This question was put to me by a very surprised friend. The surprise lies in the fact that I am the Chief Operating officer of a ….Wealth Management firm. One can rightfully be (amazed, shocked, stunned) at the fact that this grey haired gentleman, who has piled up 30 plus years in all aspects of the financial industry considers he is not apt to manage his affairs.

Let me explain. I know more about investments, financial planning, arcane investment products and taxation than most people will ever learn. So I should be uniquely qualified to make wise decisions. I can hold my own in expert company, and even come up with some valid investment ideas.

All of the above is, in my opinion, totally useless when it comes down to my own wealth building. One can be able to identify specific engine noises in their cars, does it mean one should take the engine apart? You may be able to apply a perfect coat of paint on your walls, but should you tackle electricity and plumbing?

Having lived through the markets meltdowns of 1987, 2001, 2008, and expecting a replay of those in my lifetime, I know too well what happened to friends and family who thought they were smarter than the pros. Rendered giddy by the availability of all kind of software, they happily embarked on all the bubbles that came their way. Then the music stopped. And their families paid the price.

Did I get burned? Not in the least! Reason being that I had no money to invest back in those days. Had I had the money, I know that I would have followed the crowds on the collision course of inflated expectations followed by asset killing margin calls.

Money and emotions make a terrible couple. The same people who would spend days to choose a new refrigerator may spend less than 5 minutes to invest their hard earned savings. Or inversely, generally talked into it by a “friend who made a fortune in the market”, they will feel all empowered by a couple of great trades.

I have seen many friends and colleagues in tears, literally. One of them put all of his family savings into Nortel, a Canadian darling. Many others believed in Bre-X to the bitter end. Another one thought he had an inside line into an exploration company without realizing he was basically holding half the outstanding shares at around 8 dollars. As of this writing, the stock is now trading at .01781. My friend used to own a home, no more.

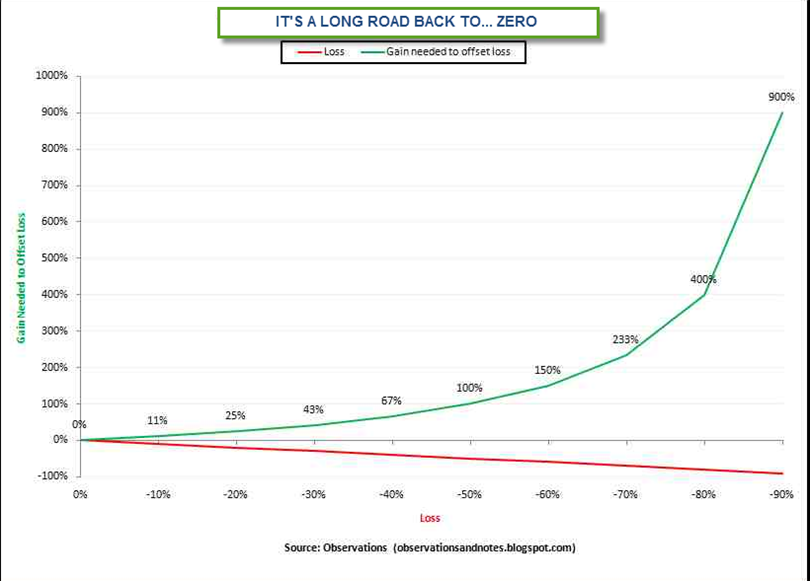

With a market downturn comes high anxiety. 10% down, everybody is a macho. Minus 15%, smiles turn into a grin. At -20%, faces get frozen. Then comes real pain, which is around minus 30%. Anxiety sets in. But there is more to come: the -40 “blowout”. This is the point where everybody runs for the life rafts, and of course, massive losses are booked.

Regrets are a useless emotion. “If only” does not pay your bills, take care of your loved ones, or let you live relatively worry free. For most people, “the markets” become an addiction, an obsession that clouds their judgement. Because I include myself in this majority of people, I do not manage my own money or, write my financial plan. I do keep a trading account that represents 2% of my investable assets. And guess what? This is the one that keeps me awake at night and that I check several times a day whereas it is totally irrelevant to my and mine wellbeing.

So if you think you have what it takes, go for it. Study for years, try every possible strategy, and watch CNN and BNN 24 hours a day. And while you are at it, fire your dentist and pull out your own teeth.

Plumbers fix leaks. Mechanics fix your car. Wealth managers manage your money, simple at that. Do they make mistakes? Absolutely! No matter how many degrees you have, how many years of experience have been accumulated, there will be times when a wrong call is made, an opportunity not seen. But do Portfolio Managers make terminal errors? Will they risk your life savings on a single investment? Will they get delusional thinking the markets are wrong and they are right? They won’t, because if they did, they would lose you as client, and could also lose their hard earned professional licenses. Their job is to keep calm when the going get rough, to help you identify your needs any time your life circumstances change, but firstly to “do no harm”, which in finance means do everything possible to ensure capital preservation over the mid to long term. In good times, anybody can make money throwing darts at “the market”. And this brings along a false sense of invincibility. Before you trust anybody with your savings, ask for their performance over the bad years, not the good ones. If you don’t, you may be chasing a train that has already reached the end of the line

The chart above illustrates how hard it is to “recover” from a significant loss. If a 10% loss can be offset with an 11% gain, a loss of 80% would require…a 400% GAIN TO BREAK EVEN