Video Short Summary

Video Full Review

Executive Summary

Turbulent times ahead

Given the very positive market performance of 2019 throughout most asset classes, we had already increased our cash positions, as we felt the need to be cautious in the giddy “risk-on” atmosphere that lasted until at least early February.

Our prudence did provide some cushioning to our portfolios when the markets plummeted. The fall was so sudden and the sell-offs so massive that the “circuit breakers” of the major stock markets were triggered, both in Canada and around the world, halting trading a few times. There is no question that the past few weeks have been harrowing on all fronts, and that markets have now entered a zone of turbulence.

Key Takeaway

Economic growth, which was uninterrupted during the past 10 years around the world, came to an abrupt halt. GDP figures, whether in Canada, in the U.S. or around the world, will show a decline for the first quarter, and a dramatic fall in the second quarter. Many analysts hope to see more stability in the third quarter, followed by a vigorous recovery in the last three months of the year. Whether this timeframe is realistic or optimistic, no one really knows at this point.

However, what is certain is that all bear markets have an ending, and that they are followed by bull markets. It is vital to have an investment plan on how to navigate this bear market: it is a great time to upgrade your portfolio and to invest in names that are priced for perfection but have seen their prices fall in unison with the general market.

Conclusion

Our approach remains the same. We now have an opportunity to pick, at attractive prices, high-quality companies that are poised to weather the recession profitably. Lower market returns actually make this search a bit easier. We continue focusing on preserving capital, being liquid and investing wisely.

Full Report

THE THREE KEY DRIVERS

The global COVID-19 pandemic, putting life on hold on much of the planet.

Investor reaction, which was very steep once it happened.

Many investors having borrowed to invest, a wave of forced selling took place in March.

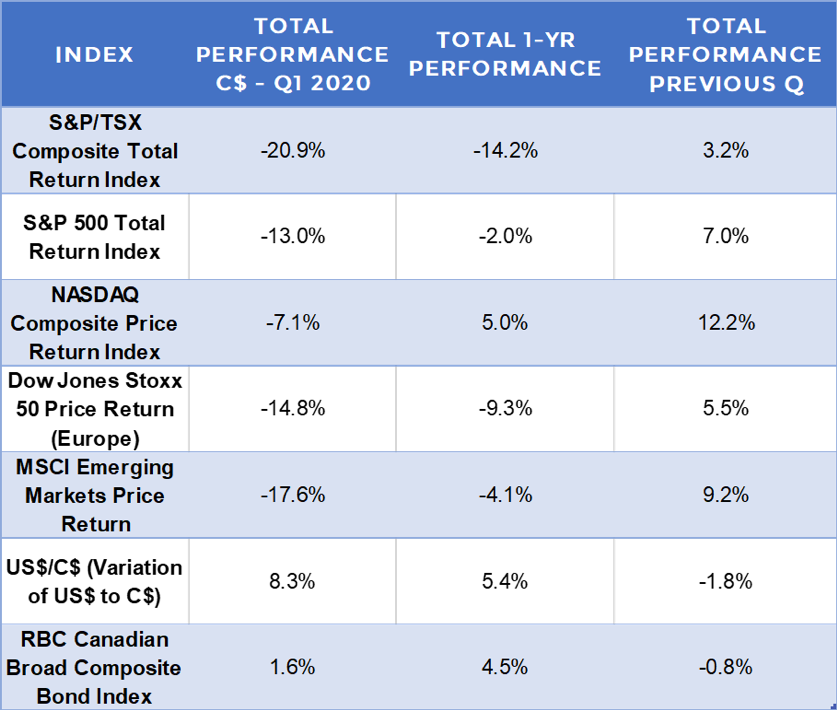

PERFORMANCE SUMMARY

Investor reaction has been both swift and deep.

Markets plummeted: the S&P 500 Index lost 34% in 23 days, while the TSX lost 37% in 22 days.

We have entered into bear market territory, where rules are different – more on this in this report.

CANADIAN MARKET SUMMARY

Given its main sector components – roughly 32% Financials (banks, insurance, etc.), 13% Energy (including pipelines and oil exporters), 12% Materials (metals and mining) and 12% Industrials – the Toronto Stock Exchange was hit by waves of selling-off starting in February and into March.

