As May 7th-13th is Mental HeaIth Week I thought it timely to post about mental illness and the Disability Tax Credit (DTC).

The Disability Tax Credit is wide ranging and covers individuals with a vast array of disabilities. It allows individuals, and their family member(s) providing for their care, with a number of tax deductions, credits and benefits (including eligibility for the Registered Disability Savings Plans).

Eligibility on the grounds of a physical disability is generally fairly straight forward. What about those among us whose disabilities are less physically apparent, but whose impact on the activities of daily living is severe? Anxiety, mood or schizophrenia disorders can have a prolonged and serious impact on every day life. Many of these individuals and their families may not realize that they too may qualify for the DTC. Or do they?

Major publications such as The Financial Post, The Star and The Huffington Post have written of late about CRA’s recent tightening in regards to mental illness DTC claims.

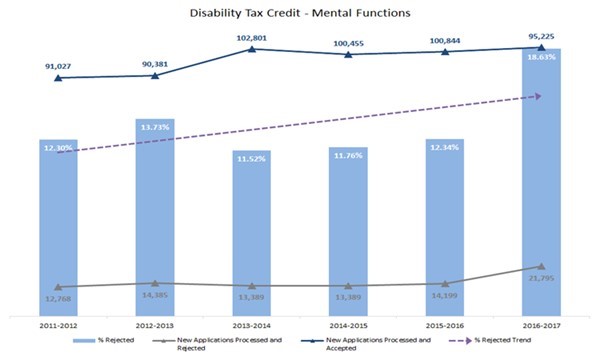

The data would seem to support that conclusion. According to CRA’s Disability at a Glance the percentage of New applications Processed and Rejected to Total Applications Processed jumped to 18.63% in 2016-2017. That said, this does still mean that in excess of 80% of Total Applications Processed are approved.

The problems for that arise for individuals with mental illnesses attempting to qualify for the DTC seems to be twofold at present.

First, those with mental illnesses may be unaware of the DTC , unwilling to claim it due to the stigmatization of mental illness, or unable to follow through with application, rejection and appeals processes.

Second, it is not specific mental or physical disabilities that create eligibility, but the severity of the disability in relation to one’s ability to perform the basic activities of daily living. The Disability Tax Credit Certificate (T2201), “Section B”, requires completion by the relevant medical practitioner. “Part 1: Mental functions necessary for everyday life” requires a medical doctor, nurse practitioner, or psychologist to certify that the individual is markedly restricted in performing the mental functions necessary for everyday life. This is further interpreted as “they are unable or take an inordinate amount of time to perform these functions by themselves; AND this is the case all or substantially all of the time (at least 90% of the time)”. This last clause proves problematic as it is quantitative, and not compatible with the way prolonged mental illness is experienced. The language used by CRA appears to be written with neurocognitive disorders in mind.

The good news there appears to be progress in the right direction on both fronts.

Initiatives like Bell Let’s Talk Day have gone a long way de-stigmatize mental illness, allowing people to seek out the help they need, including government tax credits.

CRA provides an online questionnaire to help determine eligibility prior to applying for the DTC.

Family members who are legal representatives for disabled individuals can also apply for the DTC, and follow through with the application process. If necessary, they can even take it all the way to tax court for them, like mental health advocate Lembi Buchannan M.S.M. Ms. Buchannan prevailed on behalf of her husband in Tax Court (Buchanan v. Her Majesty the Queen, 2001). She has since received the Meritorious Service Medal in 2016 for her years of lobbying efforts on behalf of disabled individuals.

Ms. Buchannon also reinvigorated the Fighting for Fairness campaign which provides excellent information on the appeals process available following a DTC rejection.

Lastly, the Liberal government reinstated the Disability Advisory Committee (DAC) in November, 2017. The Committee’s core role will be “to provide advice to the Minister of National Revenue and the Commissioner of the CRA on the administration and interpretation of the laws and programs related to disability tax measures administered by the CRA, and on ways in which we can take into consideration the needs and expectations of the disability community as well as increase awareness and take-up of measures for people with disabilities.”

It’s members include Doctors, Health Care Practitioners, Advocates and Tax Experts. In her remarks to the committee at the inaugural meeting on January 24, 2018 the Honourable Diane Lebouthillier, Minister of National Revenue said: “We want everyone who is entitled to credits and benefits to receive them. We want to hear from you how we can improve our administrative practices, and enhance the quality of our services and the delivery of credits and benefits for persons with disabilities.”