Surprise!

For most of this second quarter of 2016, the markets were rather quiet and without any clear direction. However, the June 23 vote on the Brexit proved to be a historical date in the annals of British history. By a very narrow margin, Britain chose to leave the European Union, a result that was largely unanticipated.

Of course, markets hate nothing more than surprises, and numerous comments have been made on this event. We don’t believe we can add much to the narrative. What should be said, however, is that while for some companies this is a game-changer, for others June the 23rd was like any other Thursday, and its aftermath will continue to be business as usual.

The following are some key metrics we are watching.

Oil. The price of the West Texas Light Crude barrel rose from about $37 to $48.40, an increase of over 30%.

Earnings. Corporate earnings growth continued to be slowing down, giving investors more reason for concern about stock market growth in the near future. In Canada, this slowdown was a result of falling commodity prices. In the U.S., both the oil slowdown and the rising USD have had an impact. Yet, earnings should be considered resilient. How long this resiliency will last, though, is the question on most investors’ minds.

Interest Rates. This is where the action happened this past quarter. The U.S. 10-Year bond yielded nearly 1.8% in early April, ending the month at 1.95% and closing the quarter below 1.5%. In Canada, where our interest rates are lower, the yield on April 1st was 1.24%; it later reached a high of 1.5%, and then closed the quarter at 1.06%.

Investor Sentiment. The U.S. investor sentiment as reported by the American Association of Individual Investors stands at 31% bullish. The low for the past five years has been 17%, reached during May of this year, and the high point of 53% was reached in November of 2014.

2nd Quarter 2016 Market Highlights

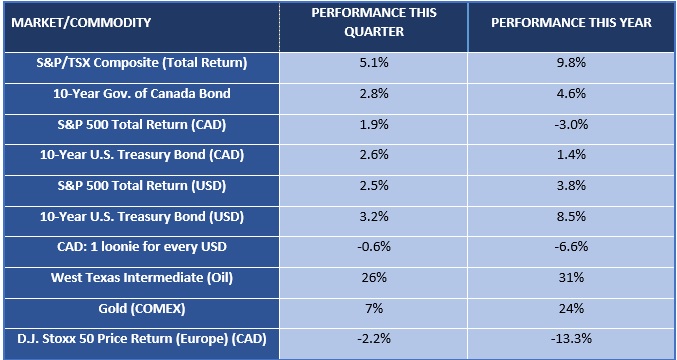

The table below shows the performance of some of the markets we follow.

The quarter was relatively quiet on the equities side. Canada continued on with its good performance and is in first position among the developed markets so far in 2016. We have the oil and gold sectors to thank for these results.

2nd Quarter 2016 Market Drivers

1 U.S. Markets

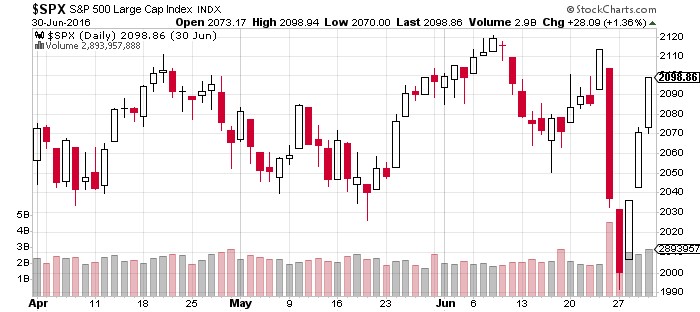

Since its 2,132 high on the S&P 500 reached last summer, the U.S. market has not been able to break this mark, despite its repeated attempts. The reason for this is simple: in the face of flat-to-weak earnings, investors’ greed turns into fear. Low-yielding bonds being pretty much their only alternative, investors go through a seesaw of emotions. When they are fearful, they buy bonds and sell off equities. . . to the point where equities become attractive from a valuation perspective, and from there, investors sell off their bonds and. . . move back to equities.

Given the absence of a catalyst for earnings to grow, we would expect this volatility to persist. This is not necessarily bad news, as our portfolios that contain options can take advantage of this volatility.