CANADA: ECONOMY

We usually publish a GDP profit expectation. However, as of the time of this writing, the economic outlook from a growth or recession is so cloudy we do not have any reliable data to present.

Recession is no longer a probability, but a certainty.

Global social distancing is affecting oil consumption. Oil reserves are now overflowing, prices have fallen (they are even negative at the time of writing). This, of course, impacts an entire sector of the Canadian economy.

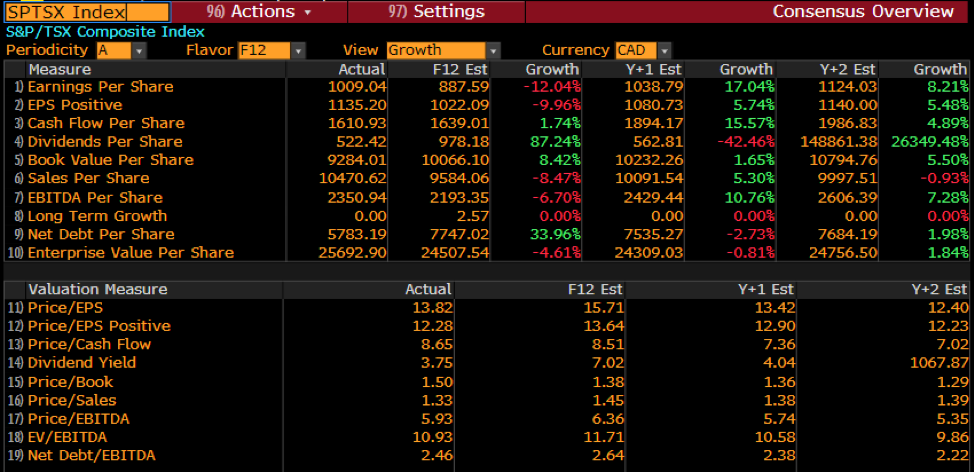

CANADA: CORPORATE PROFITS

You can see above the updated consensus earnings expectations for the 12 months as well as one and two years hence. We will present these with a high degree of scepticism. It is safe to say that the collective earnings of the S&P/TSX composite constituents was just over $1,000 for 2019. Currently, the expectation for the next twelve months is a reduction of 12%. With the information we have on hand, these expectations seem somewhat optimistic. The expectations for growth for 2022 and beyond are even more aggressive. In turbulent times, these types of top-down economic projections are notorious for being “late.” While they make for great headline fodder, they are terribly imprecise when making investment decisions. Caveat emptor!

