Volatility + Falling Interest Rates = Near Record Close

Performance

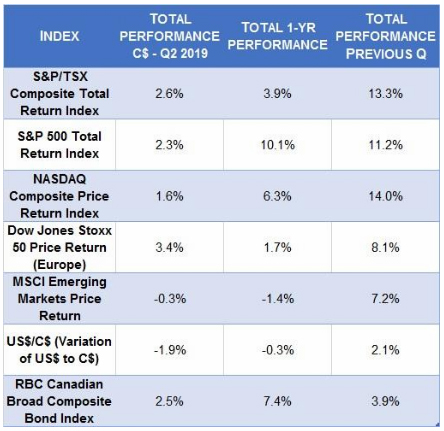

The second quarter of 2019 could be described as a roller coaster ride for equity investors and a magic carpet ride for bond investors.

For equity investors, the month of May brought significant pullbacks. Yet, despite this setback, the quarter’s performance amounts to a good one.

For bond investors, central banks’ shift to a very accommodative stance in late 2018 has made bond investing lucrative again. Interest rates are back at generational lows, which has pushed bond prices upward since December.

Another important performance marker to note has been the strong performance by gold (up 8.6% to over $1,400/oz in Q2) and gold miners (XGD up 14% in Q2) as well as defensive sectors, such as consumer staples, utilities, and real estate.

Key Takeaway

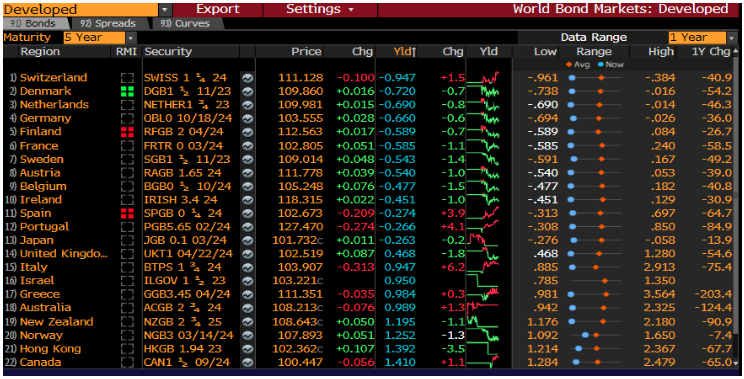

Interest rates continue to drive the equity markets. They have fallen since December in most jurisdictions and many are in fact negative. The concept of a negative interest rate seems counter-intuitive, as who would lend money to a government to guarantee a negative return? The answer: central banks. Central banks have been active in the global bond markets by driving down interest rates in the hopes of boosting economic growth. On the right, you can see the yields of various 5-year bonds.

You will notice that yields in 13 of the 22 world economies listed here are negative. The highest yielding 5-year bond of the developed countries is that of the U.S., with a yield of 1.77%.

Conclusion

For us, the key to performance and safety continues to be valuation of stocks. We can control our entry point by looking for attractive investments and focusing on a selection of quality companies selling for a reasonable price in order to position our portfolios to take advantage of the current climate. Our other alternative is to keep cash on the sidelines as return of capital can be more important than return on capital.

For a more in-depth look with our PowerPoint slides: Download them here!