Video Review – Short

Video Review With Charts & Data – Full Version

Executive Summary

A Hurt-Filled Quarter, and a View to Better Days Ahead

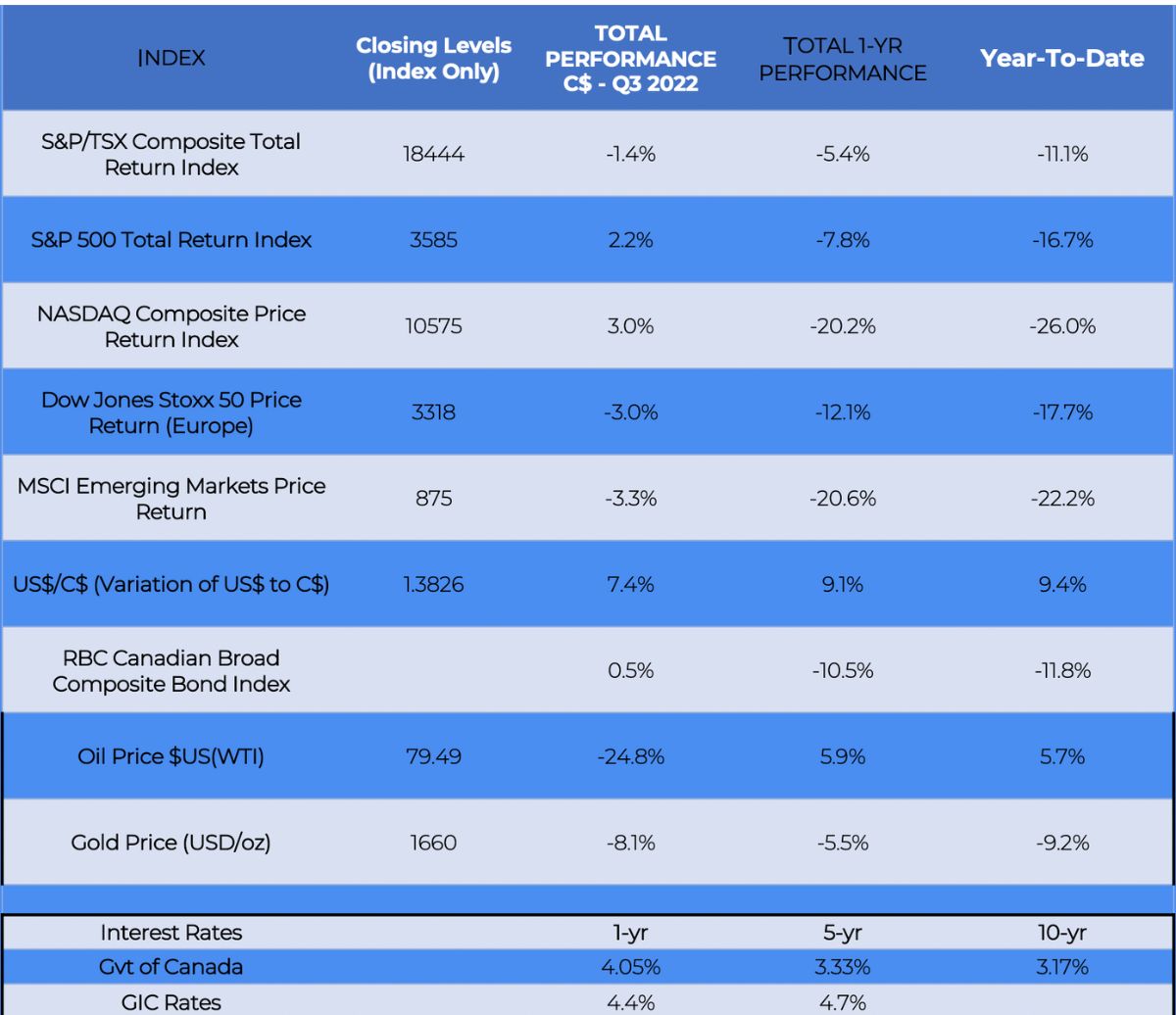

After a rough year to date, this quarter was simply a nightmare for investors. This was true in all asset classes. Performance-wise, most of the numbers for the year to date are negative. The only exceptions are the S&P 500 and the NASDAQ indices this term. Meanwhile, for the year to date, the S&P/TSX Composite Total Return Index lost 11.1%, as compared to ‑16.7% for the S&P 500, and a whopping ‑26% for the NASDAQ. Bonds are also strongly negative (-11.8% so far this year), an extremely rare situation as stocks and bonds normally rise and fall opposite to each other. Oil prices were down almost 24.8%, but remained positive at 5.7% for the year to date. Interest rates spiked.

