Ron and Mary would have more than enough to meet their modest goals, expert says

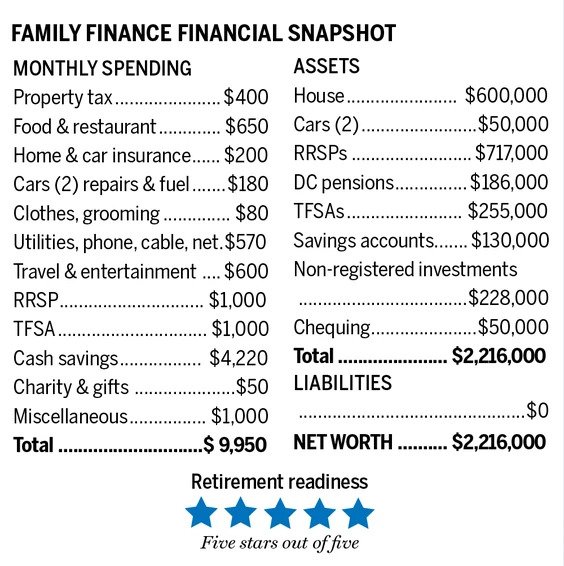

In Alberta, a couple we’ll call Ron and Mary, ages 49 and 45, are taking a long look at the end of their respective careers in machinery sales and road management. Ron has put in 30 years with his company and earns a gross annual income of $90,000. Mary, a leader in her niche of the construction materials industry, has 17 years with her company and earns $69,000 per year before tax. They take home $9,950 per month.

They want to know if they can both retire in six years with a combined annual income of $60,000 after tax. But they are also considering a second option, which would see Ron retire immediately and Mary work for another decade.

Calculating their assets

Ron and Mary both have defined-contribution matching plan to which each contributes three per cent of gross pay equalled by employers and which therefore grow at six per cent plus investment returns. Each month they save $1,000 for their RRSPs and $1,000 combined per month to their TFSAs. $4,220 monthly goes to non-registered savings.

Their assets thus include their home, valued at $600,000, which they have fully paid for; two DC pensions worth a total of $186,000; $255,000 in their TFSA accounts; RRSPs with a balance of $717,000; $130,000 in so-called high-interest savings account; and non-registered accounts with a balance of $228,000. Throw in the $50,000 value of two cars and $50,000 in their chequing accounts and their present net worth is $2,216,000.

Staggering their retirements

If Ron were to retire this year at 49 and Mary continued to work to 55, as they have considered, they would need $45,000 per year after tax for basic spending. Mary’s $3,800 monthly after-tax income would be enough to cover them. But what would happen when Mary retires?

With no further savings to registered or other accounts, Ron’s $510,000 in registered investments, including his $84,000 defined-contribution pension plan, left to grow at three per cent per year after inflation would rise to a value of $685,400 in ten years when Mary would be 55 and would retire.

That sum would provide Ron $30,480 per year for the following 36 years at the same rate of growth and distribution of all capital income. The funds would run out when Ron is 95 and Mary is 91.

Ron’s non-registered assets and savings held in joint name with Mary with a total value of $330,000, growing at three per cent after inflation for ten years, would rise to a value of $443,500. That sum would provide $19,722 annual income to his age 95. His DC pension and half this joint non-registered income, $9,861, would provide Ron an income of $40,340 in 2022 dollars.

Mary’s $393,000 of registered assets including $102,000 in her DC pension plan with annual matching contributions would grow to a value of $577,043 in ten years. That sum would generate income of $25,660 per year for the following 36 years to her age 91. Adding in half their joint investment income, $9,861, would provide Mary a total income of $35,522 at her age 55. Their total annual income would be $75,860. After splits and 13 per cent average tax, they would have $66,000 per year or $5,500 per month, right on target.

Synchronizing their retirements

Alternatively, they could both continue to work for another six years to his age 55 and her age 51, shortening her time to add to assets, but extending his.

In this scenario, his $510,000 would rise to a value of $644,944 in six years. That would generate $27,079 per year for 40 years. The non-registered investments and savings account with a combined $330,000 value growing for six years with $3,000 monthly additions would have a value of $633,886. That sum would provide each partner half of $26,625 or $13,313 per year to his age 95, giving Ron total income of $40,392 in 2022 dollars.

Mary’s registered assets would grow to a value of $496,845 by her age 51 with the same assumptions. This capital would generate $20,865 per year to her age 91. Adding in her half of non-registered income, $13,312 would give her gross income of $34,177. Their total income at this point would be $74,570 at the start of Ron’s retirement in six years. After split of eligible income and 12 per cent average tax, they would have $65,621 or $5,470 per month.

Boosts from TFSAs, CPP and OAS

Their TFSA accounts with a current balance of $255,000 growing with no further contributions would have a value of $384,432 in six years assuming contributions continue at $12,000 total for both for six years. The accounts could be a buffer for unexpected expenses or they could take the money out over the following 40 years at $16,364 annually for travel or other uses.

In the first case — Ron retires at 49 — income would rise to $82,364 or $6,865 per month. In the second case, annual income would be $81,985 per year or $6,830 per month. We’ll average it at $82,174 or $6,850 per month.

At each partner’s age of 65, Canada Pension Plan and Old Age Security benefits would be available. Contribution rates and payouts are changing, but we estimate each partner would have 75 per cent of potential CPP payouts or $10,838 at 65. At 65, each would have OAS benefits of $7,707 per year per person at 2022 rates. That’s an annual total of $18,545 each or $1,360 per month after 12 per cent tax on top of other income when each partner reaches 65. Total monthly income would rise to $8,225 when Ron is 65 and $9,585 when Mary is 65.

They would have more than enough to meet their modest goals.

Retirement stars: Five retirement stars ***** out of Five