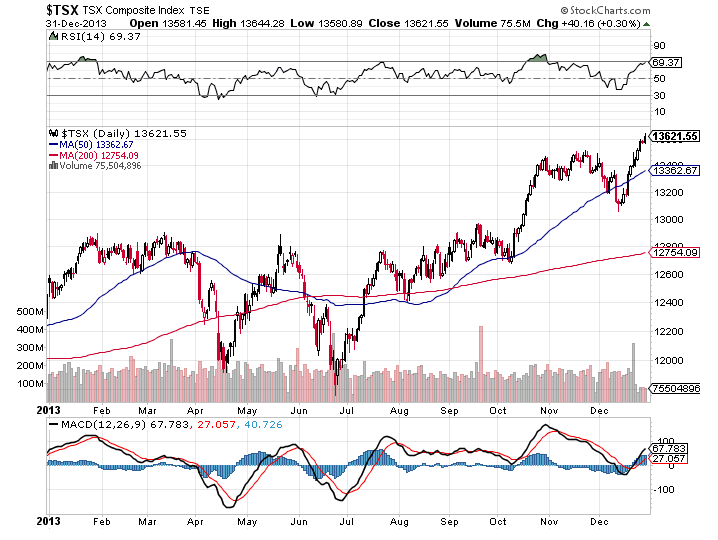

Canadian Market

The 13 percent gain of the Canadian stock market may seem tepid by comparison to the U.S. market, but only in an atypical year would double-digit growth be deemed disappointing.

Two of the three dominant sectors of the Canadian economy posted excellent returns, with the Energy sector (25% of the index) climbing 13.6 percent, and the Banking sector (22% of the index) rising 23.7 percent, but the overall market was restrained by the Materials sector (13% of the index), which posted a significant loss, -29.1 percent, during the calendar year.

The disappointing performance of the Materials sector was not unexpected in light of falling gold prices and a slowing demand for materials from emerging markets.

The pressing question now is how long the Canadian financial market, led by the banking sector, can continue its tremendous run. The financial sector, still recovering from the global mortgage melt-down of 2008, has not experienced a negative year for the past five years. In fact, it has experienced only two negative years over the past eight years—and those declines were precipitated by the global melt-down that devastated the financial markets worldwide. During 2013, the insurance sector led the way with a stunning 42.3 percent return, pulled along by a bullish stock market and increasing interest rates.

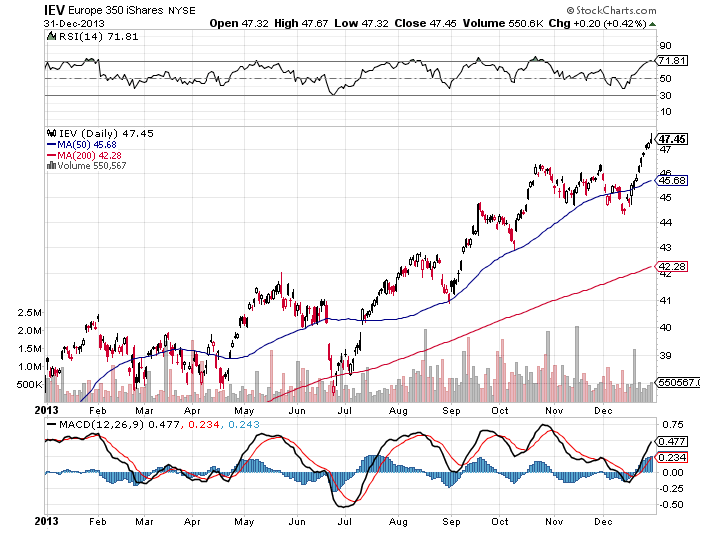

Europe

With negative headlines a distant memory in the European Union region, the Europe 350 (350 largest publicly traded companies based in Europe) also experienced outstanding returns in 2013, posting a 23 percent advance for the year.

The absence of political turmoil combined with improving economic output on the part of many EU members contributed to this advance. The European Central Bank’s statements and actions to further reduce interest rates also contributed significantly to the market tailwinds

What Moved the Markets?

