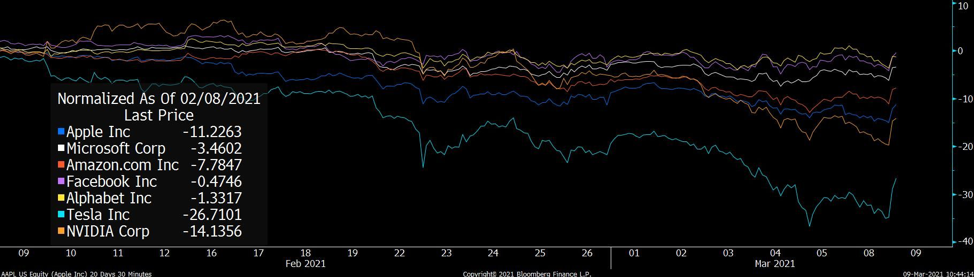

Index Movers During the First Quarter

For much of 2020, the largest 5-10 stocks on the S&P 500 carried the performance of the index. 2021 has been largely the opposite, with most of these same names dragging down the index recently. All this in spite of the fact that almost one quarter of the S&P 500 stocks reached 52 week highs in the last week. Here we have charted some of the largest index movers and their respective percentage depreciation over the past month.

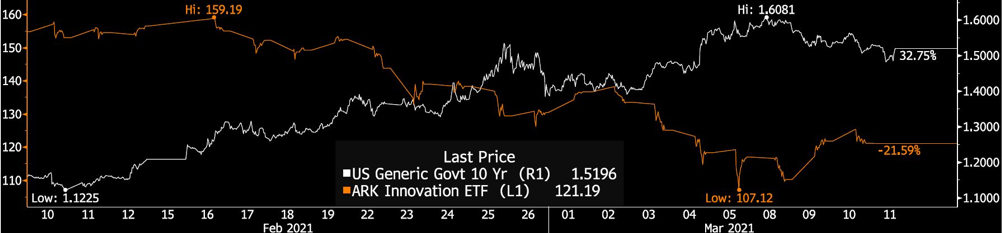

US 10-Year Treasury vs ARKK

You might have looked as some of the winners of 2020 an noticed that these stocks are very volatile of late and wondered why. The answer is the path of interest rates: up.

I will avoid the math, the but concept is due to higher rates reducing the value of future cash flows, and the higher these cash flows are expected to be, the larger the relative decline. The ARK Innovation ETF (ARKK) is a perfect proxy for high octane growth stocks as it counts companies like Tesla (11% weight), Square (6%) and Roku (6%) as top holdings.

This chart shows the US Government 10-year vs. ARKK, highlighting an almost mirror-like effect over the past month. If the 10-year continues to rise, the high growth companies that make up ARKK will continue to decline in price.

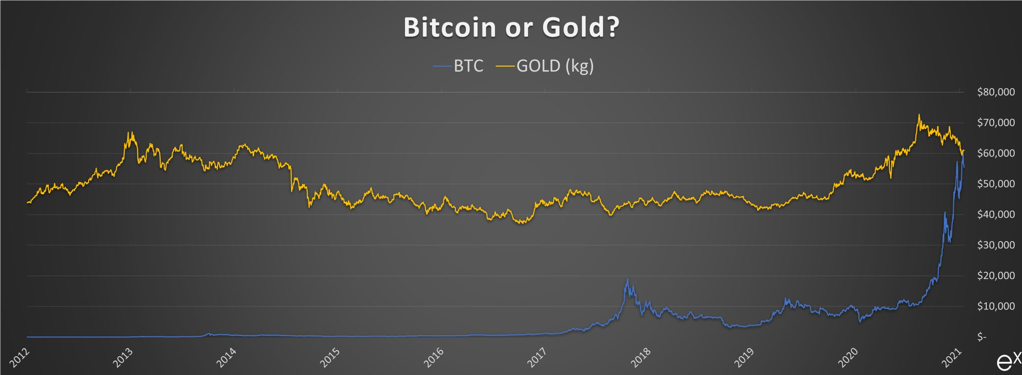

Bitcoin becomes more and more Gold-like

Is Bitcoin a store of wealth? More and more fund managers are beginning to think so. Although it is extremely volatile, and maybe too volatile to become true currency, Bitcoin has a limited supply and is attractive from a global exchangeability standpoint.

Some think Bitcoin is essentially ‘Digital Gold’, offering another alternative investment in store-holding wealth. As central banks around the world continue to devalue their respective currencies, where do Bitcoin and Crypto fit as investments?

M2 continues to skyrocket: What does it mean for investors?

When the world’s largest central bank (U.S. Federal Reserve) ‘prints’ money, how does it enter the banking system? Gone are the days of printing presses running new bills off a machine.

The Fed, through their open market operations, puts money into the economy by simply buying Treasury bonds from major banks. Since the banks have more money on hand from the proceeds, the transaction translates into an increase in banking reserves. The intended result is that the banks can now lend out more to lenders (consumers and companies).

This chart shows the YoY M2 percentage change in USD. M2 is seen as the broadest indicator of money in the economy, with the supply skyrocketing since 2019. The fear is that when “too much” money chases goods and services, the price levels increase…and that is when we experience inflation in our everyday lives.

How long can the Fed go with printing money and not concerning themselves with inflation? This is the question weighing on the minds of investors at the moment.

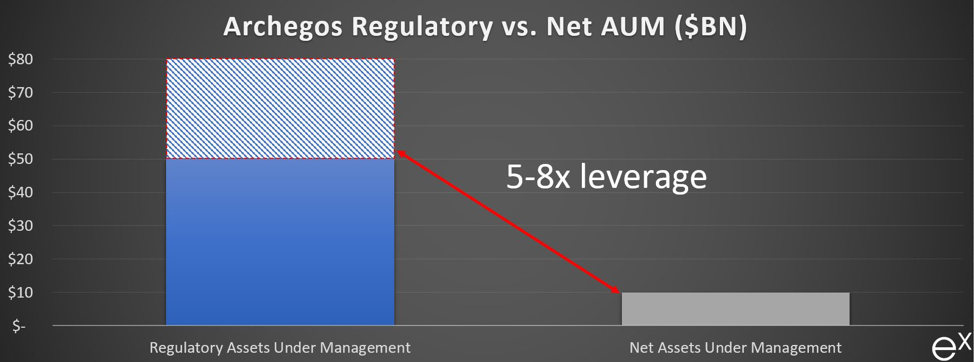

Leverage Magnifies both Gains and Losses

Bill Hwang’s family office hedge fund sent markets plunging beginning last week when his firm, Archegos, was forced to unwind positions held with Wall Street’s biggest banks. Archegos utilized Total Return Swaps, where the holder of the swap takes on both the profit and loss from a portfolio of stocks, while paying a fee to the broker or bank.

The swap strategy allowed Hwang to take massive positions in names like ViacomCBS or Discovery , while putting up limited upfront funds as he borrowed from banks. Leverage is great when you’re on the winning side of a trade, but in this case, the underlying stocks moved down, forcing banks/lenders to sell the shares in order to protect their collateral.

Because banks are selling all at once because they take over the position in order to protect their own capital, the drop is amplified as the goal of the selling is to get fills quickly. Credit Suisse and Nomura Securities have been hit the hardest, while JP Morgan and Goldman Sachs seemed to have exited relatively unscathed.

It is said that “Archegos was highly leveraged at 5-8x equity.” For the stock nerds out there, this brings back memories of Long Term Capital Management, the focus of When Genius Failed.