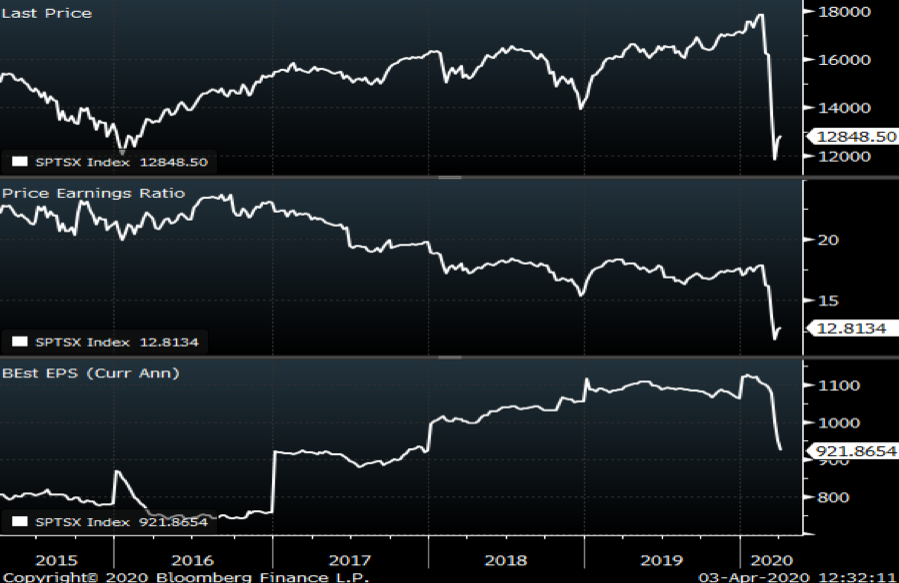

CANADA: EQUITY VALUATIONS

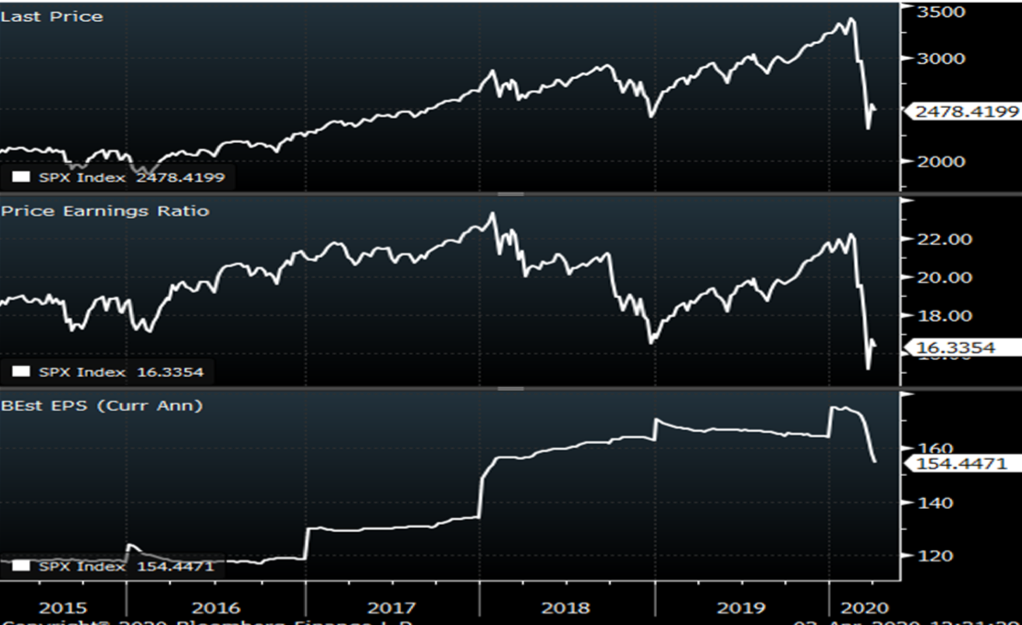

The top panel shows the level of the S&P/TSX since 2015. After setting ever new records, the index cratered after the first half of the quarter.

Downside can be defined technically (e., based strictly on market movements) and fundamentally (i.e., based on actual earnings and other fundamental financial data of corporations, in other words, in the “real economy”). In the current situation, it seems to be happening on both fronts. Time will tell, and one must continue to have an open mind and be data-driven on the decision-making process.

Earnings (bottom pane), which were at an all-time high at the beginning of the quarter, have understandably fallen, and stand to fall even more as fundamentals will degrade even more before they improve.

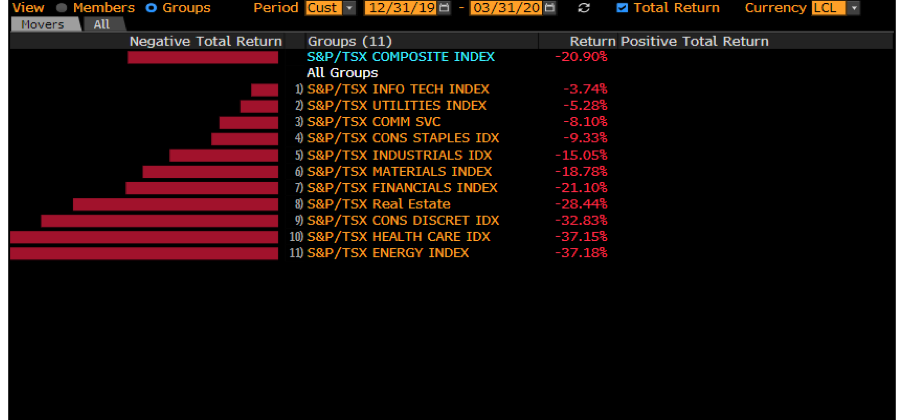

CANADA: MARKET LEADERSHIP

The Canadian market performance was negative across the board, with losses felt most strongly in some sectors that are the cornerstones of the Canadian market, such as Energy, Financials, and Materials. In relative terms, the Technology and Utilities sectors were somewhat spared.

