A Historical Rebound

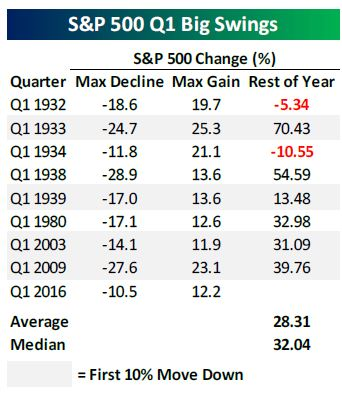

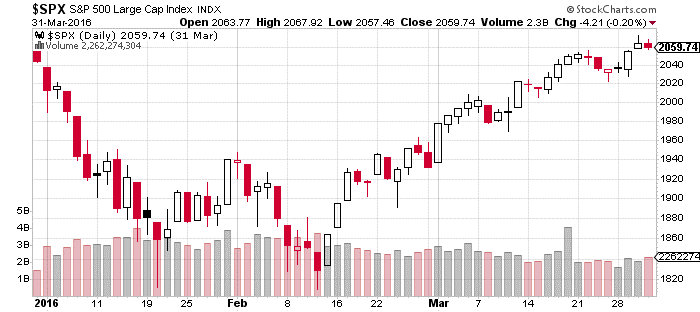

The pendulum swung both ways in the 1st Quarter 2016, as the S&P 500 plunged more than 10 percent to start the year before rebounding strongly in late February and March to finish in positive territory. The Canadian market and most major markets around the world followed suit, diving in the first half of the quarter and bouncing back in the second half.

The early sell-off was ignited by several negative economic factors:

Oil. Oil prices tumbled to new lows of under $30 a barrel, creating angst in both the energy market and the financial sector where oil sector debt had become particularly precarious.

Earnings. Corporate earnings growth appears to be slowing down, giving investors more reason for concern about stock market growth in the near future.

China. The economic slowdown in China that rattled the global markets during the 3rd Quarter 2015 continued to be a concern to investors.

But in the second half of the quarter, several positive developments helped the market rebound from its earlier loss:

Employment growth. U.S. “non-farm” jobs grew by 242,000 in February, according to the U.S. Department of Labor, which gave investors some renewed hope and confidence regarding the strength of the economy.

Oil bounces back. Oil prices bounced back to around $40 per barrel during the second half of the quarter, helping calm the high yield bond market and drive the stock market higher.

Fed keeps rates the same. The Federal Reserve made the decision at their March meeting to hold up on further rate hikes until later in the year, helping further bolster the stock market.

Favorable GDP report. The U.S. “gross domestic product” (GDP) numbers were better than expected. In February, the U.S. Department of Commerce reported that the GDP growth rate in the 4th Quarter, 2015, was 1.4% — which is low by historic standards, but somewhat better than expected.

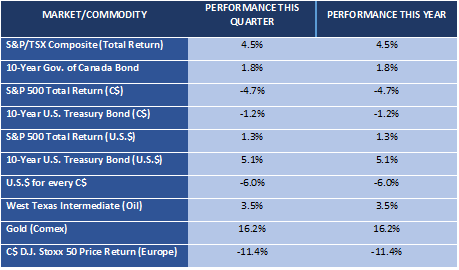

In Canada, a short reprieve in the slumping oil market gave hope to investors and helped propel the stock market to a 4.5% gain for the quarter.

In this 1st Quarter report, we’ll take a look at all of the key areas of the market – in the U.S. Canada, and the around the world. We’ll also give you our assessment of the commodities and bond markets and look at some factors that may affect the markets through the remainder of 2016.

1st Quarter 2016 Market Highlights

The first quarter of 2016 can only be described as an exercise in patience. Fears over the economy in the first half of the quarter caused stocks to plummet more than 10 percent. But some promising economic swings and a slight rebound in oil prices helped propel the S&P 500 to a new high by the end of the quarter.

(See the table below produced by Marketwatch.com for a historical context of the volatility.)

The global markets, including Canada, followed the same topsy-turvy pattern – down significantly in the first half and rebounding stoutly the second half as the oil market showed signs of a recovery.