1.1 Valuations

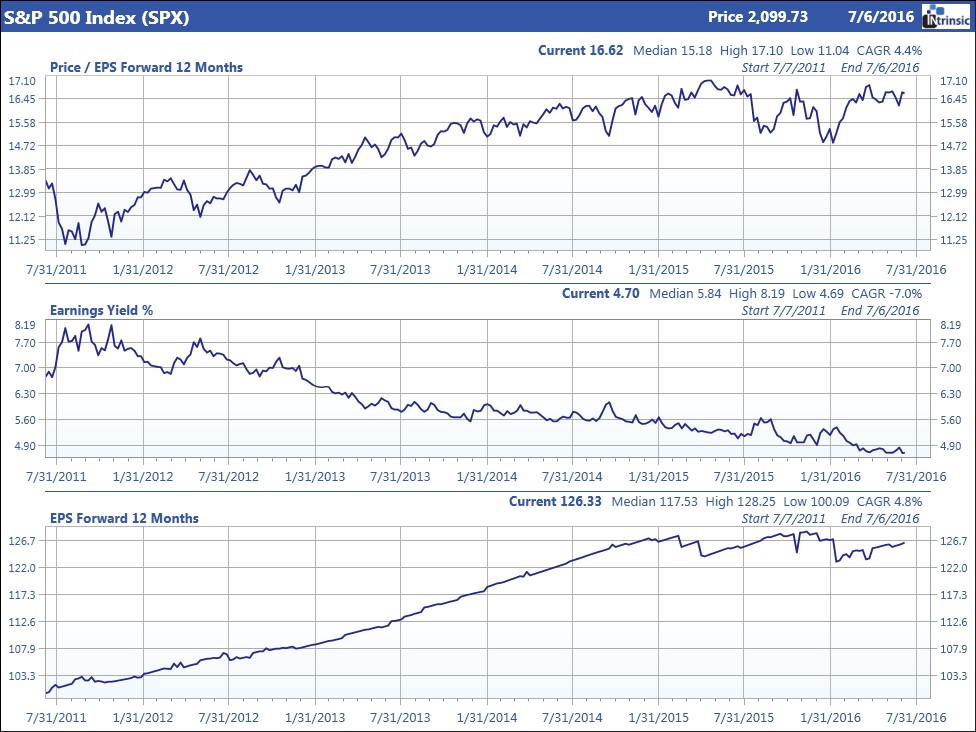

The chart below presents the valuation of the U.S. market in general as represented through the S&P 500 index. It has shown constant progress during the past five years. The question to ask now is, is this market expensive or is it still a “buy”?

Frankly, we are lukewarm on this market in terms of valuations:

- Low bond rates and yields are helping lift the values of utility and telecom stocks, as these sectors often act as bond proxies. In other words, these stocks are perceived as a safe investment that is comparatively more attractive than bonds right now; but the fundamentals of these sectors do not warrant an increase in value.

- Low interest rates are very problematic for all investors. The million-dollar question is, will they remain at these depressed levels for much longer (or, God forbid, fall even lower), or will they revert to more historically normal levels? Even the Fed finds itself in uncharted waters, despite its best intention to raise them.

1.2 Earnings

The bottom portion of the above graph illustrates the expected earnings of the S&P 500 index. In short, after the fantastic growth of the past five years, we can see that the expected earnings growth pace is slowing down.

- Current earnings are actually improving, albeit slowly. Certain sectors are doing well, and among them, some are benefitting from low bond yields. Slow and subdued sectors like consumer staples (think PepsiCo or Johnson & Johnson) are selling at extremely high valuations, as investors flock to these perceived safe stocks. Therefore we are being very cautious and actually have sold some of these names despite their long term attributes.

1.3 Risk Appetite

- Keep your eyes on the 10-year bond yields. Investors will continue to have an appetite for stocks as long as the risk-free return (i.e., the 10-year bond yield) is below inflation. The move down in yields for the quarter, which was initially surprising, was driven by lower confidence in the stock market.

- Given the Brexit issue, the Fed is on record of delaying what we believe is a much needed interest rate rise. Low interest rates are like spices: a little bit for a short time is perfect, but too much for too long can create some problems.

- Clearly, investors’ risk appetite is diminishing. In the short term, a market drop can seem scary and even feel painful. The market drop resulting from the “Leave” camp winning the referendum lasted but a few days. It seems nonetheless that investors remain skittish, a situation which we will continue to exploit as an opportunity to deploy capital.

2 Canadian Markets

The Canadian market continued its rebound, so much so that it is currently the best-performing market in the developed world.

- Within this market, Energy and Materials were the best-performing sectors this quarter.

- Financials posted a weak return of 2.9% for the quarter. Low interest rates will continue to be a problem for banks globally. This headwind is something our own banks will have to manage through; combined with high real estate valuations, this could create some headaches down the road.