The energy sector, in particular, is hit hard by the battering taken by the oil prices in connection with the global economic downturn.

Not surprisingly, the hardest-hit companies were names in the traditional energy sector, while a player in renewable energy was among the stars. Among this roster are grocers, a gold producer, a paper manufacturer, and an e-commerce platform.

UNITED STATES: MARKET SUMMARY

On the U.S. market, selling was swift and broad-based. The S&P 500 Index lost 34% in 23 days, much like most markets around the world.

Only a few sectors did relatively well, such as manufacturers of cleaning products (think soap and Clorox), delivery companies, groceries and stores like Walmart. Everything else moved downward in lockstep.

UNITED STATES: ECONOMY

We usually publish a GDP profit expectation. However, as of the time of this writing, the economic outlook from a growth or recession is so cloudy we do not have any reliable data to present.

Recession is no longer a probability, but a certainty.

The U.S. economy is a powerful engine backed by a very interventionist central bank and Oval Office. The economic rebound; in terms of both the speed and breadth will depend on the reopening of the economy and the measures used by both businesses and companies to mitigate the spread of the virus.

It is safe to say that the economic activity will be muted by both public policy measures and a new found uneasiness around social contact.

UNITED STATES: CORPORATE PROFITS

The Earnings per Share estimates (line 1 in the above table) came in at $151 for the S&P 500 Index in 2019. For 2020 and beyond, the estimates will be surprising for some. The consensus expects a fall of earnings of nearly 9% with a rebound in 2021 and beyond with a great degree of vigour.

Extrapolating is difficult at this point, since no one knows for sure what effect the lockdown will have on the economy, and whether there will be a surge in pent-up demand once lockdown is lifted.

Assuming, for instance, that economic activity shrinks by 30 or 40% in the second quarter, earnings per share would be around $135 (they were around $150 last year). As for dividends, we don’t expect them to be cut drastically, as companies that pay them tend to be in a better financial position than most. We are not giving any credence to the expected rebound in 2021 and beyond at this time, given the lack of clarity around how the economy will function.

Debt figures will be skewed, as companies are tapping their credit lines simply to make sure that banks don’t cancel them.

UNITED STATES: EQUITY VALUATIONS

The S&P 500’s bottom (top panel) was around 2250. Applying the same percentage as extrapolated above concerning earnings gives us an idea of how low the market could go.

The market has already rallied a bit, but obviously the situation remains very volatile. Having an estimate of the market bottom is very useful to help us prepare to deploy capital in a disciplined and dispassionate manner, and it will help us keep things in perspective when investing on “down” days.

UNITED STATES: MARKET LEADERSHIP

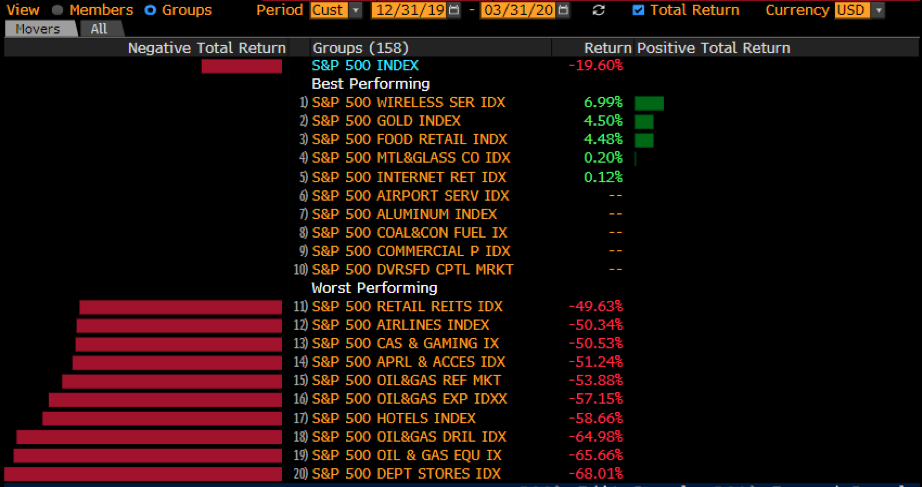

The S&P 500 Index’s return for the quarter was -19.6%. Because the coronavirus impacted their operations directly, department stores, oil and gas producers, and hotels and airlines were the worst-performing industries.

