For investors seeking income, investing in dividend-paying stocks has been one of the popular and successful strategies.

Dividends are a cash payment that many of the larger publicly-traded companies make to their shareholders. Dividends are generally paid quarterly, although some companies pay dividends monthly or yearly.

One of the most appealing benefits of dividends is that they are paid to shareholders regardless of market conditions—and often increase during strong economic periods when the company is doing well. However, some companies have been known to cut their dividends during particularly bad periods, although most blue chip stocks have a strong record of sustained dividends.

In most companies, shareholders can opt to either receive their dividends in the form of a payment or have the money automatically reinvested in more shares of stock. Reinvesting the dividends can have a significant impact on your long-term return from that stock.

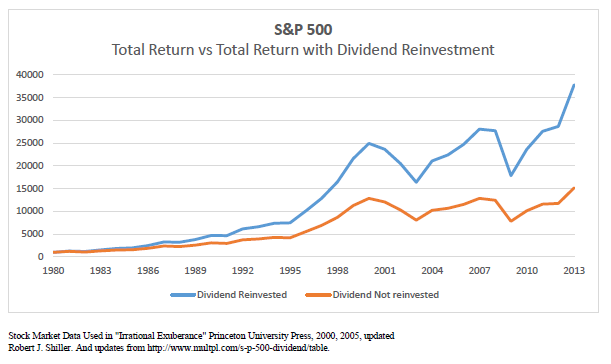

The chart below shows the performance of a $1,000 investment in the S&P 500 index over the past 33 years. The orange line shows the growth of the $1,000 investment when dividends paid by the companies in the S&P 500 are not reinvested and the blue line shows the performance of $1,000 when all dividends are reinvested in the index annually.

As you can see in the chart, at the end of the 33-year period, an investor would have earned more than twice as much by reinvesting the dividends. The initial $1,000 investment would have grown to $15,162 with no dividend reinvestment and $37,820 if all dividends were reinvested.