The table below shows the performance of some of the market we follow:

In short, the story of the first quarter could best be described as a rollercoaster ride, plunging down and soaring up to a new market high. In fact, all asset classes that had a difficult fourth quarter of 2015 saw their price action move in the opposite direction over the first quarter. Time will tell if this change of direction translates into a lasting trend – or is simply a short-term reversal within a larger trend.

1st Quarter 2016 Market Drivers

1. U.S. Markets

The graph below illustrates the violent downtrend and equally vigorous reversal – a 10.5% decline followed by a 12.2% rebound.

1.1 Valuations

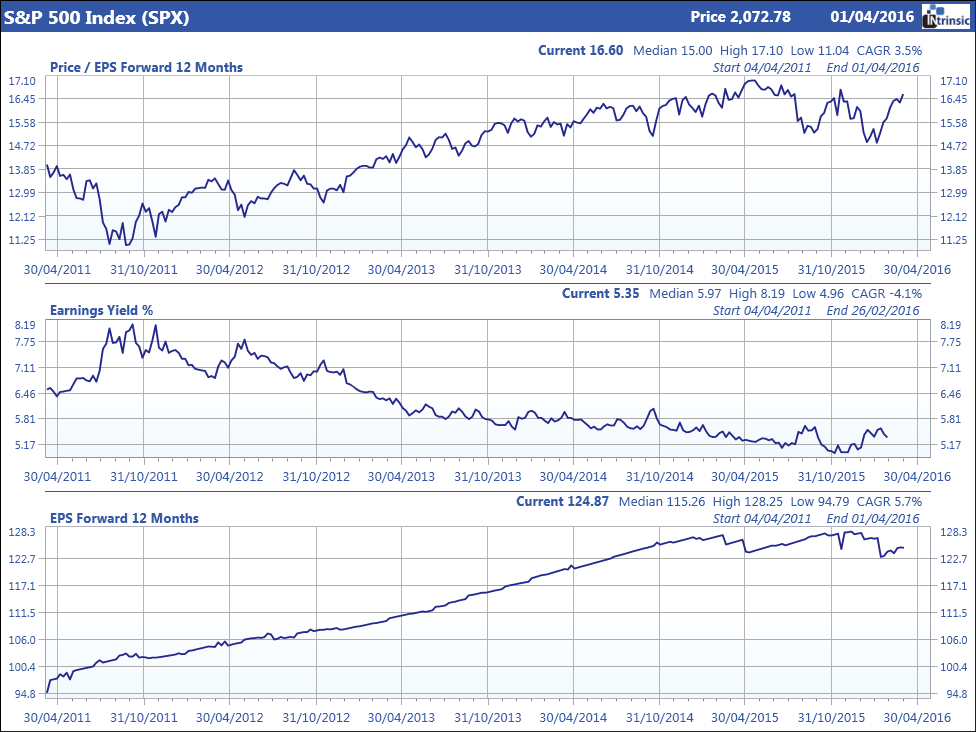

Let’s look at the chart below to get an idea of the valuation of the U.S. market in general; is it expensive or still a buy?

We are lukewarm on this market in terms of valuations:

- For 2016, the consensus is that the S&P 500 companies will now earn $125 per aggregate share, down from $128 last quarter. The lower estimate is a result of lower expectations in the oil and gas space, combined with a stronger USD.

- The forward price/earnings ratio (top pane) was quite volatile. We deployed our cash balance when we saw the ratio move below 15, which also happens to be the median of the last five years. The low for the past five years was 11 and the high was 17.1. We are currently sitting at 17.0, which is above the median, but still well below the high levels of the 1990s when the PE was consistently above 25.

- The middle pane of the graph box above compares what each shareholder in the S&P500 would earn per share based on the earnings of the index. This is known as the “earnings yield” and it allows investors to compare the market price and the yield on bonds.