Wireless services and gold, followed by food retail were the leading sectors.

As for specific companies (chart below), some pharmaceutical and technological names, as well as soap makers, did well. Not surprisingly, energy names, as well as cruise operators, were among the worst performers.

INTERNATIONAL MARKETS

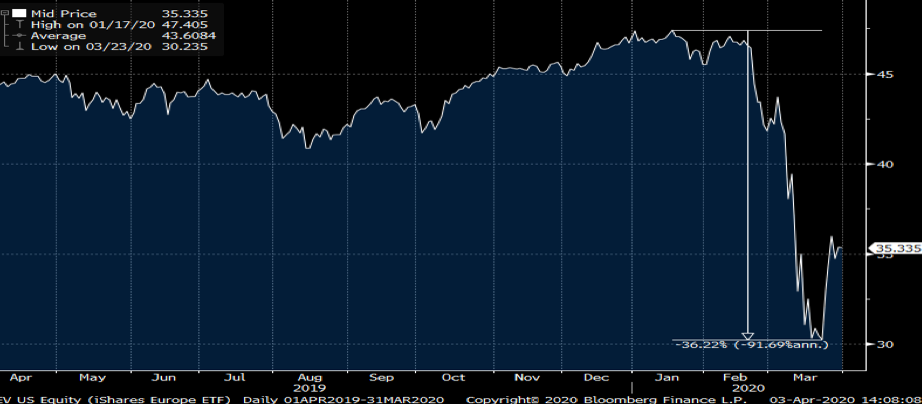

From the top in January to the drop in March, the actual change on the European markets (above) was 36.22%: truly bad, but not quite as extreme as one would have imagined. Volatility, however, was massive.

Emerging markets (below) fell about the same (-34%). This is a good example of markets being correlated. In a downdraft such as this one, there is no safe place.

CURRENCIES

After topping at $0.77 early in the year, the loonie (above) fell to $0.69 and finished the quarter at $0.71.

This can be explained easily by the general flight to safety, the U.S. bond market being considered as providing a high-quality investment.

The euro (above) stabilized during 2019. However, it has seen a lot of volatility since February, and it is unclear at this point where the bottom lies for this currency.

CANADA: INTEREST RATES

Predictably, the yield curve in Canada stopped being inverted, which was an anomaly that we noted in the past quarters. As shown above, long-term rates (10-year) rose, as they should in a time of uncertainty, relatively to short-term (2-year) rates. The spreads between these rates have now become strongly positive.

UNITED STATES: INTEREST RATES

The yield curve in the U.S. had already stopped being inverted last quarter, as illustrated by the interest rate differential between the 10-year (longer term) U.S. Government bonds and the shorter term (2-year) maturities. Since these spreads started from a higher point, they shot up even higher than their Canadian counterparts.

We cannot resist pointing out that the inversion of the yield curve (i.e., when longer-term rates are lower than short-term rates), which the media was very concerned about last year, did not, in and of itself, usher in the recession we find ourselves in right now.

