Executive Summary

Struggling to break through all time highs

Performance

The third quarter of 2019 was action packed. Indices hit all time highs on both sides of the border…but then gave up 4% or 5% only to roar back to a mentionable positive performance late in the quarter.

Investors are worried. Markets are near all time highs, the geopolitical climate globally should be described is tumultuous and many of the trade and business friendly political tones that investors have benefited from are being “walked back”.

A global economic slow down, Brexit, trade wars and the Hong Kong protests are just some of the images that are on the minds of all of us who are investors. Overlaid on top would be the never-before seen low or negative interest rates juxtaposed with 50-year low in U.S. unemployment is enough to make any sane observer hesitate about the next “move”.

Key Takeaway

Sometimes, one has to simply look at the facts. While the negative narrative is now with us, one must not lose sight that there are two sides to every story…and every trade. While indicies are hitting all-time highs, some quality business are being overlooked. Companies that are innovators and/or control an important part of their industry combined with good management, sound financials and an ability, a history and a policy of paying increasing dividends to shareholders…this is what we are looking for.

The good news is that the current volatility is making some stocks that have been historically expensive buyable again. For instance, a great global franchise that we added to is 3M…the stock is down 30%+ from it’s high two years ago. We feel that despite all the recession fears this is a great entry point for a great franchise that has been through many recessions in the past.

Conclusion

While market volatility can be stomach churning. The upside is enjoyable but the downside is downright awful. Our cash holdings will be depleted as bargains become apparent. However, we will continue to raise cash when investors become overly giddy with some of our holdings. Have a great 4th quarter!

Full Report

THE THREE KEY DRIVERS

- Winds of a possible recession.

- Trade wars remaining top of mind.

- Nine months of a great run for stocks, thanks to low interest rates.

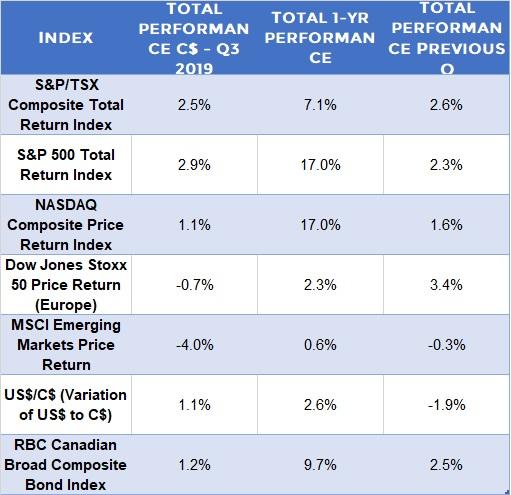

PERFORMANCE SUMMARY

- The U.S. market turned in a solid quarterly performance.

- Europe and emerging markets are still struggling.

- The USD/CAD exchange rate is holding steady.

- The drop in interest rates drove the bond market to yield a solid, equity-like quarterly return.

CANADIAN MARKET SUMMARY

- The TSX is still above 16,000.

- The last two months have been great for the TSX! A high of 16,899 was reached on September 30th from the low of 16,012 reached on August 15th.

- This level of 16,899 is an all-time high.

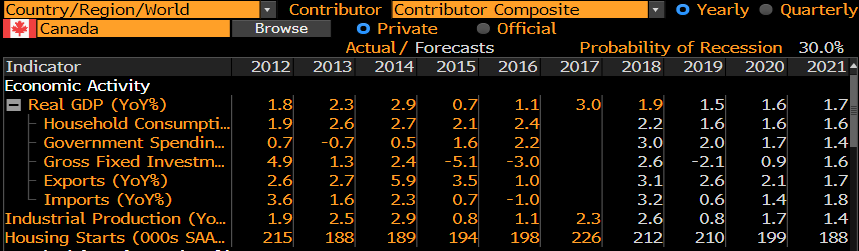

CANADA: ECONOMY

- Canada’s expected growth rate for 2019 is quite low, and rests on expectations of increased household consumption and government spending.

- The Fixed Investment Spending component is negative once again (2015 and 2016). This implies a reduction of future economic productivity. Industrial Production is also a notable standout for the wrong reasons, as it is also weak.

- The Bloomberg probability of a recession stands at 30% (it was at 27.5% last quarter).

