Canada

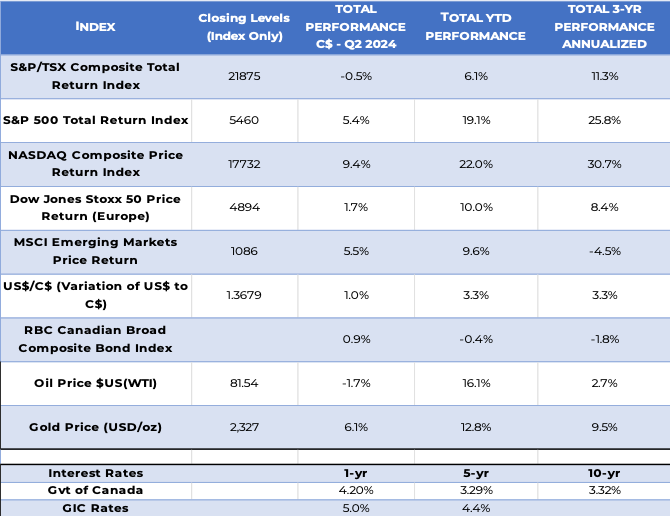

The Canadian market turned in a firm first-half performance, with a return of 6.1% so far this year. Financial names such as Royal Bank and Manulife led the positive performance, which was helped by the energy sector. The Exponent Canadian selection did well, with 6 of the 15 top performers present in your portfolio. The telecommunication sector, Shopify, and the CNR led the laggards on the downside.

United States

A select few technology names dominated the American markets, and this domination is even more extreme than the one we witnessed back in 2000. As of the end of June 2024, 8 of the top 20 most valuable companies in the S&P500 are in the technology sector and represent 37% of the index’s total. In fact, the first seven most valuable companies are technology names.

As you will notice from the chart below, the concentration of the first seven names exceeds what most portfolio managers would consider prudent weights. In short, diversification and proper weighting have detracted from performance in 2024. We know that appropriate risk management does pay off over the long term.

For historical context, technology companies represented 20% of the index at its peak in 2000 or about half of what it is today. As we look at other assets, bonds continue to have a difficult time in 2024, underperforming compared to other assets. Gold and oil, on the other hand, fared much better. The yield on Canadian bonds in the five—and ten-year maturities barely keeps up with inflation.