What are options?

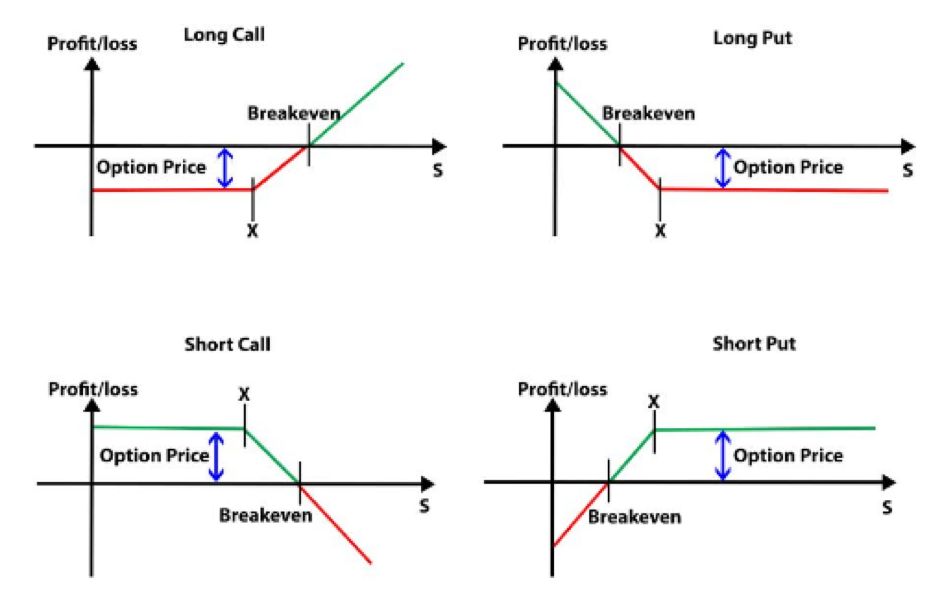

An option is simply a financial derivative which gives the holder (the buyer) the right, but not the obligation to buy or sell an underlying security (usually shares of a company) at a set price at a point in the future. Options are either calls or puts; these two instruments mirror each other in every way. Calls give the holder the right to buy at a given price, while puts give the holder the right to sell at a given price. The given price is called the strike price of an option.

Speculating with Options

Traders can profit using options by betting on up or down movement in the price of an underlying security. Profiting from options will occur when the trader correctly predicts the up or down movement in price, while using leverage along the way. Leverage is created because the options on a stock will always be cheaper than the stock itself. As such, more option contracts can be bought for the same capital outlay. Unlike other leverage scenarios, an investor can get levered upside exposure for a known loss potential with the purchase of a put or call option. Buying calls, which gives the holder the right to buy a set number of shares at a set price at a point in time. When buying calls, the investor pays an option premium for the potential right (but not the obligation) to buy those shares. If the call expires worthless, then the option holder loses the premium they paid- the capital at risk. On the other hand, an investor can speculate on the fall of a price of a stock by buying a put. For the cost of the option premium, the put buy will have the ability to sell his or her stock at a specified price and by a specified date…thus locking in a “floor” on the proceeds from the sale of a stock. This put option will increase in value as the price of the stock falls, with all else being equal. In short, option speculating revolves around correctly predicting the move of an underlying asset for which the option is based. The right to sell the stock at the now higher strike price, the trader may exercise the option at a profit, or may choose to sell the profitable option instead. Leverage comes from a relatively small cash outlay. Profits come only when correctly predicting the move of the underlying; gains will be magnified.

What influences the price of an option?

Options are traded openly in options markets and their price is set by a variety of different factors. Underlying price is the most important. The price of a stock for which the option is based has a strong correlation to that option price, whether it be a put or call. The value of a call will increase with an increase in the price of the underlying. On the other hand, the price of a put decreases as the price of the underlying security increases. Calls have a positive relationship with the underlying, while puts have a negative relationship.

The next aspect is the exercise price and its relation to the price of an option. For calls, the lower the exercise price versus the current market price of the underlying stock, the more the call is worth. This is due to the right to buy the underlying security at said lower price. For puts, the higher the exercise price is in relation the underlying stock price, the more the put is worth. This is due to the right to sell the underlying security at a higher price. Relating to exercise prices, calls have a negative relationship with the exercise price, while puts have a positive relationship with exercise prices.

Time to expiration is an important concept in valuing options, this is called Theta. For both calls and puts, the more time there is to expiration, the more the call or put is worth. With more time comes more potential for price movements in the underlying stock, giving the option more value. Time to maturity looks to capture increased probability of a profitable exercise. The risk-free interest rate also plays a role in the pricing of options.

Volatility increases will drive up the price of both calls and puts. Volatility has more potential as time to expiration is longer, as these two factors work together to help the holder.

Options Pricing and Implied Volatility

Implied volatility is simply a measure explaining how the trader measures the chances that an underlying security changes in price, up or down. Traders use implied volatility to compute moves in futures markets and in pricing options contracts. With either calls or puts, the higher the implied volatility is, the higher the premium is for an option. From a macro standpoint, implied volatility will increase in bear markets and decrease in bull markets. Implied volatility is represented by sigma and will be shown by percentages and standard deviations over a timeframe. Implied volatility does not predict the direction of a price swing – up or down. Rather, high implied volatility only means a higher expectation of a large price swing in either direction. As option pricing is directly related to overall volatility, the option with higher volatility will command a higher premium. Traders know that implied volatility is an expression of the probability of a price change in either direction. An easy way to understand implied volatility is to replace the word volatility with probability. The higher the probability, the higher the option value. The probability is increased the more the underlying stock price oscillates.

What is Gamma Hedging?

Gamma Hedging is an options strategy used by traders in the event of rare occurrences, and it is low probability, high impact in nature. This strategy is usually used with options that are close to their expiration date, while the underlying security on which the option is based is highly volatile. Experienced traders use this approach when they wish to reduce their risk exposure on either side of a trade. Options generally become more volatile as their respective expiration date nears, and Gamma Hedging is the answer to minimizing price risk in such an event. Price swings on either side of the trade are natural; this is nothing new to the trader. In any advanced trader’s playbook, Gamma Hedging is often the answer to large moves up or down in the price of an underlying security. Related to Delta Hedging, Gamma Hedging is similar in the sense that it seeks to curtail losses with meticulous computations throughout the trading process.

Mechanics of the Gamma Hedging Trade

While a market maker has sold many call contracts in their current portfolio, Gamma Hedging revolves around adding diverging option positions (and sometimes stocks) to said portfolio. So, if a market maker offsets this upside risk with Gamma Hedge by adding call options, or the underlying shares to the portfolio. As prices rise, the market maker must add positive exposure thereby adding “fuel to the fire” by buying more. This additional buying can become a tsunami of positive price action. However, when the price action turns negative, the market maker must reverse course and reduce exposure quickly, thus adding selling pressure.

Conclusion

Gamma Hedging will contribute to volatility when heavy buying or selling forces market makers to hedge off large price movements in illiquid and/or volatile stocks. The next time you see a stock soar on what seems like a whim, it is often because the internal mechanics of the option markets forces which are leverage and exposure combine to augment stock price movements. Often, speculators will augment the impact of a trend by the use of leverage which forces others involved in the options market like market makers to protect themselves from the violent price movement which in turns amplifies the price movement.