However, we may be close to a market bottom, and things might be starting to look up for the future. Remember that we invest prudently and patiently. Historically, over the long term, the market not only recovered after it cratered, but it typically went up even higher than before.

The Long-Term View

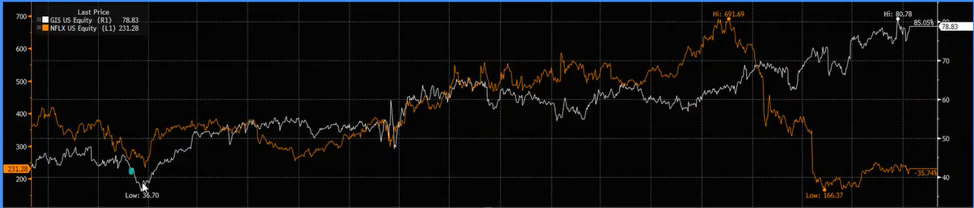

With inflation now rampant globally, remaining invested is paramount to help preserve your purchasing power. And some no-frill stocks easily beat last year’s darlings in the current environment. For instance, in 2018 we invested in a plain household name, General Mills, that was not at all popular, and we shunned Netflix when it was all the rage. With the pandemic, Netflix shot up and looked like a winner, but our cereal-maker had strong fundamentals. In the end, Netflix lost 35% while General Mills increased by 85% (before even adding in dividends).

That is why we are confident that tuning out the headlines, ignoring volatility, keeping the long-term view, and remaining invested is still one of the best ways to achieve your long-term goals.

For the rest of 2022 and beyond, Exponent will continue to apply the same valuation discipline. We always want to avoid overpaying for a stock, and we look for these characteristics: reliable dividends; a high-quality balance sheet; a proven management team; business with a global reach.

As always, let us know if you have any questions or concerns. Enjoy the fall season!

Full Review

A Hurt-Filled Quarter, and a View to Better Days Ahead

Performance Highlights

Commentary

After a rough year to date, this quarter was simply a nightmare for investors. This was true in all asset classes. Performance-wise, most of the numbers for the year to date, and even for the past 12 months, are negative. The only exceptions are the S&P 500 and the NASDAQ indices this term. Meanwhile, the Toronto Stock Exchange is clearly a lesser evil at this point. For the year to date, the S&P/TSX Composite Total Return Index “only” lost 11.1%, as compared to ‑16.7% for the S&P 500, and a whopping ‑26% for the NASDAQ. Bonds are also strongly negative (-11.8% so far this year), and this negative performance, which is showing even over 12 months, is an extremely rare situation, as stocks and bonds normally rise and fall opposite to each other.

Oil prices also had a very rough quarter, down almost 24.8%, but remained positive at 5.7% for the year to date. Gold is also negative (-8.1% for the quarter, -9.2% for the year to date). As to the Government of Canada interest rates and GIC rates, they spiked. The U.S. dollar is also up sharply: 7.4% this quarter, 9.4% for the year to date.

However, we may be close to a market bottom, and things might be starting to look up for the future. Read on to know more.

Performance Attribution

Despite oil prices having a rough quarter, all of the leaders in the S&P 500 index were energy producers. On the negative side of the ledger, some of the stars of 2020 and 2021 are now the laggards. Basically, consumer “pandemic” (or pandemic-related) stocks – such as entertainment, technology, home improvement, and retail – were offloaded by investors faster than people could get addicted to the latest Netflix series.

