Stop me if this sounds familiar: You work for a great company. It’s growing like crazy. And fortunately you were granted a healthy amount of stock and/or options that seem to increase in value by the minute.

If that sounds like you, then first of all: Congratulations. You’re in a great position to tremendously impact your financial future.

Yes, I’m sure you’re very capable and you’ve worked very hard to be in this position, but you might also consider yourself fortunate to be employed by the right company, at the right time. Lightning rarely strikes twice, and many very smart, hard working people don’t ever even get such an opportunity.

In all likelihood, this is a once-in-a-lifetime chance to secure your future (you should at least treat it as such). Let’s make the most of it! But how do you do that without losing upside participation, or feeling like you’re selling out too early?

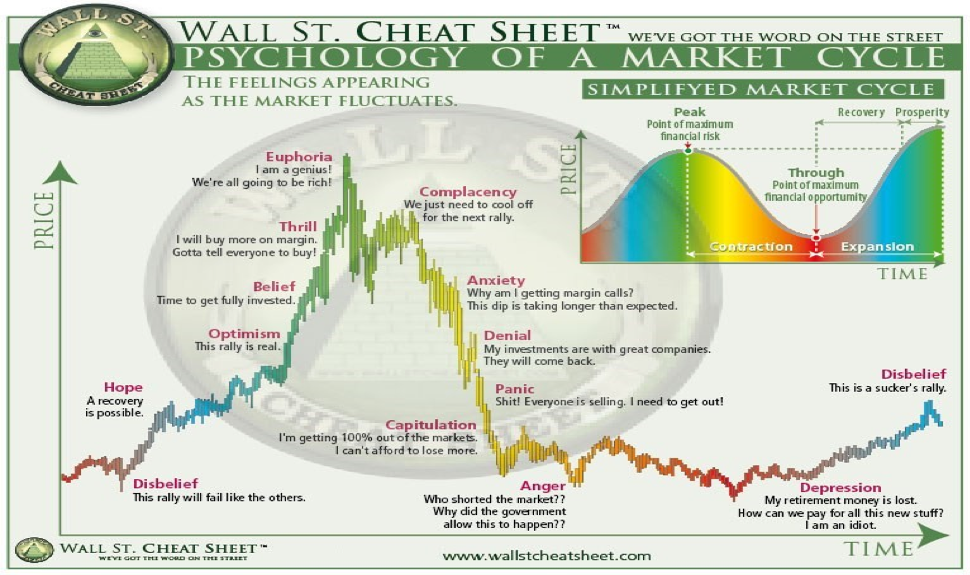

Working and having options at a stock market darling can be intoxicating at times. Fear of missing out (FOMO) on market gains can cloud even the soberest minds. And it’s not unheard of for employees to face internal pressure to not sell their shares in the name of sending the wrong message to staff or even company executives.

Portfolio concentration risk, however, is very real. And nothing lasts forever. Even when you’re sitting on a present-day winner, the long-term odds still aren’t in your favour: JPMorgan research shows that, since 1980, roughly 40 percent of all stocks have declined 70-plus percent from their peak, with many never returning to their former glory.

That’s why having a clear exit strategy is paramount. Otherwise, you could wake up one day wondering why your fortune – which existed only on paper – has suddenly vanished.

What’s the right plan?

It’s important to realize there’s no “how to” manual on this, and no single way of doing it 100-per-cent correctly.

In my experience working with clients in this very position, it’s about finding a balance of selling part of your shares when your portfolio hits certain milestones, while holding the rest of your shares for future participation.

It’s also vital to create a plan you can live with, and stick to, while staying flexible enough to tweak certain details depending on market realities.

You’ll often hear military generals say a plan never survives first contact with the enemy. It’s an astute observation in a battlefield context, but it doesn’t apply here. Do your research, give your plan a lot of thought, and stick to it – even when FOMO strikes.

The cornerstones of a smart exit strategy

There are four specific data points I recommend using to trigger the sale of stock option tranches. These can be modified and/or others can be added.

• Time frame: You’ll sell X% of your portfolio by X date, keeping greed-to-fear market cycles in mind (see image below).

• Company stock price: You’ll sell X% of your portfolio when shares reach X price and so on.

