Short Review

Complete Review With Charts & Data

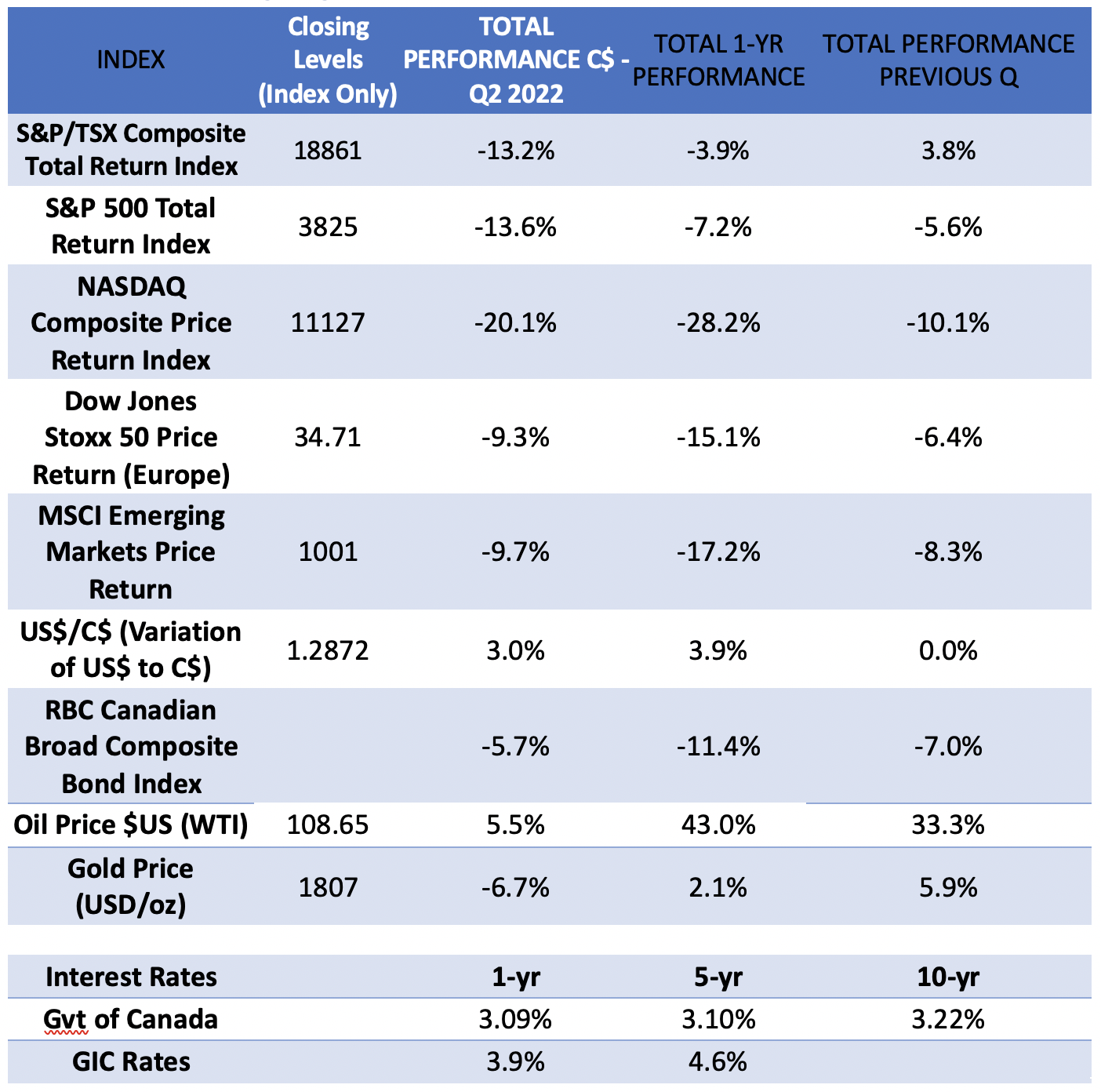

Performance Highlights

Commentary

What a difference from just six months ago! At the end of 2021, everything seemed to be going swimmingly. The mood on most markets was euphoric (with China and emerging markets as the exception). The NASDAQ closed the year by posting a 20.5% gain, while the S&P/TSX Composite boasted a 25.1% return, and the S&P 500, at 27.7%, reached its highest level ever. Some clients told us they wished we had invested in the (then) high-flying technology stocks.

But at the end of February, Russia invaded Ukraine, which created a nasty surprise and signalled that the party was over. Returns for the first quarter of 2020 went negative (except at the oil-heavy Toronto Stock Exchange). For the second quarter, indices saw their losses deepen even further. For the S&P 500, this was the worst semester since the 1970s.

What is unusual about this year so far is not that all markets fell, but that bonds fell along with stocks. Normally, these asset classes move in opposite directions. Even gold, that perennial safe haven, posted losses. Oil, in which we had invested when it wasn’t considered a hot commodity, was the only exception to the carnage (with the US dollar).