In Canada, the same dynamics were at play. All the winners are energy or energy-focused companies, and the losers are previous winners and investor darlings such as Shopify, Aurora and Canopy (cannabis stocks), or Bausch Health Companies.

There was truly nowhere to find refuge. Exceptionally, bonds did not provide a haven either. As interest rates climbed, all asset classes were walloped, including bonds. The magnitude of these negative returns is historical. Even a conservative portfolio (comprised of 60% stocks and 40% bonds) lost 19% since the beginning of the year, while the exchange-traded fund that represents the 20-year U.S. Treasury Bond (“TLT”) was down 30%.

A Pandemic-Affected Economy

The pandemic came at the apex of an economic cycle. After the Great Recession of 2008, the markets had been steadily climbing and reached ever new peaks. When COVID-19 was declared a pandemic by the World Health Organisation (WHO) in early 2020, the stock market was at a record high. As many industrialized countries decided to go into lockdown, there were massive market selloffs around the world. Lockdowns disorganized the economy, stressed supply chains, and reduced the number of workers (as many retired or returned to school). Despite government support, many companies were bought or went bankrupt due to a combination of higher costs, fewer customers, difficulties hiring, etc. The prices of various commodities became unpredictable. In short, multiple disruptions occurred.

At Exponent, we believe that we are nearing the end of the worse economic impacts of the pandemic. Yet more than a few headwinds remain.

Possible Continuing Headwinds

There were – and still are – more than a few headwinds on the economic stage. These are: higher interest rates; higher inflation; lower labour participation; investor sentiment; decisions by central banks and finance ministers; and finally, despots, dictators and other politicians around the world.

These all played a role in this downturn and can complicate the recovery.

Since August 2020, interest rates have been climbing steadily. The U.S. government (like many other governments) issued bonds, which the Federal Reserve (or the country’s central bank) bought. When central banks get involved on the buying side, yields drop; and when they decide to exit, yields increase. Right now, the Federal Reserve is tapering off its bond buying, which is why rates are shooting up. The U.S. 10-year Treasury bond rate now stands at 3.83%, a level unseen since before 2007, and it could even reach as high as 5%.