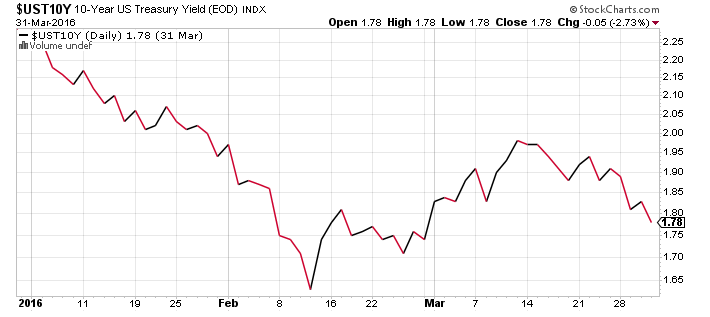

In this case, based on 12-month future projected earnings, owning stocks would yield 5.35% as compared to just 1.78% for ten-year government bonds. This comparison shows that stocks still earn more than twice the yield of bonds, and thus continue to represent a relatively solid value.

This is what we said last quarter regarding the market valuation: “What this (valuation table) tells us is that if we are going to see a significant market downdraft in stock prices, it will not be because stocks are overpriced, but rather due to unforeseen external forces.”

What drove down the stock market in early 2016 was the dramatic fall in oil and the vigorous rise in the USD. These moves seemed to spook investors into thinking that the expected rise in US interest rates combined with the USD level and low oil prices would hurt US earnings and, thus, profitability levels. When the Fed reversed course on interest rates, these fears were not warranted and the equity selling reversed, as oil rebounded and the USD fell slightly versus most other major currencies.

1.2 Earnings

The bottom portion of the graph illustrates the expected earnings of the S&P 500 index. In short, the growth has been fantastic for the past five years. But you can see that the pace of the growth in earnings is waning.

- The graph shows that the earnings level of the market has been flattening. You can also see why some pundits expect to see earnings growth turn negative – which would qualify as a recession.

- U.S. companies face a number of headwinds. While the U.S. consumer is benefitting from lower commodity prices – particularly oil and gasoline – as well as lower interest rates and a stronger USD, the average member of the S&P 500 derives much of their profits (as much as 50%) from outside the U.S.

- Our U.S. names are focused primarily, if not directly, to profit from this situation. In short, we like consumer-oriented stocks that stand to benefit as the “average” American finally begins to benefit from the six-year-old recovery through higher employment and wage growth.

1.3 Risk Appetite

- Keep your eyes on the 10-year bond yields. Investors will continue to have an appetite for stocks as long as the risk-free return is below inflation. We were surprised to see a move down in yields for the quarter, which was driven by lower confidence in the stock market.

- Investors continue to keep an eye on the U.S. Federal Reserve for the timing of rising rates. The Fed has indicated that they are likely to raise rates two more times this year, but it’s difficult to predict exactly when those rate hikes will occur.

- Clearly, the risk appetite is diminishing for investors. In the short term, a market drop can be scary and even painful. But we saw the recent market drop as an opportunity. We deployed a significant portion of our cash hoard where possible, but remain vigilant on individual names. If we see prices getting ahead of the fundamentals, we will act quickly and sell the positions.

2 Canadian Markets

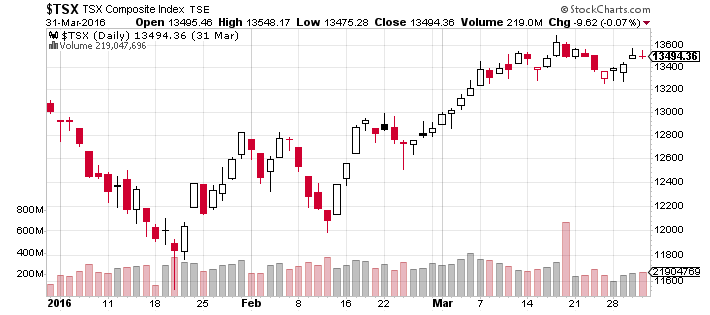

The Canadian market (TSX Composite Index), illustrated above, rebounded from a -8.3% performance in 2015 with a 4.5% return for the first quarter of 2016. The performance in 2016 posted by the TSX made it one of the best performing equity markets in the world. This performance is a result of the rebound in commodity stocks, including oil, materials and gold. Question is, are we witnessing a lasting turnaround or a countercyclical rally?

- We continue to be of the opinion that oil prices will stay at these lower levels for a long period of time, despite the recent rally. The downturn is a result of oversupply, not a lack of global demand. As such, this supply needs to naturally disengage from the market – either by high cost producers leaving the industry by way of bankruptcies or by an orchestrated lower production agreement amongst the OPEC countries.

