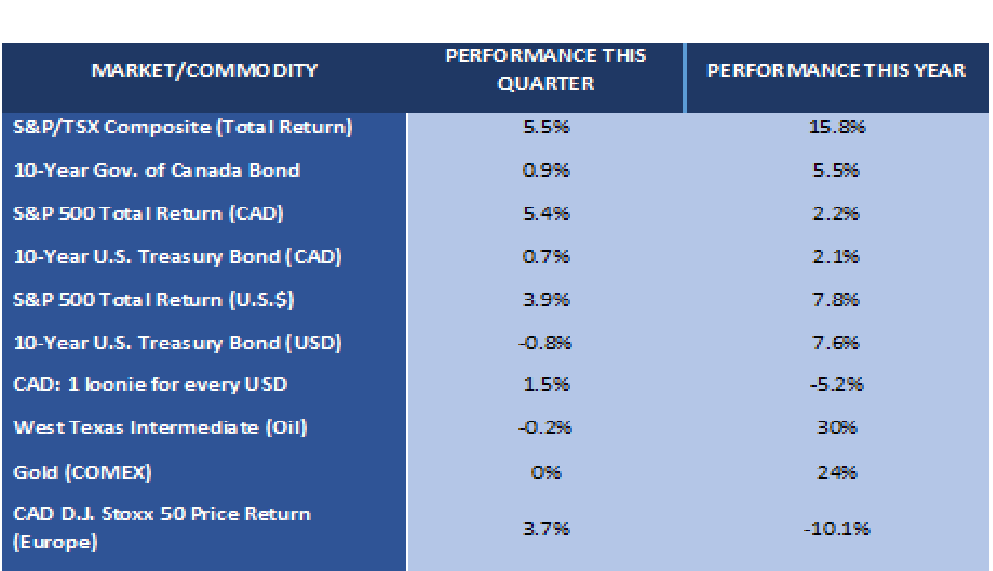

A good year so far, despite the pundits

In spite of predictions – including our own – we sit higher at the end of this quarter than at the beginning. In fact, the year to date is proving to be much better than we had anticipated. However, this has only served to increase our caution and, correspondingly, our cash levels.

Market-timing is always a high-risk game, and we have no qualms admitting that we are not very good at it. Instead, our strength comes from doing our own research. Being independent and quite nimble in that department allows our team to be very clear-eyed about valuations. In markets as expensive as the one we see now, it is truly critical to determine the correct entry and exit points in terms of stock valuations. As investors are weary, any sign of a company’s operational weakness usually leads to significant price drops.

And we love that. The market’s reaction is often overdone, and that creates opportunities for those, like us, with cash available.

At the moment, however, we are much more active on the sell side than the buy side of the ledger. Our existing holdings hit our sale prices targets faster than the pace at which we find investments that meet our quality and value criteria. This explains why we currently hold higher-than-usual cash balances.

In our view, not only is the market is expensive, but the current prices are jarringly out of line when the storms that are brewing on the horizon are taken into account. To name just a few:

- In politics, the upcoming U.S. election and the looming Brexit;

- On the geopolitical front, a renewed assertiveness on the part of Russia and China;

- In macroeconomics, the rising USD with its impact on the huge debt volumes issued by foreign entities in this currency.

While not gloomy, our outlook is cautious. We have identified our list of potential investment opportunities and are being patient about our entry point prices to increase the odds that our investments pay off.

Oil. The prices keep on going up despite many predictions to the contrary (including our own). We are not tempted by this move up. The prices have risen based on an OPEC agreement on curbing production. If history is any guide, it is doubtful this agreement will stand the test of time. Technology has allowed North American producers to be profitable at around $55-$60 per barrel; the net result is that anytime the price of a barrel approaches these levels, North American production increases. It is also important to watch the rise in the USD, as commodities tend to weaken when the greenback grows stronger.

Earnings. Corporate earnings growth continued to plateau in the U.S., giving investors more reason for concern about stock market growth in the near future. In Canada, earnings are appreciating as a result of the turnaround in oil prices.

Interest Rates. The U.S. saw a significant rise in interest rates, as illustrated by the 10-year bond rate which posted a negative return. This is something we had not seen in a while. In Canada, interest rates in the 5-year and 10-year horizon are continuing to fall. This is good news if you have a mortgage, but not if you are a GIC investor.

Investor Sentiment. The latest U.S. investor sentiment as reported by the American Association of Individual Investors stands at 28% bullish (the long-term average being 38%). The bearish sentiment, on the other hand, is at 27.9% while the long-term average is 30%. There are fewer optimists than usual, but also slightly fewer pessimists. In other words, this is not particularly significant.

The quarter was relatively quiet on the equities side. We did see a noticeable drop in equity prices in Canada and the U.S. However, the results continue to be positive (and near the long-term average) in the U.S., while the Canadian market is having a great year. We can thank the oil and gold sectors for this performance.