OPTIONS MARKET

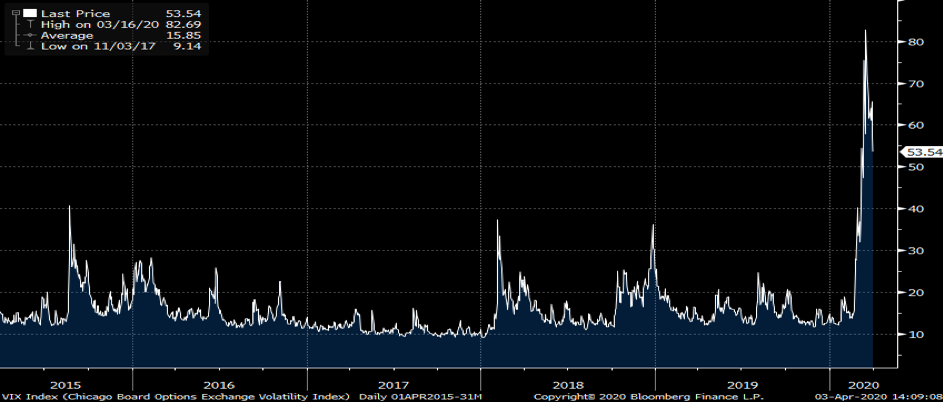

The VIX Index (also called the “fear index”), which measures the volatility of the S&P 500 Index, spent most of last year in a fairly subdued state. After starting the year around 12, it has now come back up with a vengeance. It peaked above 80 and stood at around 53 at the time of this writing.

MARKET ACTION LESSON

We find ourselves squarely in a bear market. And if we were to paraphrase Woody Allen, this section would be entitled Everything you always wanted to know about bear markets (but were afraid to ask). So, without further ado…

A bear market is when a market experiences prolonged price declines. It typically describes prices falling 20% or more from recent highs, amid widespread pessimism and negative investor sentiment. Bear markets usually accompany general economic downturns, such as recessions.

One striking feature of a bear market is that asset classes – various kinds of stocks (common shares, preferred shares), bonds, etc. – all move in the same direction, as investors no longer view any type of security as offering a safe haven.

In recent history, we have had a few bear markets that started with the following events: the “Dark Monday” of October 19, 1987 (‑35%), the bursting of the dot-com bubble in 2000-2001, and the Great Recession of 2008-2009. Historically, all have rebounded and the upward movement, with time, more than compensated for the losses.

Bear markets play out following a similar pattern. First is the initial fall. After a while, the market rallies, sometimes in spurts, and starts recovering from its losses. However, this rally can be what is often called a “bear trap” or “relief rally” as this upward movement can be interrupted by a new test on the downside, which is a drop or a series of drops that can be less severe than the initial fall, but nonetheless cause other losses.

Never discount one’s immediate emotional state. It is important to remember that markets reach their bottom when all the “weaker” owners have exited. These exits usually happen in times of extreme pessimism. This explains why markets and stocks bottom well before the economy or the corporate activity has had a demonstrable rebound. In short, one has to “lean into” the fear and pessimism. Thankfully, one has time to deploy capital, as market bottoms are a process and not necessarily an event.

CONCLUSION

While now is an emotionally trying and nerve-racking time, it also provides an opportunity to pick high-quality stocks on sale. And that is our goal: in a bear market, we are working to upgrade the portfolio to top-tier names at bargain prices and position ourselves for the next bull market.

Being liquid is our first step. To that end, we have strategically sold and will continue selling parts of the portfolio, divesting ourselves from companies that will not do well in a protracted recession.

As mentioned, bear markets have three stages: initial fall, rally (“bear trap”), and re-test. How soon will the re-test happen, and how long it will last, will depend on the pandemic itself, and on the introduction of a vaccine or cures. Our strategy of stock picking is based on this historical context. We continue to be patient in our resolve to add quality companies at good prices, and the goal is to deplete our cash reserve.

The main thing to remember is this: bear markets always end – always have, always will – and they give way to bull markets.

It is vital to remain invested, because a lot of gains happen right after a bear market. Looking at data going back to 1930, Bank of America found that if an investor missed the S&P 500′s 10 best days in each decade until 2019, total returns would be just 91%, strikingly below the eye-popping 14,962% return for investors who held steady throughout the ups and downs.

In order to stay disciplined and reap the benefits of the inevitable bounce back, it’s important to have a plan and to follow it without letting emotions get in the way, to keep an open mind to seize the right opportunities, and to always remain rigorously data-driven. That is our work, and we will continue to do it. If you have any questions, concerns or comments, don’t hesitate to contact us. We’re always there for you.