- Given the unlikely scenario of OPEC members agreeing to not only curtail production, but respect any agreement for longer than it takes a snow ball to melt in the Arabian desert, we are of the opinion that the oversupply issue will end either by slower demand by way of a global economic slowdown or, the more likely scenario, corporations in non-OPEC countries permanently reducing production. For this cut in production to materialize, bond holders and/or banks who are currently keeping many oil producers alive, must decide to throw in the towel and cut off funding by calling in their loans.

- It is important to remember that oil prices are political in nature. The OPEC block uses oil revenues as way to raise funds in order to finance economic, political and geo-political initiatives. Economics do not always make it to the top of the list. For most economic agents, lower prices would curtail most to lower production, especially if the market price is below the marginal cost of production. However, if a government is reliant on oil revenue to finance the operations of a country, regime or geo-political aspirations, the reverse happens; lower oil prices beget more production. For example, OPEC produced, on average, 35.9 millions of barrels per day in 2014 when prices were between $100 and $60 per barrel. For 2016, OPEC expects to produce about 37.1 millions of barrels per day when price estimates are expected to range between $20 and $50 per barrel. As Yoda would say: “Rational decision making, this is not”.

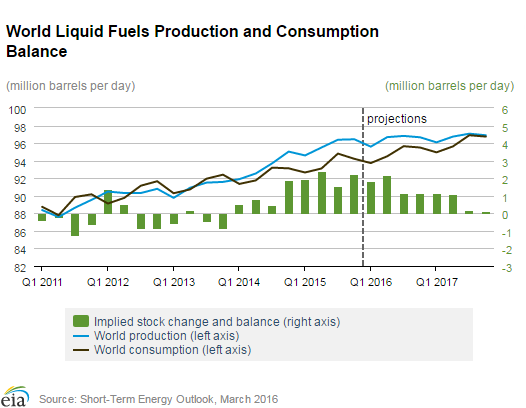

- One final interesting fact about oil: the market is still oversupplied. The International Energy Agency expects that the average daily supply for oil will be at 96.4 million barrels while demand is expected to come in at 94.8 million barrels each and every day. Please refer to the graph below for the supply/demand curve.

- A simple way to look at the oil market is to look at both the over/under production for each day. Currently we have an oversupply of a little less than 2 million barrels per day, as illustrated by the green bars in the above chart. Supply and demand, as illustrated by the black and blue lines in the above chart, are not expected to be in equilibrium until late 2017 or early 2018.

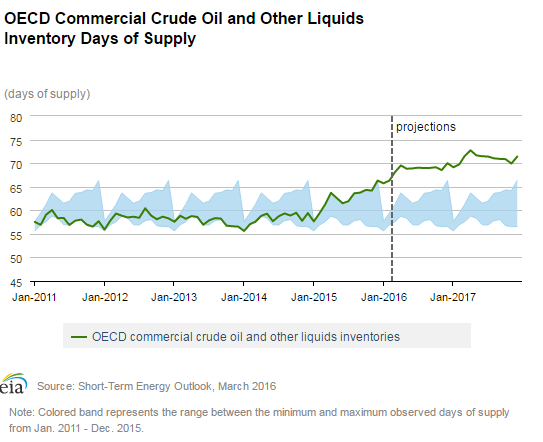

- Even more compelling reasons for lower oil prices are not only the imbalance between supply and demand, but also the accumulated imbalance, otherwise known as the stock or inventory of oil. The chart below illustrates this by the number of days of inventory of oil on a global basis. Since 2011, the inventory has been stable at around 55-60 days. In the next two years, it is expected to jump to over 70 days, an increase of 17%. In short, the data tells us that this oversupply situation will continue for at least another year. Even then, it will take some time for the accumulated inventories to be worked through.

The best cure for oversupply is lower prices – even though it is painful for the producers (especially the inefficient ones). It is important to note that the Canadian producers who will survive if not thrive in a lower price environment will do so because of innovation and rationalization of operating costs. This rationalization will come by reducing input costs, which includes the more efficient use of inputs such as water, chemicals, diesel or natural gas. Could we see a day when Canadian producers become the poster children for efficient production and best of breed when it comes to environmental impact?