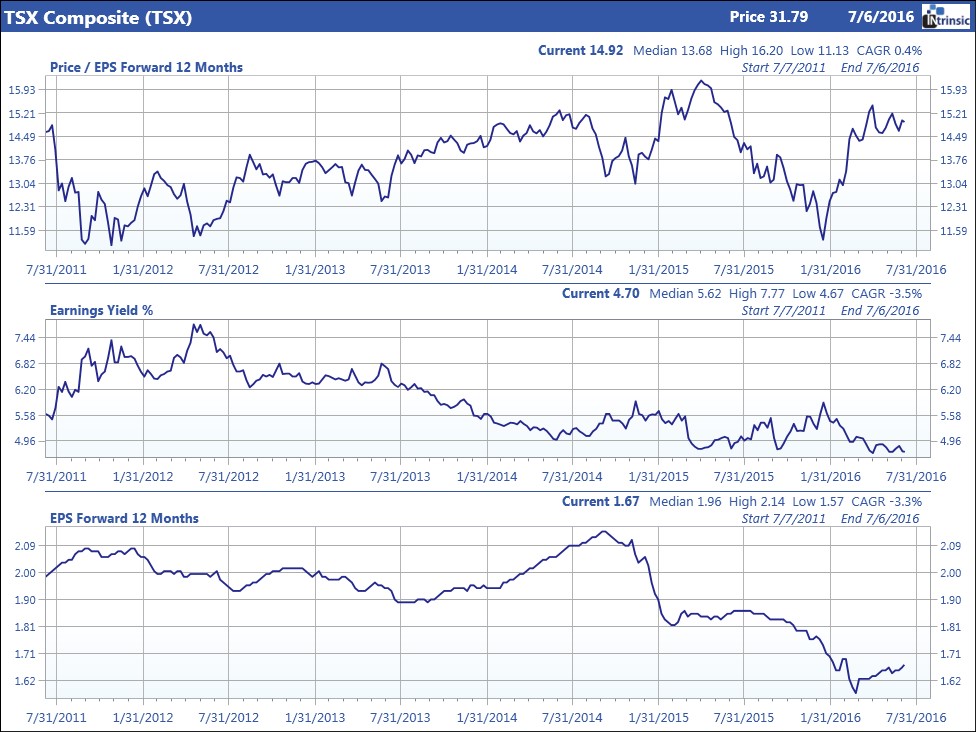

Above is our familiar look at the TSX from a fundamental perspective. The top pane of the chart displays the PE ratio (what investors are willing to pay for a dollar of earnings). The investment crowd was back and bidding up the PE ratio this quarter, pushing it above the five-year median.

We do not share such an optimistic view. The Canadian economy does not enjoy ideal conditions. The dollar is currently too high to provide a meaningful advantage for our exports, and while commodity prices have rebounded, that rebound represents neither a meaningful progress nor a permanent footing for the economy. Like with all previous cycles in the Canadian economy, we believe the recent upward move in oil prices is a counter-trend rally within a downward trend for our economy.

We remain focused on Canadian exporters or companies with meaningful operations outside Canada. Not only do we expect the currency exchange rates to provide some relief, but we expect the economy in the U.S. and even Europe to post better results.

The middle pane illustrates the earnings yield of equity holders in Canada as compared to Canadian bonds. It shows that the earnings yield received by investors in equities represents a premium over bonds, since the yield on a 10-year Government of Canada bond hovers around the 1.0% level only. The trend does flatten out however, which would indicate that either earnings must improve or prices must fall for future appreciation to continue. Having said that, investors realize that there are simply no compelling returns available in the market other than on stocks. Canadian investors are caught between a rock and a hard place.

In short, Canada is cheap and will probably become cheaper, with no catalyst for a change of opinion on that. Given the rebound of the loonie relative to the U.S. dollar, we would take this opportunity to add exposure to international markets if this exposure is below your comfort level.

