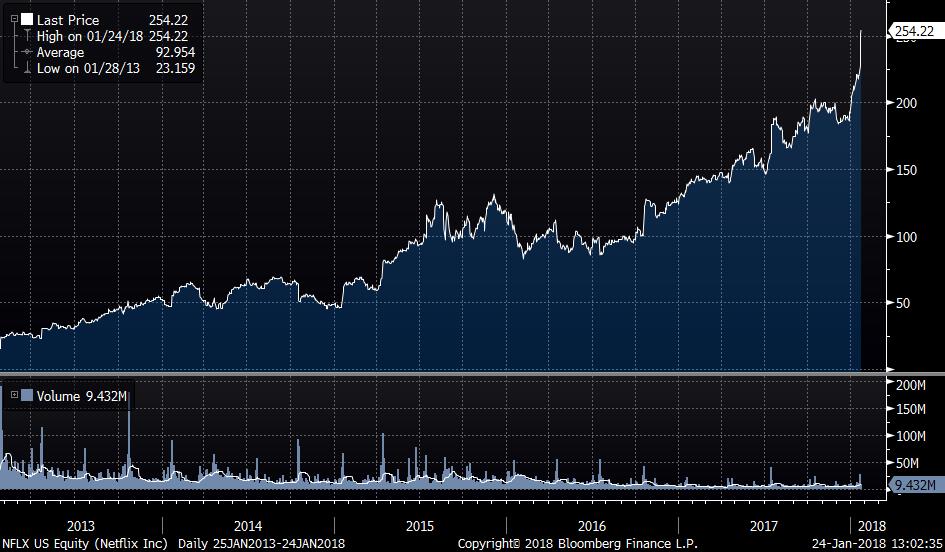

For the neophyte, you could ask why this is a big deal. If you were in grade school when the last tech bubble imploded, you might argue that the growth of the company is has been spectacular and the premium (stratospheric?!) valuation is warranted. After all, how many companies do we know that can grow their sales 4X in five years.

Allow me to illustrate my point. In my mind, NETFLIX is an app. A REALLY good one. It is priced so that no one really bothers to cancel the service. However, the content is the key. They have realized this and are now creating content as well, the more you watch, the less you need to use NETFLIX. Only my 13-year old daughter will watch Grey’s Anatomy three times over 🙂 This puts them in an interesting dilemma; they have to spend money constantly to keep their clients happy.

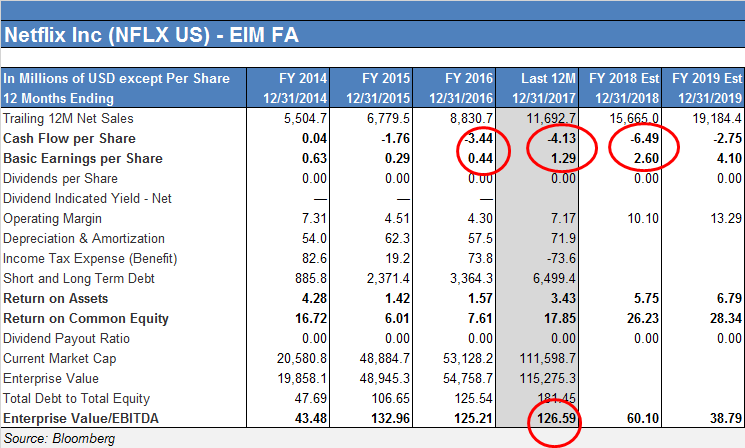

So the cash flow question is related to this content question. I am not a forensic accountant, but companies with large discrepancies between cash flows and earnings where the cash flow is negative and the earnings are positive is awfully surprising. A few well known financial collapses had that particularity. Remember kids, you can’t “adjust” the cash flow statement as easily as you can the earnings statement.

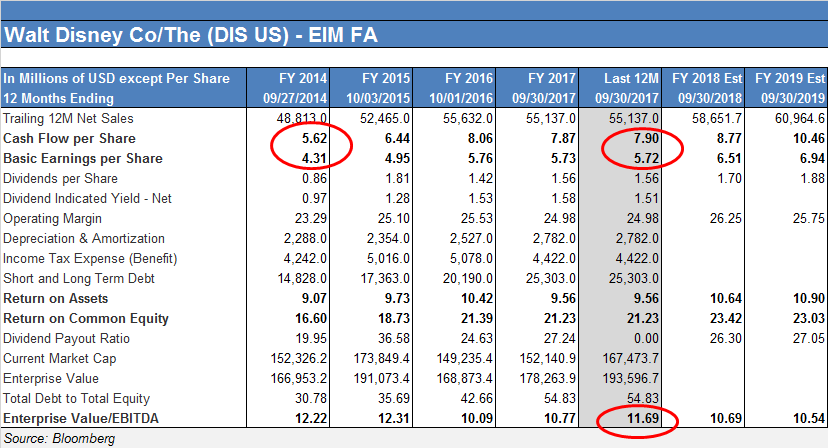

As a contrast, we can look at The Walt Disney Company. The company is large and far from perfect. The question I have for you is, which one is a better investment…for investors?

What matters here is the earnings and dividends in my opinion. The second point is how much are we paying today for those earnings (valuation) and finally, where are those earnings coming from?

Many are worried about the demise of ESPN and the other networks they own. I would wager that the end of stock cycle, I would rather own a company that at it’s core, is about repackaging content over and over again through new mediums. Mickey started as a short film in movie theaters almost a century ago and now has is own app; Talk about transcending generations! Here are the financials for Disney…and compare them to the those from NETFLIX above.

- The sales of DIS have not grown as quickly as NETFLIX, but look at those cash flow and earnings lines! The dividend line is pretty good too!

- Better return on assets and equal return on equity.

- Valuation is actually reasonable, if a little on the expensive side. The new pending acquisition is muddying the waters here. You are paying 1/10 the cash flow valuation…

The conclusion is that NETFLIX is expensive and this cannot be debated. The sales have grown tremendously, but the shareholders have not seen their lot improved by way of consummate growth in earnings per share. The cash flow number is massive warning. For those that are interested, page 9 of latest quarterly results will shed some light on the massive cash cost of creating content. The past growth of the company seems to be to be more than baked into the current stock price. In fact, A LOT of good news from the future is priced into the current quotation.