Let’s take a step back and offer some perspective on all the moving parts.

Interest Rates

Most investment values are predicated on interest rates because, quite simply, interest rates represent the cost of money at a particular moment in time. When interest rates are low, future income is worth more than when interest rates are high. Investors will try to establish the worth of this income in the future by predicting future interest rates.

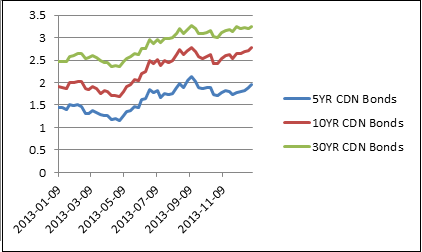

The Canadian Bond Market

Illustrated on the left are the three benchmark yields for the Canadian Bond market based on data compiled by the Bank of Canada.

While interest rates remain low by historic standards, rates trended up in 2013.

What is the significance of this rise in interest rates? Bond prices move in the opposite direction of interest rates. So as rates move up, bond values move down. In 2013, the rise in interest rates resulted in negative returns for bond investors. Long dated maturities posted a decline of 6.2 percent (-6.2%) while shorter term maturities managed a slightly positive 1.7 percent return.

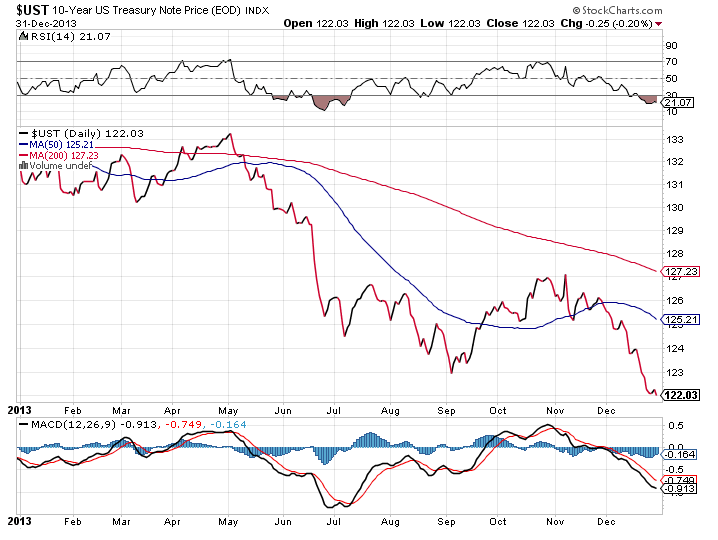

The U.S. Bond Market

The Canadian interest rate market followed the U.S. market, which experienced a significant rise in interest rates during the fourth quarter. Illustrated on the left, you will find the 10-year U.S. bond yield trend for the past quarter. As you can see, the latter part of the year brought on a dramatic increase in interest rates.

To further illustrate the dramatic price action that resulted from interest rate increases, we have illustrated below the price action of these bonds during 2013. In examining the chart, you will see a loss in value of more than 8 percent towards the middle of the year.

We have been advocating for more than two years that investors tread lightly with bonds since prices have been, and continue to be artificially high, buoyed by the artificially low interest rates. Our clients have benefited from this approach as we have sidestepped this landmine while many of our competitors have been steering their clients into this asset class based on the fact that the historical returns before 2012 were quite spectacular. Our job as portfolio manager is to make the right choices of investments that will be included in your portfolio, as well as avoid investments that could prove to be unprofitable in the long term.

Market Undercurrents

Canada

The Canadian economy is experiencing what is commonly referred to as a “soft patch”. Our exports are not growing but remain significant contributors to our economy. This sluggishness is due to the fact that our main trading partners, the United States and China, are also in a “soft patch”.