Interest rates were raised a few times and are expected to continue to rise into 2023. With higher rates come lower valuations: as the cost of borrowing increase, the price of assets is reduced. The same implacable logic holds for businesses, houses and cars, for instance. At the same time, inflation, which was only a rumour last year, is now felt everywhere and dominates the headlines. In such an environment, negative sentiments understandably take hold.

Furthermore, markets run on two emotions: greed and fear. Markets went from one side of the seesaw to the other in less than 180 days. As professional investors, it is our job is to keep these emotions in check. When everyone stands on one side of the boat, it is usually a wise move to move over to the other side to avoid getting wet. That is why we were not swayed by the excitement last fall and why we are now cautiously optimistic as many investors are throwing in the towel.

A Story of Ups and Downs

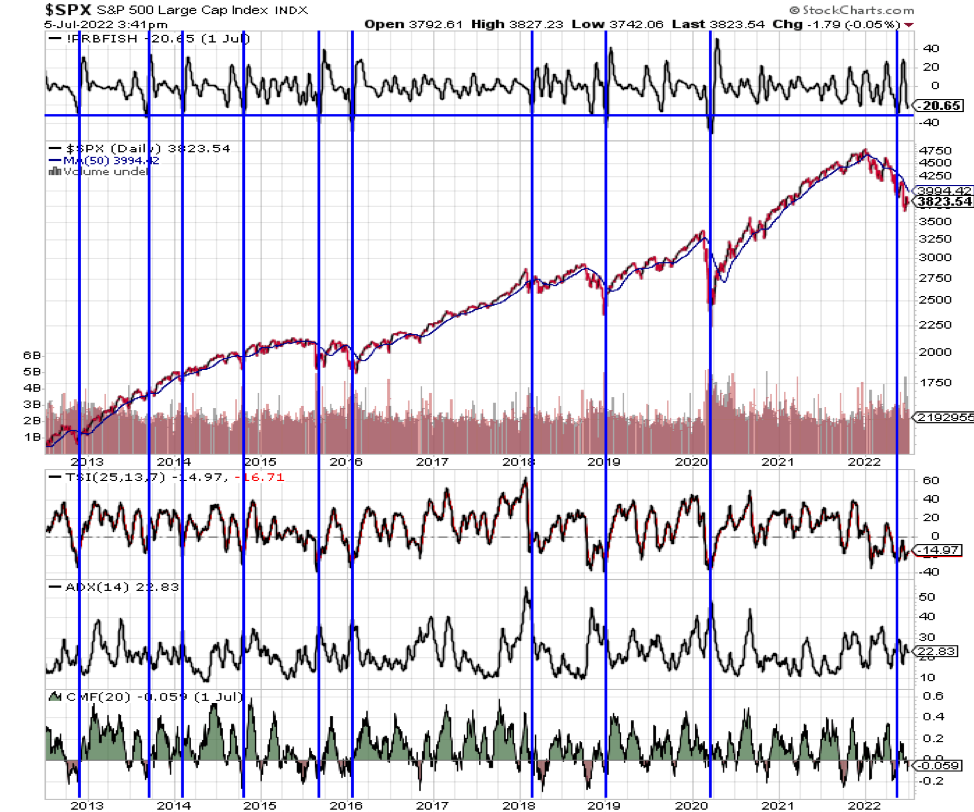

To understand what comes next, it is useful to look at market bottoms in the recent past. The chart below illustrates previous points at which the market (indicated by the red line) bottomed out before resuming its ascent. Sometimes, as in 2015-2016, the markets do not have to fall very much, they can stagnate for a certain time, which purges out the excesses just as well. This takes place over a matter of few months, or maybe sometimes up to 18-24 months.

