Retiring early sounds great but can it help you live longer? Certain studies have illustrated that there’s a strong correlation between retirement and longevity.

What these studies established is that people who take early retirement, say in their mid-fifties, live well into their 80s, therefore collecting 25+ years of pension cheques. Later retirees on the other hand, typically in their mid to late sixties, collect less than 2 years of pension cheques on average. Why is this so? Most likely, wealthier retirees who were able to call it a career in their early to mid-fifties probably managed their time, health and finances better than those who were unable to retire before age 65. “The hard-working late retirees probably put too much stress on their aging body-and-mind such that they are so stressed out to develop various serious health problems that forced them to quit and retire…. With such long-term stress-induced serious health problems, they die within two years after they retire.” (Dr. Sing Lin, 2002)

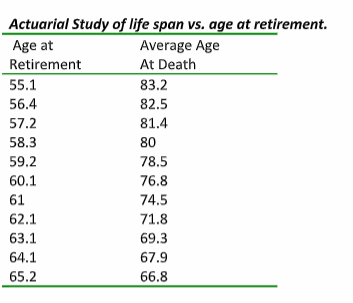

The below table from an actuarial study of life span vs. age at retirement illustrates precisely this point. The study is based on the number of pension cheques sent to retirees of Boeing Aerospace in the US. Results show that on average, from the age of 55, deferring retirement costs 2 years of life for every 1 year of deferral. Similar results were produced in studies of many other global companies. Very staggering, especially when you consider the average Canadian currently spends their final decade with sickness and disability.

Source: http://faculty.kfupm.edu.sa/coe/gutub/english_misc/retire1.htm

To anyone just starting out a 35 to 50 year working career, as the saying goes, “Find a job you love to do and you’ll never have to work a day in your life.” This isn’t always possible but it’s still good advice. If you’re in your mid-fifties to early sixties, the saying may still apply as Canadians are living longer and therefore choosing to, or having to work later on in life. Planning a healthy retirement might include transitioning from the daily grind of full-time work to a more lax part-time job in a chosen field. Casual or part-time income can easily be integrated into a quality retirement plan. Call it semi-retirement if you will. As a side note, many studies have also shown that working part-time past the age of 50 can be beneficial to your overall health, as well as prevent isolation, so long as it’s not super stressful work.

The bottom line. If (and it’s a big if) you have a decision to make regarding when to retire, make it sooner than later. Work out a plan by yourself or sit down with an advisor to see what it looks like. You WILL live longer for it.