Pushed further, some are even hoping that Canadian producers become so efficient because of the need to survive in a lower price environment that they will be able to charge a premium for every barrel of oil they produce. Consumers would theoretically be willing or induced to pay for “greener” or “cleaner” oil. Although this concept of a commodity that can be differentiated for qualitative reasons might seem outlandish and far-fetched today, there a historical precedent: conflict-free diamonds.

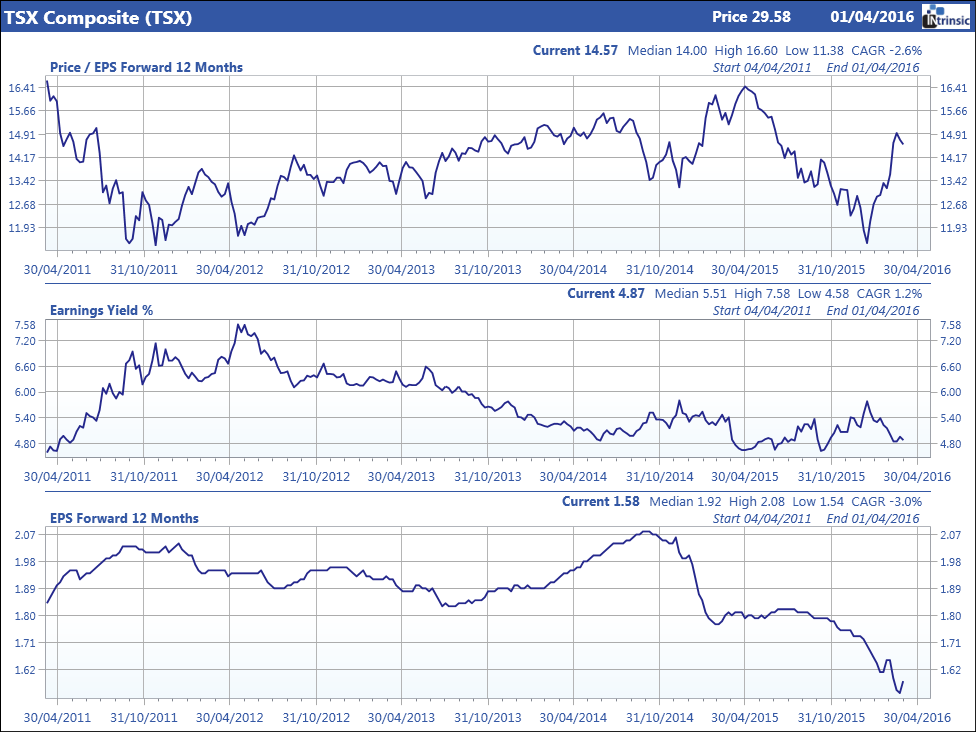

Above is our familiar look at the TSX from a fundamental level. The top pane of the chart displays the PE ratio (what investors are willing to pay for a dollar of earnings). In the past five years, when investors were giddy, they paid up to 19.5X, and now they will pay about 14.6X. From a historical valuation perspective, this is a relatively mild change given that the 5-year median is 14X. The problem is that this valuation comes in the context of falling earnings as illustrated by the lower pane. In other words, investors are paying a higher multiple because they expect a rebound in earnings.

We do not share this optimistic view. Like our beloved Senators, the Canadian economy does not possess the ideal conditions. The dollar is currently too high to provide a meaningful advantage in terms of exports, and, while commodity prices have rebounded, that rebound does not represent meaningful progress nor permanent footing for the economy. Like all cycles, we believe the recent upward move in oil prices is a counter trend rally within a downward trend for our economy. So while the Senators are good enough to make or narrowly miss the playoffs each year, they are too good to have good draft picks every year and improve on a more meaningful way and on permanent footing.

We remain focused on Canadian exporters or companies with meaningful ex-Canada operations. Not only do we expect the currency exchange rates to provide some relief, but we expect the economy in the U.S. and even Europe to post better results.

