A Registered Disability Savings Plan (RDSP) is a long term investment vehicle for Canadians with disabilities. The plan is designed to build an asset pool from which funds can be withdrawn during the retirement years to assist with the disabled individual’s care and necessities of daily life. Ensuring funds are set aside for those later years is critical as the primary caregiver, typically a family member, may no longer be living or able to provide support.

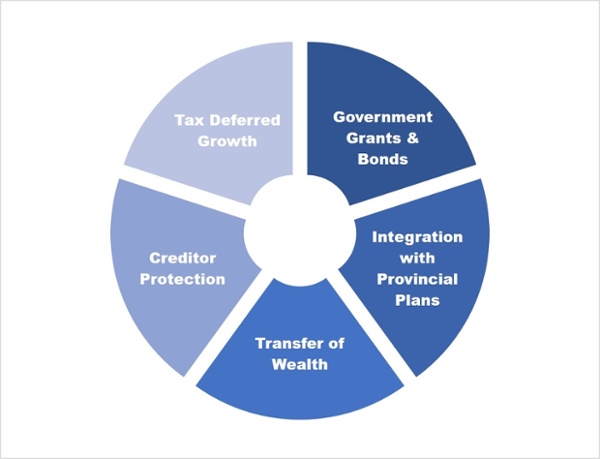

RDSPs provide significant benefits for the disabled individual (the beneficiary), and potentially their families, as described below.

First, to open a Registered Disability Savings Plan the beneficiary must meet all of the following conditions:

- Be eligible for the Disability Tax Credit (DTC)

- Have a valid Social Insurance Number (SIN)

- Be a Canadian resident when the plan is opened

- Be under the age of if 60, unless the RDSP is being opened as part of transfer from an existing RDSP

Government Grants & Bonds

Employment and Social Development Canada (ESDC) will match contributions to RDSPs by way of the Canada Disability Savings Grant (CDSG) based on family net income. Grants amounts are set a 100%, 200% and 300% of contributions up to prescribed limits.

Additionally, ESDC disburses the $1,000 non-contributory Canada Disability Savings Bond (CDSB) also based on family net income thresholds.

Integration with Provincial Plans

Assets held in, and income received from Registered Disability Savings Plans will not disqualify the beneficiary from provincial assistance plans like the Ontario Disability Support Plan (ODSP) or trigger Old Age Security (OAS) repayment.

Transfer of Wealth

RRSP/RRIFs of parents and grandparents, upon whom the beneficiary is financially dependent, can be rolled over into RDSPs tax free upon death up to the $200,000 life time contributions limit. Other strategies can also be employed to ensure receipt of CDSG, while reducing the taxation on the decedent’s RRSP/RRIF.

Creditor Protection

While not exempt by statute, Alary (Re), 2016 BCSC 2108 ruled that RDSPs could not be used to satisfy the claims of creditors.

This ruling may provide piece of mind for holder(s) whose professions expose them to increased risks of bankruptcy.

Tax Deferred Growth

Investment gains and income are not taxable while in the plan.