3 Foreign Markets

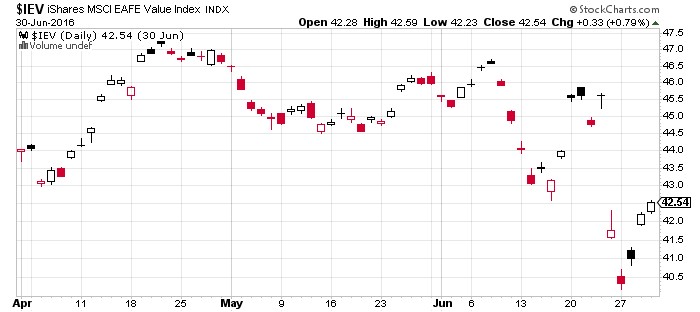

Above is the Morgan Stanley index representing Europe, Australasia and the Far East. It shows a flat return for the quarter, despite an initial price decline and subsequent rally.

- The higher American dollar is still causing problems for many Asian economies. Since their commodity input costs are priced in USD, they do not reap the full benefits of lower prices.

- We remain concerned that many emerging companies and governments have issued debt in USD. As the greenback marched forward in 2016, interest payments in local currencies rose in step with it. Those higher payments create a drag on these economies. The more they pay in interest, the less they can contribute to the global markets.

As the above chart illustrates, European equities, when converted in U.S. dollars, suffered an important pullback. The Brexit vote hurt the Euro as well as the prices of equities.

- European multinationals are at an advantage in this environment: the low currency will help drive their sales and competitiveness. While this will probably not translate into higher equity prices right away, this currency advantage will ensure these companies’ long-term health.

- Foreign investors in the European market must contend with two variables: equity prices and the currency level. The Euro is currently 18% below its high relative to the USD in 2014. This is why we maintain that current circumstances present a great entry point to invest in the European continent from a currency point of view.

- Many of these multinationals will not see their businesses materially impacted by the Brexit vote; however, their current prices are depressed as all European stock prices have fallen. We believe these stocks represent tremendous value.

4 Bonds and Interest Rates

The chart of the U.S. 10-year bond, above, shows a significant reduction in yields, which translates into higher prices for this asset class. At the end of the quarter, investors were locking in returns of 1.49% for ten years.

- It seems our expectation for a march upwards in yields towards 2.75% or even 3% by this time next year would be either delayed or simply wrong. We remain unsure of the outcome of this projection given that the U.S. Fed has signalled a pause before raising short-term interest rates.

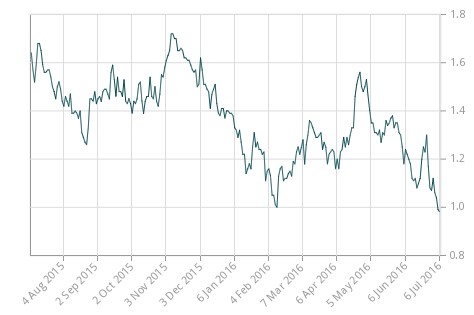

The graph below from the Bank of Canada shows bond yields for the 10-year maturity throughout the past twelve months:

- The yields in 2016 for the 10-year Government of Canada bond ranged from 1.00% to a high of about 1.65%. The equity selloff drove investors to the bond market, thus driving prices up and yields down to a low of 1%. In other words, some investors locked in a 1% return for ten years!

- By comparing the bond yields of the 10-year Government of Canada chart above and the U.S. Government bond chart shown earlier, you can see why our loonie fell back this quarter. There were two opposing forces: oil prices rallied, but our 10-year interest rates fell.

- This situation is not about to change soon. The low loonie will be with us for a while yet. It would be surprising (and actually a bit troubling) if Canadian 10-year yields moved above 2% in the next year.

5 Options

The following VIX chart measures the volatility of the S&P 500 on 30-day rolling periods.

A few remarks:

- Volatility spiked during the quarter, and in a significant fashion, due to the Brexit. Anytime the VIX is higher than 20, it is an indication that investors are more fearful than usual.

- Our strategy aims to convert market volatility into tax-advantageous income by selling options and thus collecting option premiums. The higher the volatility, the higher the option premium we collect.

- When the VIX is above 16, that is when we see better performance from the option accounts vis-à-vis our conventional accounts. The second quarter represented ideal conditions for our conservative option strategies.

6 Our Opinion

- We remain cautiously optimistic. Our risk controls revolve about being cognizant of valuations. If stocks reach and surpass prices that our research demonstrates to be above their fair value, we will sell them and look for better opportunities.

- We expect continued volatility in the markets, which enables us to profit from the ups and downs as we can deploy capital when prices are lower.

- The fallout from the Brexit vote will be with us for some time. We are monitoring the situation closely in case this political event should create financial turbulence; there is a small probability of that (but it remains a possibility). As of the time of this writing, there is no indication of this problem spilling over.