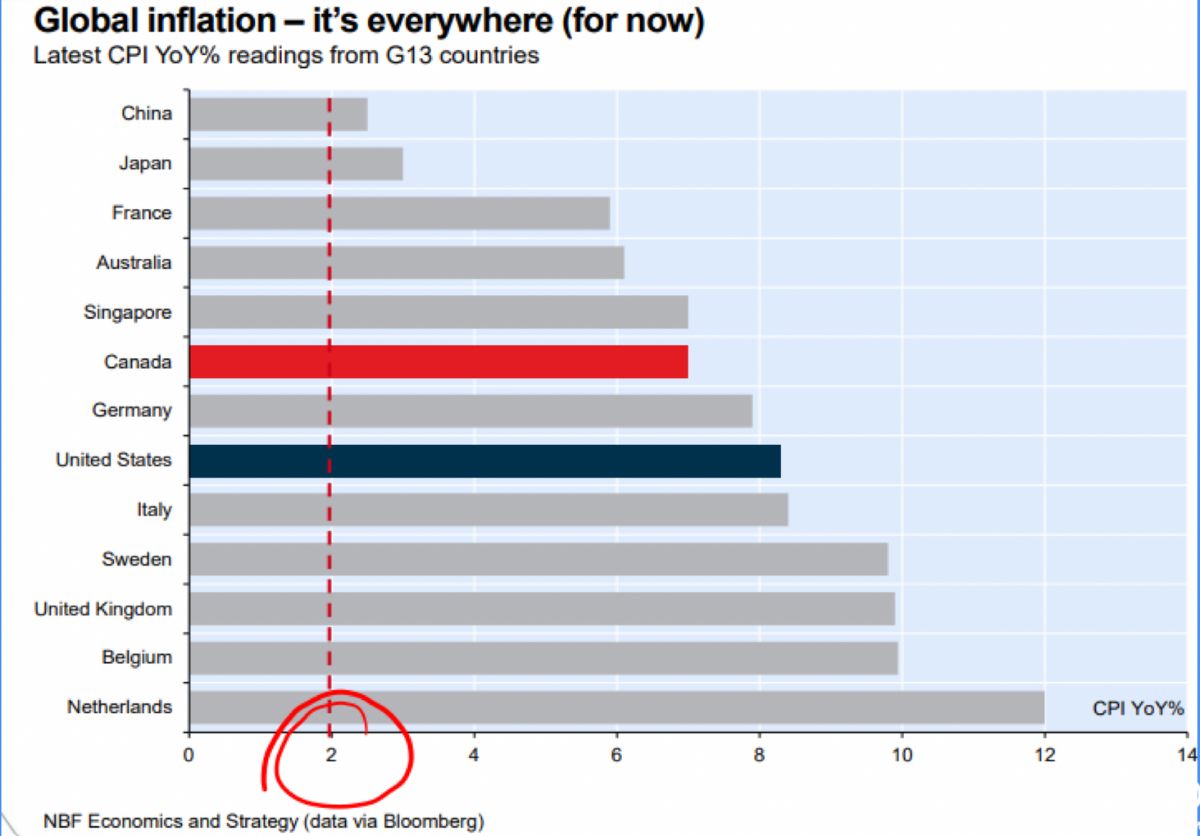

Inflation

During the past 10 years before COVID, inflation was mild and predictable, hovering at around 2%. After the pandemic shutdowns, inflation started to rise spectacularly as economies reopened in Canada, the United States, and Europe. Initially, pundits believed that inflation would be short-lived. However, as we passed the 5% mark in late 2021/early 2022, central bankers and investors have become worried. Everyone wants to avoid a replay of the mid-1970s to mid-1980s inflation (which was triggered by an oil shock). But Europe’s inflation, in particular, will continue to climb as energy costs soar due to the war in Ukraine.