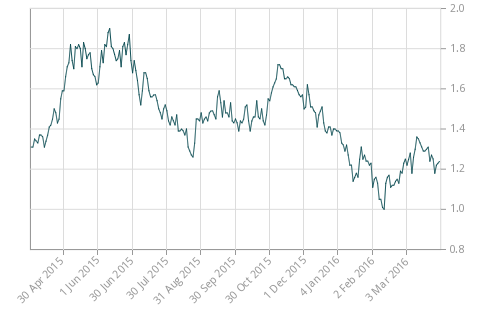

When we look at the middle pane, which illustrates the earnings yield of equity holders in Canada, and compare this valuation to Canadian bonds, we can see that the earnings yield that investors are receiving represents a premium over bonds, since the yield on a 10-year Government of Canada bond hovers around the 1.2% level. The trend does flatten out, which would indicate that either earnings must improve or prices must fall for future appreciation to continue. Having said that, investors realize that there are simply no compelling returns available in the market other than in stocks. Canadian investors are between a rock and hard place.

In short, Canada is cheap and will probably get cheaper, with no catalyst for a change of opinion on that. We would take this opportunity in the CAD rebound versus the USD to add exposure to international markets if exposure is below your comfort level.

3 Foreign Markets

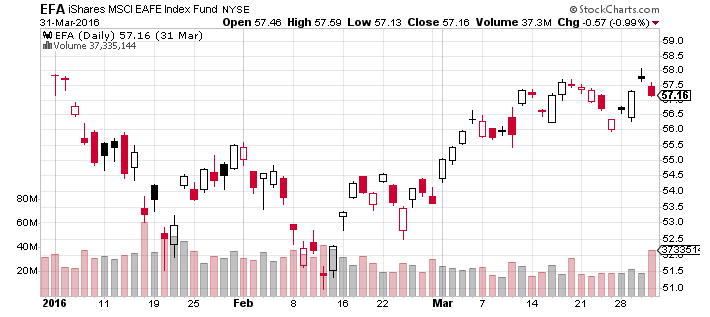

Above is the Morgan Stanley index that represents Europe, Australia and the Far East shows that the return was flat for the quarter despite the initial price decline and subsequent rally.

- While the higher USD is still causing a problem for many Asian economies – since their commodity input costs are priced in USD and thus not benefiting from the full benefit of lower prices – these markets saw a reprieve as the USD dropped about 6% versus a basket of global currencies.

- We are still concerned that many emerging companies and governments have issued debt in USD. As the USD marched forward in 2016, interest payments in local currencies rose in step with the rise in the USD. Those higher payments can be a drag on these economies. The more they pay in interest, the less they can contribute to the global economy.

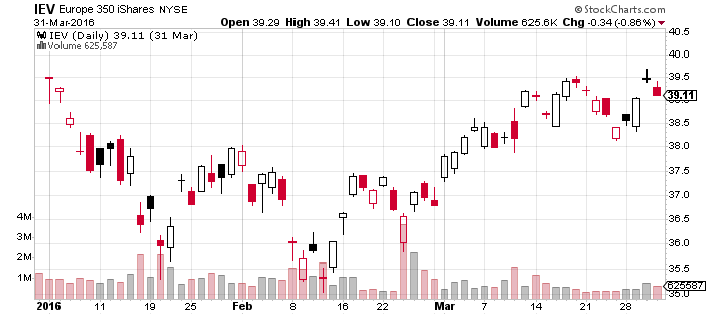

As the above chart illustrates, Europe also participated in the global equity seesaw. The region was slightly down for the quarter in terms of performance in USD.

- Europe is in the second year of its turnaround from a stock perspective. We have some tweaking to do on that front, but our thesis remains intact. We expect to make money in Europe well before we see a recovery in the Canadian market.

- Foreign investors in the European market must contend with two variables – equity prices and the currency level. The Euro is currently 18% below its high versus the USD in 2014. This is why we maintain that currently this is a great entry point to invest in the European continent from a currency point of view.

- When we look at a three year graph (below) of the 350 largest companies represented by the IEV exchange traded fund, we can also see that the index is down 20% from its high in 2014.

- In short, these two data points show that European stocks are a good value from a currency and valuation point of view.

4 Bonds and Interest Rates

The above chart of the U.S. 10-year bond shows a significant reduction in yields, which translates into higher prices for the asset class. At the end of the quarter, investors were locking returns of 1.78% for ten years.

- It seems our expectation for a march upwards in yields towards 2.75% or even 3% by this time next year would be either delayed or simply wrong. We remain unsure of the outcome of this projection given that the U.S. Fed has signaled a pause before raising short term interest rates.

