The first quarter of 2024 was kind to investors. Here are the highlights:

Market Performance

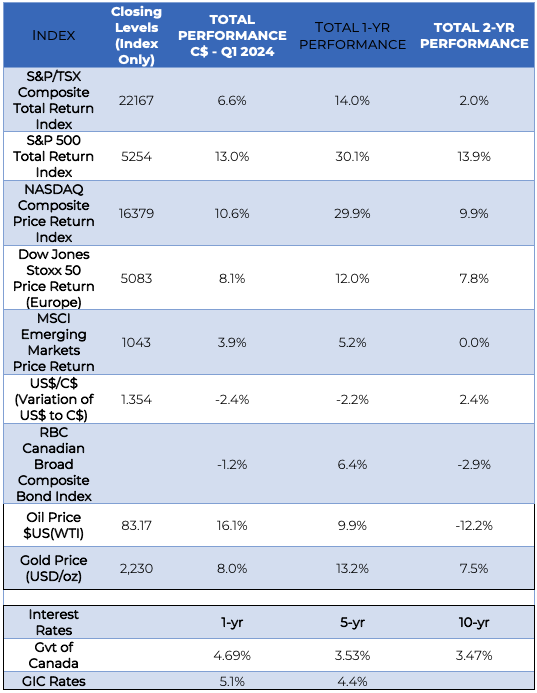

The global stock markets exhibited strong performance in the first quarter of 2024. Significant gains were seen across major markets, with the Canadian market increasing by nearly 6%, and U.S. markets showing double-digit growth in Canadian dollar terms. Europe and emerging markets also reported robust returns.

Sector Highlights

Oil prices surged by 16%, and gold also had a notable increase of 8%. However, higher interest rates led to negative returns for bond investors, specifically in Canadian government bonds which returned 4.7% annually.

Market Dynamics

The S&P TSX and the S&P 500 indices showed variations influenced by the COVID-19 pandemic and subsequent recovery. The Canadian market has fluctuated within a specific range since early 2021, emphasizing the significance of dividends in such stagnant market conditions.

Investment Strategy

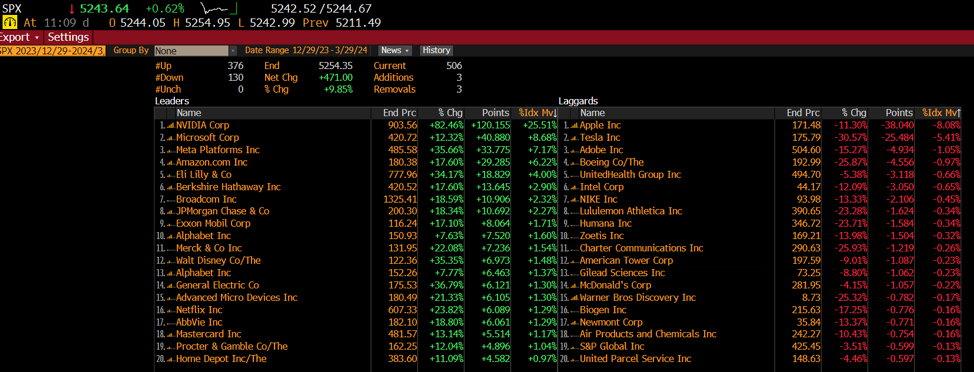

We want to highlight the importance of a diversified investment approach. The performance in Canada was not dominated by a few companies, unlike in the U.S., where significant returns were concentrated among top tech giants like Nvidia, Microsoft, Meta, Amazon, Tesla, and Apple.

Tech Influence

The tech sector continued to be a major driver of market performance, with significant disparities between companies within the same sector. For instance, while one tech company in Canada posted a 12% increase, another experienced a 5.5% decline.

AI and Market Trends

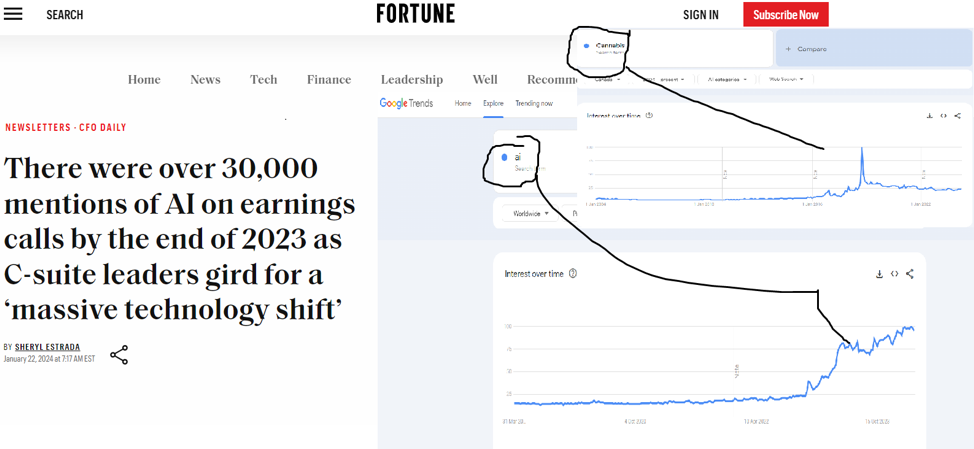

The use of AI in market analysis has become increasingly prominent, reducing the time needed for market analysis. The presentation also touched upon the influence of AI on corporate strategies, as indicated by its frequent mention in earnings calls. Like past trends seen with cannabis, AI’s current popularity in searches may reflect a transient public fascination, although its implications on investment and technology are profound and ongoing.

This recap provides a comprehensive overview of market conditions and investment strategies, with a focus on diversification, dividend income, and the significant impact of technological advancements on market dynamics.