Labour participation

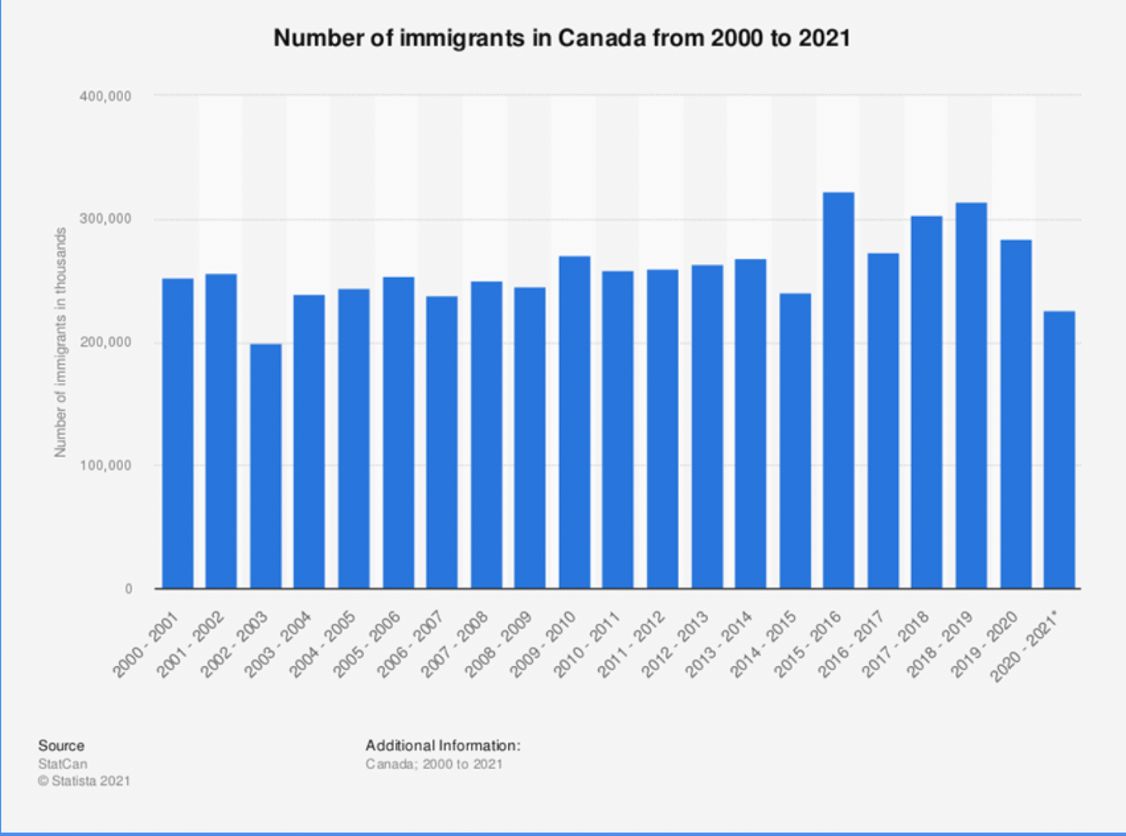

In our advanced economies, 70% of the activity depends on consumers, who, in turn, need a salary. That is why employment figures are so vital. In Canada, fewer people are currently working and contributing to the economy. In the early 2000s, the Canadian work participation rate was close to 68%. After COVID, just 64% of the able population is actually working. This low participation level creates an obvious economic headwind. Also, Canada is normally a land of immigration, which bolsters labour participation. However, the country has welcomed far fewer immigrants that the target number of 400,000 new immigrants per year – again, due to the pandemic.

The situation leads to salary increases, as it is extremely difficult to find and keep workers. Meanwhile, public sector jobs have been created at an unprecedented pace in just two years. They rose 15%, from 1 million positions in 2020 to 1,150,000 in 2022.

With two consecutive quarters of negative GDP, North America is technically in a recession, but since job creation is still positive (thanks in no small part to the public sector), economists are not calling it a recession (yet). It should be noted that this is the first time in history where job growth is positive while GDP is negative. And the situation is far from settled. In eHowever, tarly October, a KPMG survey revealed that 50% of CEOs were considering job cuts. Jobs could be a lagging indicator and eventually go down as well.

Investors

As a group, investors can be very emotional. When the World Health Organization declared a pandemic in early 2020, they ran for the exits and sold massively, often at a loss. When markets roared back up in 2021, euphoric investors were willing to overpay to secure a dollar of earnings, as shown by the blue line, compared to the index (yellow line). Price-to-earnings (or P/E) ratios peaked in the first quarter of 2021. They have since come down (-25% since the beginning of the year) and are now back at the mean P/E ratio (around 17). What investors are paying for a dollar of earnings is marked down 43%, but earnings are still expected to continue to grow. From this angle, the market has normalized and stocks could even be undervalued right now.

Central banks and finance ministers

Policy interest rates shot up in the first quarter of 2022, both in the U.S. and in Canada. In the U.S., pundits expect 5 to 5.5% interest rates. About 60% of that increase has already happened in just three quarters. Canada raised its own rates even faster than the U.S. However, south of the border, the ratio of deficit in relation to the gross domestic product (or GDP) is back at where it was before the pandemic. In Canada, the deficit in relation to our GDP (which represents the size of our economy) is worrisome: it is equivalent to about 12% of our GDP. This is a huge number, as the average is a mere 1.8%. Canada finds itself in uncharted territory with this level of debt and higher-than-anticipated interest rates.

Despots, Dictators, and Politicians

Various political players are also to blame. Our policies aiming at countering climate change drove economic change. These new ways of generating power were supposed to create new jobs and be good for the economy. Unfortunately, new energy systems are far from prime efficiency, and entail various unintended consequences. With the current war in Ukraine, Europe is suffering an energy crunch due to its dependence on Russian oil, and general inflation there hit 10%. Meanwhile, OPEC members cut their oil production to protect prices and margins.

Market Recovery Ingredients

Some of the elements required to see a market recovery take hold are the reverse of the above headwinds:

– Central bank “pivoting” – Rates need to become stable and predictable.

– Low stock valuations – We are getting closer to this point.

– Improved earnings – This depends on the company.

– Geopolitical clarity – Not necessarily peace (as markets can rise during wartime), but more predictability.

– Pro-growth political climate – For the past 10-15 years, a progressive agenda has superseded pro-growth politics. Growing paycheques and the economy will need to become top of mind again.