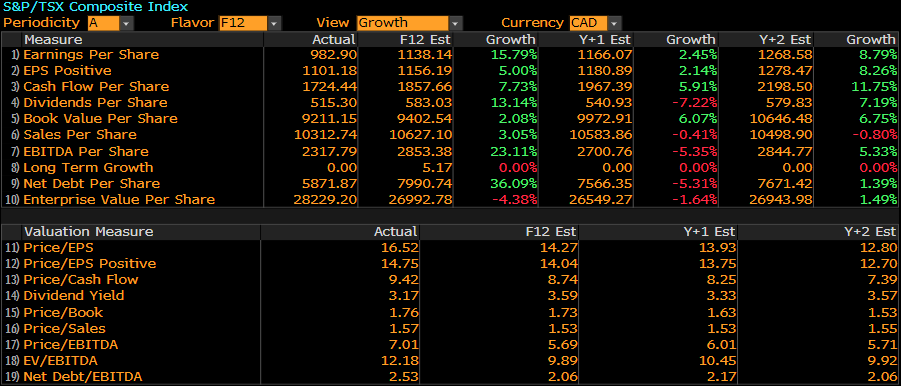

CANADA: CORPORATE PROFITS

- Corporate profit expectations are robust, which is most perplexing. How can there be robust expectations for corporations along with low economic growth for the general economy?

- We are still concerned about corporate debt, which is growing faster than sales, cash flow, and earnings. This higher debt is directly linked to low interest rates, as low rates create an incentive to borrow.

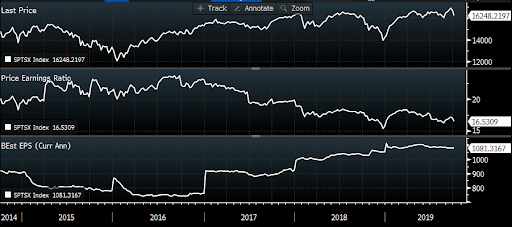

CANADA: EQUITY VALUATIONS

- The top panel shows the level of the TSX since 2014. The recent September high is a new record for the index.

- Despite reaching this record level, valuation (second pane: Price/Earnings Ratio) is quite reasonable.

- The low P/E ratio can be explained by healthy earnings that are also at an all-time high.

- The recent increase is justified, as it is built on solid earnings results. The question is, are investors looking past these results and assessing a lower P/E ratio as an expectation of lower future earnings?

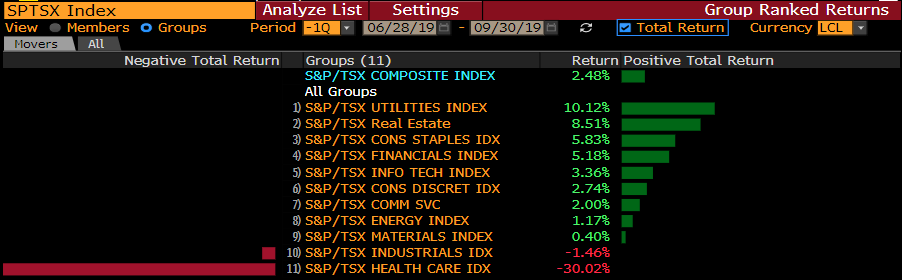

CANADA: MARKET LEADERSHIP

- The market performance was strong, with

a broad participation by all member groups. - The usually stodgy utilities sector led

the way in performance, thanks to falling interest rates. The Health Care index, dominated by cannabis stocks, had a rough summer. - Mergers and acquisitions impacted the top ten performers (Canfor and Dream Office REIT). The rest of the top performers are a diverse collection. The worst performers are found in the cannabis and commodities sectors.

UNITED STATES: MARKET SUMMARY

- The U.S. market continued to hover near all-time highs. While August was a difficult month, the gains in September offset these losses.

- It should be noted that the index’s performance for the quarter was essentially flat: the positive performance for Canadian investors was the effect of a weak Canadian dollar plus reinvested dividends.

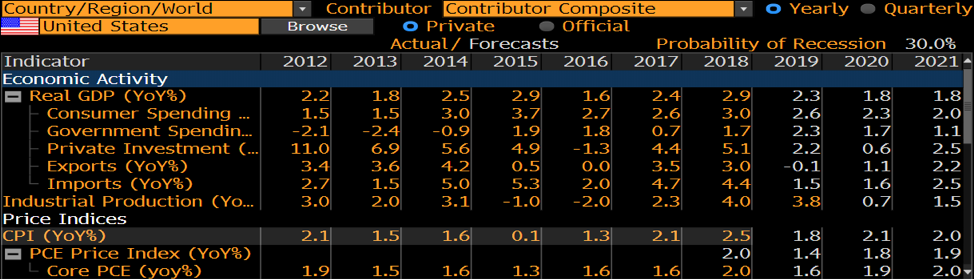

UNITED STATES: ECONOMY

- U.S. economic expectations for 2019 are falling. Expected growth stands at 2.3%, while expectations were at 2.5% the previous quarter.

- Trade wars and slower global trade are having a negative impact on exports, industrial production and private investments.

- The Bloomberg recession probability is currently at 35%, compared to last quarter’s 30% reading.

UNITED STATES: CORPORATE PROFITS

- U.S. corporate profits have grown at a healthy pace, but future expectations for corporate growth are now being marked down considerably.