The graph below from the Bank of Canada shows bond yields for the 10-year maturity throughout the past twelve months:

- The yields in 2015 for the 10-year Government of Canada bond ranged from 1.25% to a high of about 1.9%. This equity selloff drove investors to the bond market, thus driving prices up and yields down to low of 1%. In other words, some investors locked in a 1% return for ten years!

- By comparing the bond yields of the 10-year Government of Canada chart above and the U.S. Government bond chart we showed earlier, you can see why our loonie bounced back. There were two primary reasons: oil prices rallied 3.5% while our 10-year interest rates climbed into the 1.25%-1.35% range – a significant rebound in a short time period. This rebound was felt all along the maturities.

- This situation is not about to change soon. The low loonie will be with us for a while yet. We would be surprised (and actually a bit concerned) if our 10-year yields moved above 2% in the next year.

- The CAD rebound in the first quarter versus the USD seems to be predicated more on the fact that the USD gave ground. Case in point, the USD fell 6% versus a basket of global currencies (Euro, Yen, Swiss Franc, Chinese Yuan), which mirrors its loss versus our loonie.

5 Options

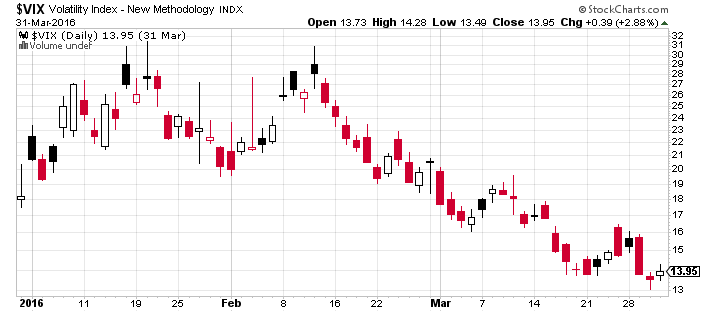

The following VIX chart measures the volatility of the S&P 500 on 30 day rolling periods.

A few remarks:

- Volatility spiked during the quarter, and in a significant fashion. Anytime you see the VIX above 20 or 25, it is an indication that investors are more fearful than usual.

- Our option portfolios benefited from higher option premiums in mid-late February. We were sellers of options at that time.

- However, many names in oil and commodity space saw their prices rise by 30-80% during the quarter, thus forcing us to buy the calls back, thus limiting our profits. We had less than a handful of these situations.

- We expect some of the positions to be called away at a profit since prices have rallied after their purchase in mid-late February.

- Our strategy aims to convert market volatility into tax advantageous income by selling options and thus collecting option premiums. The higher the volatility, the higher the option premium we collect.

- When the VIX is above 16, that is when we see better performance from the option accounts vis-à-vis our conventional accounts. The first quarter represented ideal conditions for our conservative option strategies.

6 Our Opinion

- We continue to adhere to our base case investment thesis: We are seeing a replay of the 1990’s – low commodity prices, strong USD, and economic growth led by the U.S. Clearly, the U.S. stocks reflect this. Much like the 90’s, this period can last many years.

- Our investment thesis for Canada is also much like the 90’s, but with the fiscal problems of the federal government replaced by the fiscal challenges of the provinces and the municipalities. These problems are largely tied to an ageing population that is putting pressure on health care costs and pension obligations, combined with an ageing infrastructure system. The Canadian consumer and housing markets are overextended, and the only thing keeping this train moving is historically low interest rates.

- The low level of the Euro continues to benefit European based multinationals. While not the screaming bargain they represented a year ago, the values are still very compelling. The recent market softness should be viewed as an opportunity to redirect funds into these names. We are also seeing signs of internal demand from European economies, as well. Like the U.S., Europe can self-sustain its economy to a certain extent.

- We deployed a significant cash allocation to equities during the selloff of the early part of the year. This decision proved to be timely and, more importantly, profitable.

- Our concern continues to be on valuations. We are very vigilant, and will continue to watch and react to mounting valuations. Should prices get ahead of the fundamentals, we will be sellers of individual names exhibiting these characteristics. This is not a market-timing or trading exercise as much as it is a risk management strategy.