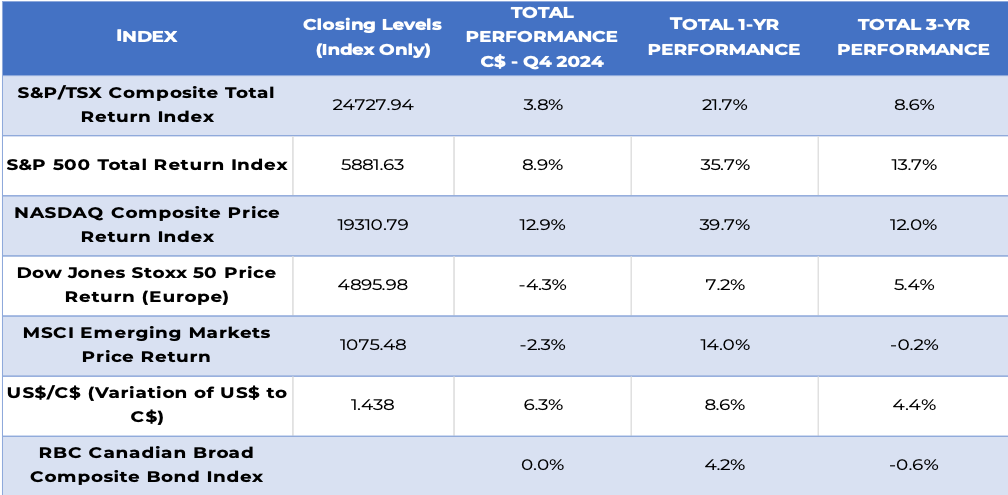

The past year brought exceptional returns across several indices, with Canada’s TSX delivering 21.7%, the S&P 500 achieving 35.7% in Canadian dollar terms, and the NASDAQ soaring by 39.7%. European markets lagged, with the Dow Jones Stoxx 50 rising by only 7.2% over the year, and Emerging Markets managed a modest 14.0%. Over a three-year period, the Canadian and U.S. markets exceeded or met long-term averages, while Emerging Markets remained flat. Bonds provided minimal returns over the past three years, with a slight improvement in 2024 (4.2%), while gold was a standout performer, returning 133% over three years, including a 28% gain in 2024.

Despite strong market performance, many investors struggled to match benchmark returns in 2024. This is attributed to concentrated growth in a few sectors and stocks, particularly technology, which dominated the S&P 500. The index’s top 10 names, including Nvidia (+171%) and Microsoft (+12%), accounted for 37.3% of its performance. However, portfolio constraints, such as capping specific sector exposure at 10–15%, limited participation in these gains. Diversification into other sectors or geographies and valuation-driven strategies like trimming winners further detracted from returns. We can also point to sector misclassifications, with companies like Alphabet and Meta categorized outside the technology realm despite their tech-driven operations.

The year raised concerns about market valuations and potential bubbles, with some experts, like Howard Marks, warning that rising asset prices could dampen expected returns over the next decade. While 2024 was the second consecutive year of 20%-plus gains, the debate between passive and active management continued, with concentrated performance among a few stocks creating challenges for both approaches.

Exponent Investment Management remains focused on delivering consistent, balanced returns by combining growth, security, and consistency. The firm emphasizes research-driven active management to navigate volatile markets and minimize risks. Despite geopolitical concerns and market volatility, we can express cautious optimism, noting that valuations for global franchises remain reasonable and many risks are already reflected in prices.