- This new development is what is driving the recent market volatility: investors are unsure about the continuation of profit growth.

- The growth rate in debt is muted in the U.S., and corporate debt is expected to decrease over the next three years.

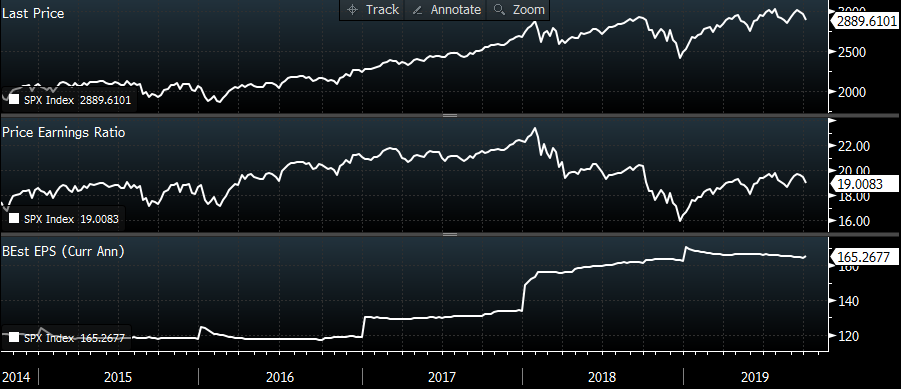

UNITED STATES: EQUITY VALUATIONS

- The S&P 500’s price appreciation (top panel) has been remarkable since 2016, but the index has stayed range-bound for the past two years.

- The earnings growth of the past two years has been muted, which squares with the index’s lack of price appreciation.

- Valuations (middle panel) can be described as average.

- Investors seem to be nervous about future S&P 500 earnings. Current events are not soothing these fears.

UNITED STATES: MARKET LEADERSHIP

- We continue to see a change in the

S&P 500 sector leadership. Technology is no longer the driver; less volatile sectors, like healthcare, are taking the lead. - The leading stocks this quarter are broadly diversified; this should be considered as positive.

- Retailers remain on the worst-performers list. One notable addition is Netflix, which used to be a perennial member of the best-performing names in the index.

INTERNATIONAL MARKETS

- The European markets (upper panel) had a rough quarter. A lower euro and a near-recession in Germany, combined with a slowdown in the Chinese economy, are being felt on the Old Continent.

- Emerging markets (lower panel) also had a difficult quarter. Global trade activity has subsided while geopolitical strife is increasing.

- The silver lining is that both Europe and the emerging markets have seen their valuations improve.

CURRENCIES

- Our loonie continues to hover around US$0.75.

- The US$0.75 +/- $0.05 range has held since 2016.

- Both the euro and the pound have lost over 20% since 2014 as the USD has strengthened.

- The narrative is driven by the strength of the USD versus all other global currencies rather than by our loonie weakening.

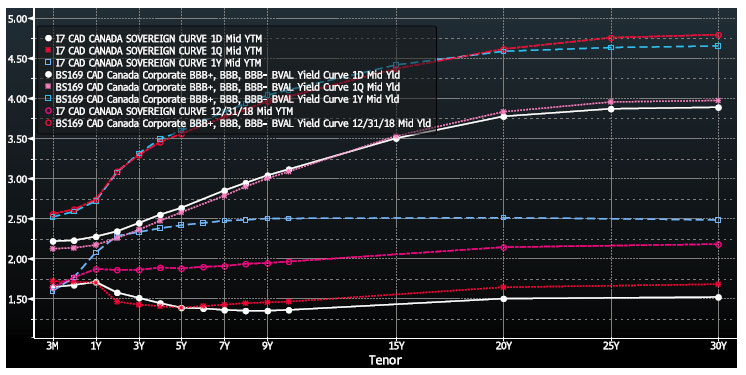

CANADA: INTEREST RATES

- The yield curve in Canada continues to invert.

In other words, short-term (< 2 years) interest rates are higher than long-term (≥ 2 years) rates. - Interestingly, the yield curve is not inverted for corporate bonds (upper white line).

- Many pundits associate an inverted yield curve with a recession. The shape of the curve matters, but the drivers of the shape are key factors as well.

- This inversion is increasing. Current short-term rates (white line) are higher than last quarter (red line), and the situation is reversed for longer-term maturities.