– Innovation and ingenuity – New products/services can take the market by storm (think of the progression made by YouTube – which didn’t even exist 14 years ago – or new medical technologies).

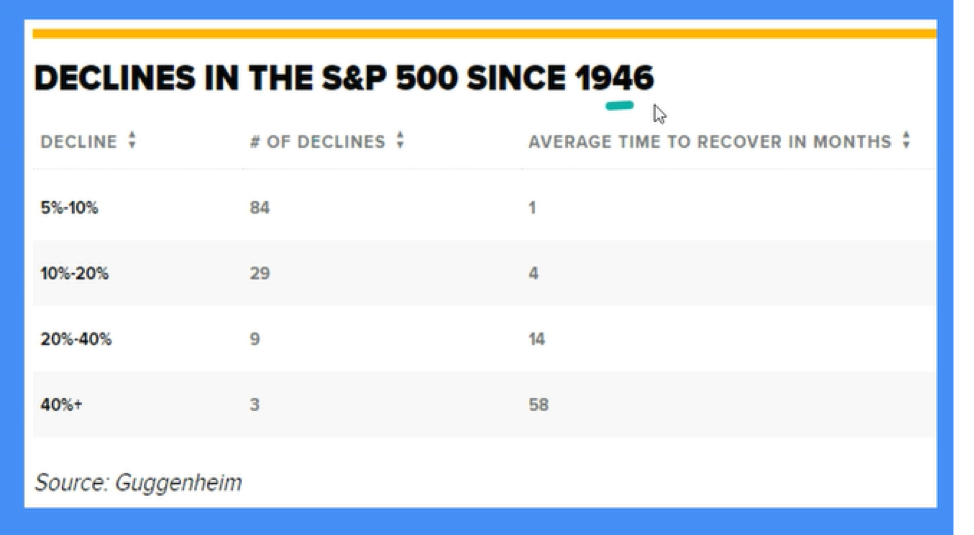

It is also essential to remember that market declines are normal and not to be feared, as this chart of declines in the S&P 500 since 1946 shows.

Principles for Portfolio Management

As markets are impossible to time or predict, all portfolio managers base their work on some common principles. You try to limit exposure to downdraughts. You strive to go against the grain, and sell when markets are buoyant. It is best to avoid wholesale and tilted decisions; incremental decisions are safer. There is only one immutable law: reversion to the mean. Something that goes up too much will retreat, sometimes excessively on the downside. The reasons for your outperformance are why you may underperform later.

Oh ‒ and bear markets provide opportunities.

Right now, the “ugliest” stock in our portfolio is Logitech. It has never traded this cheaply in its history, despite being strongly supported by trends and fundamentals. And some no-frill stocks easily beat last year’s darlings in the current environment. For instance, in 2018 we invested in a plain household name, General Mills, and shunned Netflix when it was all the rage. With the pandemic, Netflix (orange line) shot up and might have looked like a winner, but our cereal maker (white line) had strong fundamentals. In the end, Netflix lost 35%, while General Mills increased by 85% (before even adding in dividends).

General Mills has never traded this high. It takes discipline to trim something that went up. You will always be a little late or a little early, and have to accept looking foolish sometimes. We are fine with that.

For the rest of 2022 and beyond, Exponent will continue to apply the same valuation discipline by remaining impervious to screaming headlines. We always want to avoid overpaying for a stock, and keep looking for the following characteristics:

– a reliable dividend (or sometimes share buybacks);

– a high-quality balance sheet;

– a proven management team;

– business with a global reach.

This greatly increases the odds that a stock ignored by the market will become a solid performer inside our portfolio.

Conclusion

The previous quarter, we took into account the significant probability of an economic slowdown associated with rising rates. This quarter validated our views. Things will likely be difficult on the economic front for a while, but the markets can still provide attractive opportunities. We continue to remain prepared for various market and economic outcomes.

We thank you for entrusting us with the management of your investments. This is a responsibility the Exponent team takes at heart every day. As always, do not hesitate to let us know if you have any questions or concerns.

Benoît Poliquin, CFP, CFA

President and Portfolio Manager