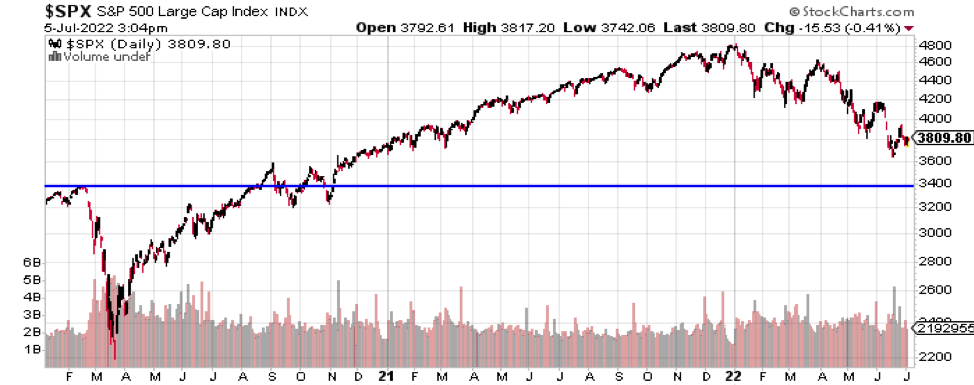

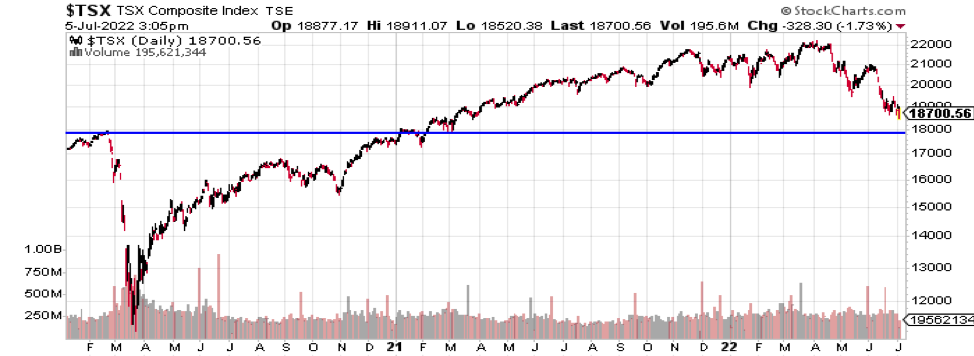

The following two charts, below, show the S&P 500 and S&P/TSX indices’ variations since the beginning of the pandemic. They tell the story of how, after COVID broke out, governments and central banks decided to get involved to try to avoid a replay of the 2008 Great Crisis. Governments did this by spending truly astronomical sums of money to support people and businesses, and central banks made this possible by printing the money needed by governments.

These measures had the predictable effect of inflating the value of assets. “Animal spirits” (in this case, greed) took over. In early November of 2020, when Pfizer and BioNTech announced that their vaccine was highly effective at preventing symptomatic cases of COVID019, this boosted (pun intended) the market even further. This “Vaccine Monday” sparked a rally which continued well into 2021 and lasted through most of the year, only to be ended by the war in Ukraine in early 2022.

While not over, the pandemic appears much more manageable, and the central banks have realized that they must stop their stimulation efforts as the economy is now overheating. Governments have not stopped their stimulative and supportive spending yet, and the economy suffers from excess demand caused by governments pouring billions in the economy by way of spending programs. Central banks are struggling to harness all the liquidities that flooded the financial system and can only fuel inflation – the inflation of assets (which is enjoyable), but also inflation of costs, which already influences consumption. They have to do this while, if possible, avoiding causing a recession. This is the narrow path that central bankers need to navigate.

How (Not) To Time a Market Bottom

For investors, the two emotions that will signal that a bottom has been reached are disgust and distrust. Many headlines are pointing to these themes. A major survey, that of the American Association of Individual Investors, shows that their members are now incredibly bearish (see the small graph on the right). Their outlook has never been this negative in 20 years.

Adding to the current mood of doom and gloom, expectations are that the next earnings season will be horrendous. Some technical indicators show that 20% of the stocks are trading below their 50-week moving average. This does not allow us to say for sure that the bottom has been reached, but it suggests that it is a possibility.

And how will the recovery take hold after the walloping suffered by investors? A few conditions must be met. There needs to be: (a) low expectations (check); (b) low valuations (not really); (c) central bank change of direction (not yet); and (d) the right environment (unclear). Central banks need to announce that they are almost done raising interest rates or at least show a path in that direction. They have only signalled that their rates would continue to rise into 2023, which is still a bit distant and not terribly precise. Finally, the current geopolitical environment adds a layer of uncertainty to the environment.

The truth is that no one knows. It looks as if we are closer to the end of the bear than the beginning. Markets have possibly done their selloff, or most of it. However, it is impossible to know for sure, nor to exactly “time” the market’s turn towards a recovery (just as it is impossible to “time” the market top to sell at maximum profit). Currently, valuations are neither too low nor too high.

This is why we have core positions that we trim rather than trade, and we will add or subtract to the cash balance. Investing responsibly for the long term is an exercise in adjustments. But we will never be 100% out, and rarely 100% exposed.

If Disoriented, Look to Your Whys

The reasons for investing are even more starkly important right now. Sure, one can always sell everything and go to cash or park the money in guaranteed return assets to avoid all volatility. However, when inflation is rampant and interest rates are going up, this is not viable. You will not only miss out on better investments, but also your money’s purchasing power is being eroded by the day.

Remember that your reasons for investing are:

1. Ensuring that you and your family have enough money throughout your retirement;

2. Preserving your purchasing power despite inflation (which is always a factor); and possibly

3. Leaving a financial legacy.

If you can tune out the headlines, ignore volatility, and keep your eyes on these three prizes, remaining invested in equities is still one of the best ways to reach your long-term objectives as an individual investor.

Conclusion

As we said last quarter, there is a significant probability of an economic slowdown associated with rising rates. More than ever, we are steadfast in our approach always to remain prepared for various outcomes both on the markets and in the general economy.

Thank you for entrusting the Exponent team with the management of your investments. As always, do not hesitate to let us know if you have any questions or concerns. And don’t forget to have a great summer!