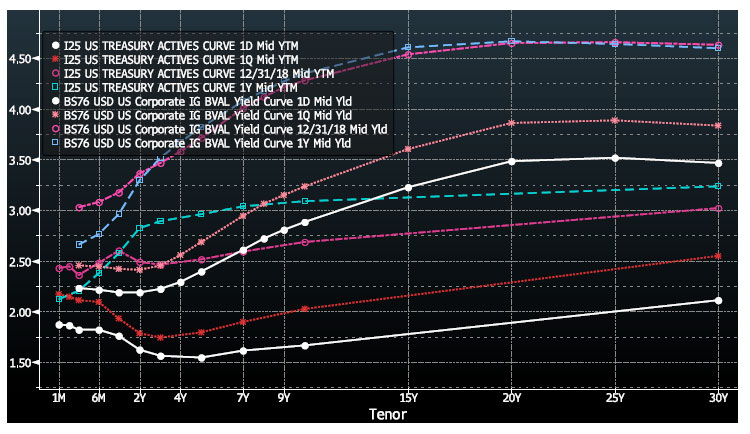

UNITED STATES: INTEREST RATES

- The yield curve in the U.S. continues to invert.

In other words, short-term (< 2 years) interest rates are higher than long-term (≥ 2 years) rates. - Interestingly, the yield curve is not inverted for corporate bonds (upper white line).

- Another development unique to the United States: all of the interest rates have dropped dramatically compared to the previous quarter (white line compared to the red line).

- While the yield curve is still inverted, rates are significantly lower, which should help the economy and stock market returns.

OPTIONS MARKET

- The volatility measure (VIX index) for the S&P 500 index spiked this quarter.

- This is a natural occurrence as these indices move in opposite directions. However, the VIX is elevated when compared to market action – i.e., the market performance is flat for the quarter, while the VIX is higher than usual for the current state of the markets.

- The VIX is currently at the ideal level for selling options. The short term thus looks promising for our option-selling portfolios.

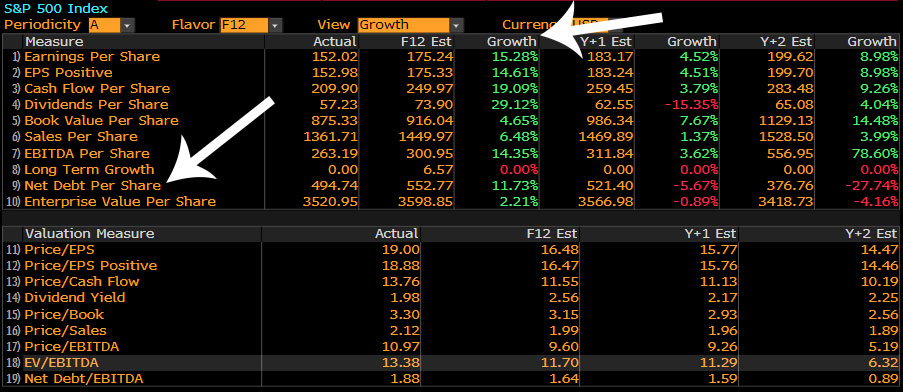

MARKET ACTION LESSON

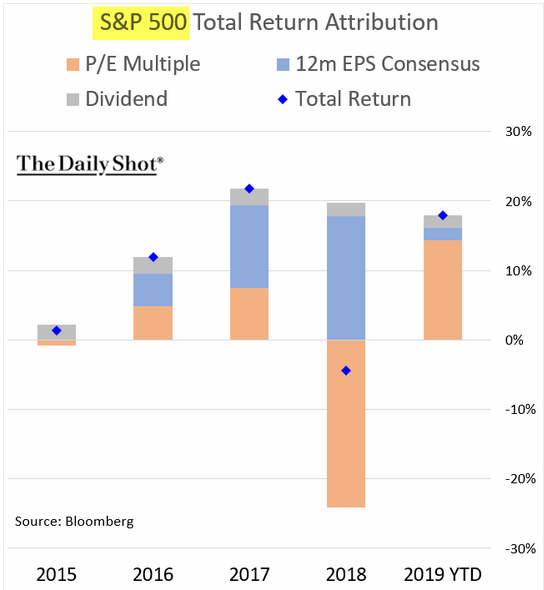

- It’s important to know what drives market action. Stocks go up either (a) because the underlying earnings grow, thereby increasing the business’s value or (b) because investors are willing to pay more for a dollar of earnings.

- Earnings (EPS, or earnings per share) can increase or decrease the value of a stock or index. In addition, valuation metrics (price/earnings or P/E multiple) can affect the value of a stock or index. These two factors can work together or against each other.

- The chart on the left illustrates the impact of valuation, earnings, and dividends on the return of the S&P 500. We can see that in 2018, the multiple (pink segment) contracted while earnings and dividends were positive contributors.

CONCLUSION

- Despite markets being at all-time highs, we are always on the lookout for overlooked quality companies. This quarter, for example, we bought 3M stock at 30% off its price of two years ago. This dividend-paying company is healthy, well managed, and has proven its value through many previous recessions.

- We have accumulated cash reserves and are ready to buy more quality stock when investors worry about the news. And when the mood turns giddy, we will sell the holdings that have already yielded good profit.