Because of its tax benefits, a Tax Free Savings Account (TFSA) is a one of the best retirement savings tool for working Canadians over 18. Currently, you can contribute up to $10,000 per year to a TSFA, a massive increase from last year’s limit of $5,500.

If you were to maximize your contributions every year for 30 years, earning a 5.5 percent real return, how much money would you have?

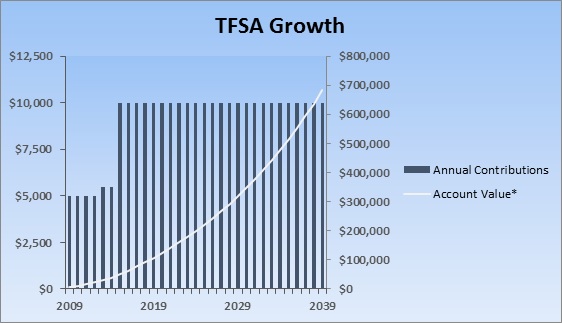

Check out the graph below.

The left hand axis shows the annual contribution room per year with the blue bars. The white line with the right axis shows the total value of the savings. In 30 years (starting in 2009) contributing the maximum every year will equal $682,351 in 30 years. The best part about the savings power of the TFSA is that you can withdrawal all the balances tax free and use those withdrawals for contributions in future years.