• Company outlook: You’ll sell X% of your portfolio when the company’s metrics reach X.

• General market outlook: You’ll sell X% of your portfolio when the benchmark market index hits X.

The plan is fairly simple:

You peel off a predetermined percentage of your original shares and vested options whenever triggers are hit. That way you’re consistently taking profits from your shares, while also keeping a portion should they go even higher.

Within the above, however, things can be kept fluid. Maybe you prefer selling your first tranche when any of the four milestones are met. Or maybe you’re more comfortable executing the plan after two, three, or all four events are triggered. You can pre-establish your sell triggers for just your first tranche, or all tranches (in the case of the former, you’ll then need to set new benchmarks upon selling the first tranche).

Note that we’re not mentioning the “T” word, taxes – don’t let taxes payable on a sale influence your chance to secure your future. Have a tax plan in your back pocket, but never let it drive your investment decisions.

Michelle’s plan: An exit strategy example

To illustrate what we’re talking about here, let’s take a fictional employee shareholder – we’ll call her Michelle – working for ABC Company currently trading at $100 per share. She was granted shares and options when she started working for ABC 2.5 years ago. After seeking (but not solely relying on) professional expert advice, she’s committed to the following exit strategy of selling her first tranche when one of the following four conditions apply:

• Time frame: By June 1, 2023, Michelle will sell her first tranche of shares and vested options, no matter what’s happening in the stock market at that time.

• Company stock price: Michelle will sell her first tranche anytime the stock price hits $200. She could also set a price range instead of a single value.

• Company outlook: Michelle will sell her first tranche if company shares trade above four standard deviations. Major company catalysts such as earnings, key product launches, acquisitions, and big client wins should be kept in mind before triggering a sale. Important Note: Trading on non-public information is illegal and could land you in serious hot water. Never sell stock on inside information or on learning of non-public information. If she’s unsure, Michelle will check with compliance before selling stock.

• General Market Outlook: Michelle will sell her first tranche when the S&P 500 reaches 5,500 points, with an average price to earnings ratio (P/E) above 1.5 standard deviations (sometimes the market will tell you everything you need to know about when to sell your shares – or to hang on for more upside).

Planning your tranches

Michelle will be ready to sell her shares by preparing in advance. This could mean completing company paperwork ahead of a planned sale, and/or opening brokerage accounts for your shares to be sold etc… You may find this tip obvious, but I’ve seen terrible things happen during an administrative delay that could easily have been planned for ahead of time.

So, you’ve sold your first tranche. Excellent! Each tranche represents a major milestone in your financial security, but this is just the first of many steps.

If you’ve pre-determined your second tranche triggers or need to set them, now is the time to re-evaluate your benchmarks to ensure they’re still relevant and realistic. If your second tranche benchmarks aren’t yet determined, what’s a realistic new trigger? Does it still correspond with reality?

How much to sell?

You will need to determine how much of your original allocation to sell in each tranche. This, again, can be somewhat fluid. Here’s Michelle’s plan:

• First tranche: Michelle will sell 20 percent of her shares and vested options. The first tranche represents her most meaningful sale and likely secures her future the most, by helping her buy a home, pay off her mortgage, or pay off student loans.

• Second tranche: Michelle will sell 20% of her original allocation.

• Third tranche: She’ll sell 20% of her original allocation.

• Fourth tranche: She’ll again sell 20% of her original allocation.

• The “Moonbag” or the rest of her shares: Similar to the moonbag strategy favoured by successful crypto investors, Michelle will hold the balance of her shares indefinitely, but every time their value doubles, she’ll sell half… think Apple, Amazon or Tesla at the beginning.

Lessons from experience

Above all else, stick to the plan. This will require serious conviction: Whatever plan you hammer out, I can’t stress enough that it’s going to be completely useless if you don’t stick to it, no matter what the stock price is doing.

Don’t let FOMO get to you. Don’t be greedy. “Bulls make money, bears make money, pigs get slaughtered” is an old investment industry saying, and a warning against being too greedy.

Finally, never look back or second guess yourself. It’s not productive to do so and, in fact, may hinder your future decision-making and final outcome. Warning: It will be painful to see the stock price continue to rise after a disposition. But if you stick with your plan, you’ll end up securing your future while dramatically reducing risk exposure in the process.