Overview

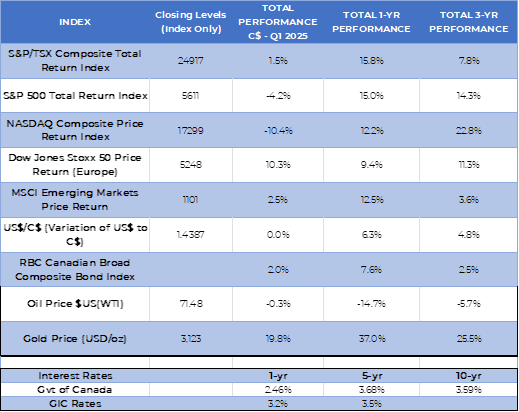

As we wrap up the first quarter of 2025, it’s clear that the market is experiencing a phase of mean reversion. While technology-led U.S. indices such as the S&P 500 and NASDAQ stumbled, lagging regions like Europe and Canada posted stronger-than-expected returns. Volatility returned, but so far, the data suggests we’re experiencing a tremor, not an earthquake. Gold continues to stand out, delivering exceptional returns both in the short and long term, while oil prices remain range-bound.

Market Narrative: Mean Reversion in Play

2024 saw the tech-heavy NASDAQ and S&P 500 outperform. In Q1 2025, mean reversion took hold — tech and discretionary sectors underperformed, while Canada and Europe gained ground. Defensive and commodity-related sectors led the charge.

The MAG 7: From Dominance to Drag

Apple, Alphabet, Microsoft, Tesla, Amazon, Meta, and Nvidia—the so-called “Magnificent 7″—dominated post-COVID market growth, comprising over 35% of the S&P 500 at their peak. After a peak in late 2021 and a 43% retracement, they rebounded in 2023 and continued driving gains into early 2024. However, their weight has become a double-edged sword as volatility returns.

Is This a Market Tremor or an Earthquake in the Markets?

To assess market risk, we analysed key indicators:

- Consumer Credit (US Credit Card Delinquencies): Returning to 2014 trend levels. No crisis signal.

- Government Bonds (US Treasuries): Yields are fluctuating but within a normal historical range.

- Corporate Credit (BBB Bonds): Slight spread widening, but still well within risk tolerance.

- Volatility (VIX Index): Elevated but far from crisis levels seen in 2008 or 2020.

Conclusion: We’re experiencing a normal correction, not a structural collapse. Market behavior signals a tremor — not an earthquake.

How Often Do Market Tremors Occur?

- Since 2010, Canada’s market has fallen more than 10% 17 times — about once a year.

- The S&P 500 has fallen 10% or more 15 times since 2010.

Volatility is normal. Selloffs are frequent, but rarely catastrophic.

What to Do in a Market Tremor: Sell & Upgrade

Tremors create opportunity. During corrections:

- Sell laggards or names with failed investment theses.

- Upgrade to market leaders that are usually expensive.

- Consider trimming top performers to lock in gains and reallocate into temporarily discounted quality stocks.

Markets don’t recover in straight lines — the rebound tends to be bumpy. Take your time.

Final Thoughts

At Exponent Investment Management, our goal is to be boring — in the best possible way. We build solid, dependable portfolios that grow consistently without chasing fads. We manage the tension between capital growth, security, and consistent return generation, especially during such periods.

As always, if you have questions or feedback, we’re here to help.

Warm regards,

Benoit Poliquin

Portfolio Manager, Exponent Investment Management