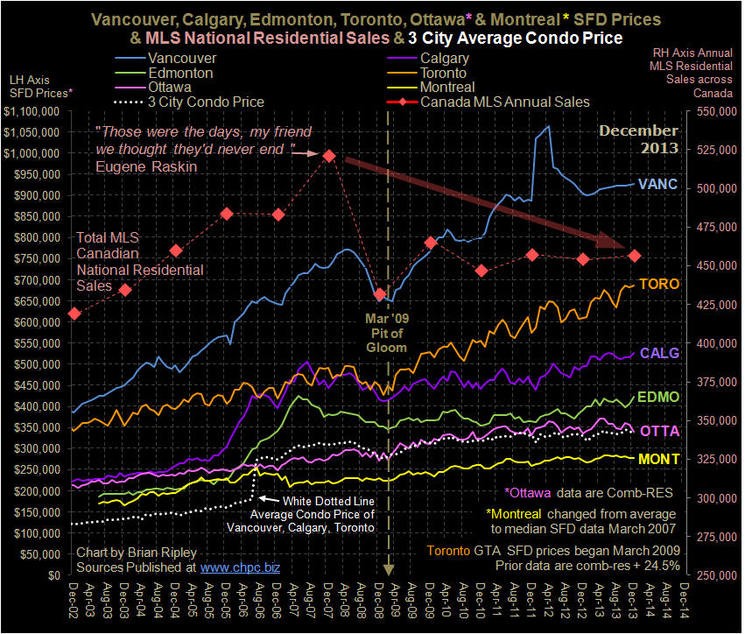

While exports are important to Canada, our internal economy, anchored by consumer spending, is also in a funk. The main driver of consumer sentiment is the health of the housing sector.

The illustration to the left represents the long term housing chart in Canada.

It is clear from the chart that the Canadian housing market is cooling. We are not in a position to comment on whether or not a crash is imminent, but it is safe to say that the mortgage lending, construction and retail sectors are experiencing difficult times.

In fact, high home prices combined with little or no increase in values can lead to a situation in which the consumer is left feeling asset rich and cash poor. When you combine that scenario with high debt levels of Canadian consumers, it is readily apparent that the slow consumer sector will also be with us for some time. Only income growth and/or significant increases in our exports will pull the Canadian economy from this low level of growth.

For 2014, we have reduced some of our Canadian holdings. Our intention is to invest in larger blue chip companies that will benefit from a more robust US and global economy. The sale candidates were more concentrated in the Canadian holdings of the smaller, more domestic-orientated companies.

United States

The equity markets in the U.S. continue to be very kind to Exponent portfolios. We have always maintained positions in the U.S., even in the face of weak markets. In late 2011 and again in late 2012, we made a conscious decision to add to our U.S. holdings. As of the time of this writing, we have paired a little our U.S. stock portfolio in order to make room for our strategic decision to invest in European names.

A wise investor once said you never go broke taking a profit. Our reduction in U.S. holdings is not entirely based on a prescient call on the direction of American equities, but rather our inability to find companies that suit our Exponent profile (sound balance sheet, quality management, growing markets that result in an ability, a history and a policy of growing dividends).

We are happy to report that we have found what we believe to be fertile grounds for reinvestments of these U.S. dollars.

Emerging Markets

We have changed our view on Emerging markets to a much more cautious approach. We don’t believe that the current funk plaguing these markets will persist. The risk-reward profile is not quite where we would like it to be. While we dipped our toes in these markets during 2013, we have reversed course.

Europe

Europe continues to be the region that we find most appealing. The landscape reminds us of what we foresaw two or three years ago in the U.S. We see:

- A currency that has room to appreciate versus the USD and CAD

- A central bank that is increasingly active in lowering interest rates to increase asset prices

- Governments ready and willing to take on the heavy task of structural reforms

- Business leaders having paid and learned from the excesses of the past decade

- Valuations that are at significant discounts to their American and Canadian peers

- Financial results that, in many cases, leave room for significant dividend increases.

We have pared back our U.S. and Canadian holdings to focus on Global franchises that are based in Europe.

You might have noticed sale transactions over the past few weeks, and you will be seeing our redeployment towards these European names over the coming weeks.

The old adage from Warren Buffet—“be fearful when others are greedy and be greedy when others are fearful”—may prove to be golden once again.