3rd Quarter 2016 Market Drivers

1. U.S. Markets

The U.S. market moved past the 2,132 high on the S&P 500 reached last summer. The new top seems to be at the 2,190 level, and not any higher. The reason is simple – in the face of flat earnings becoming weaker, investors’ greed turns to fear. For most investors, the only alternative to stocks is found in low-yielding bonds. This leads to bond purchases and equity sell-offs when the mood is fearful, to the point where equities become attractive again from a valuation perspective. Then, investors sell off their bonds and move back to equities. A modest rate increase of 0.25% by the U.S. Fed is expected in December, while Canada’s short-term interest rates should remain steady.

We expect this volatility to continue given the lack of a catalyst for earnings growth. Our portfolios are well positioned for what we believe is a logical eventuality. When the Fed raises the interest rate, stock prices will decline and present us with more buying opportunities.

1.1 VALUATIONS

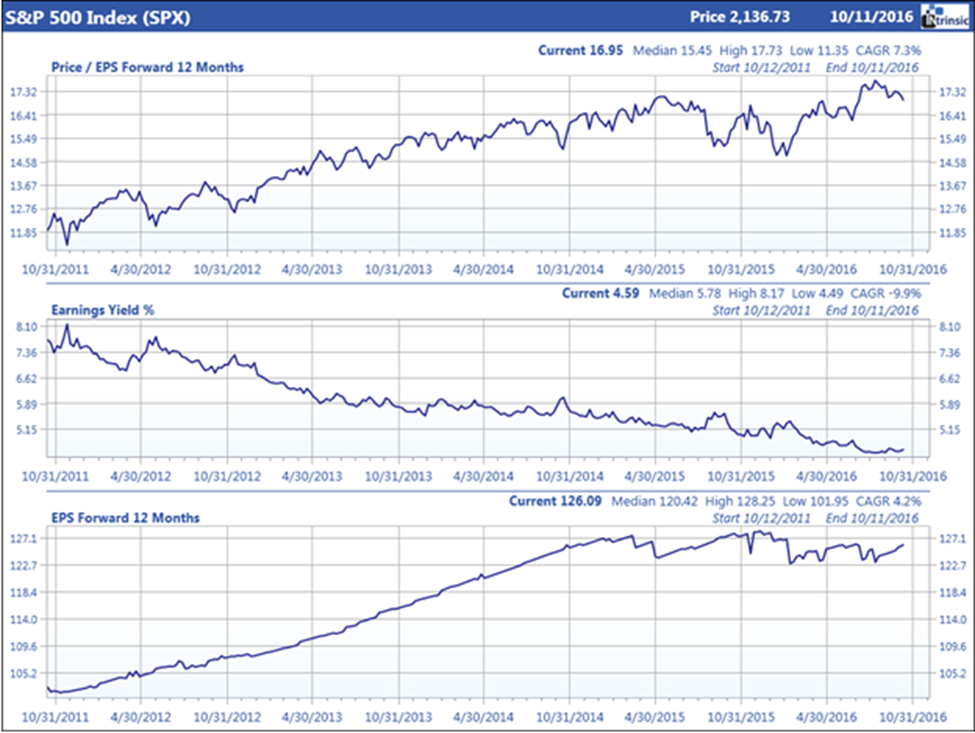

The following charts display the forward price/earnings ratio (current stock price divided by projected earnings 12 months out), earnings yield and forward earnings per share for the S&P 500. We use these charts to determine whether the U.S. market in general is overpriced. In short, we do not find these valuations convincing.

1.2 EARNINGS

The bottom portion of the graph illustrates the expected earnings of the S&P 500 index. After a fantastic sequence, expected earnings growth has waned and remains on a plateau that began back in Q3 of 2014.

We have seen some interesting stock moves in the United States market. Dividend-paying stocks that were all the rage during the last 18 months are showing some weakness, with names like Clorox (-14% from its high this quarter), Disney (-10%) or Nike (-13%). As mentioned in our summary above, bargains are beginning to emerge.

1.3 RISK APPETITE

The 10-year bond yield, considered a risk-free return, serves as a gauge for investors’ risk appetite. Investors invest in stocks as long as the risk-free return does not cover inflation. Again this quarter, faltering confidence in the stock market made bond prices rise, which dragged yields lower.

The Federal Reserve has long been postponing what we consider a necessary increase in interest rates. It is now expected to announce a modest rise at its December meeting. The stimulus recipe of maintaining interest rates extremely low for a long time can create problems. Market participants are now much more cognizant of this fact.

We are indeed seeing some interesting events in this respect. For instance, the stock of Deutsche Bank (Germany’s largest lender) is down nearly 44% so far this year, and nearly 74% since the beginning of 2012. Low rates are very problematic for lenders. So much so that many clients of the bank are now questioning its solvency. When rates are negative, lenders cannot make a profit no matter the loan volumes. And, absent a healthy lending environment, the velocity of money slows to a crawl – and so goes economic growth.

The British pound also bears some watching. It is down about 17% so far this year, and such a large variation in one of the world’s main currencies is unusual. This will make some U.K.-based exporters much more competitive, and makes the stock prices a bargain from a CAD or USD perspective.

In closing, let us not forget the rise of trade protectionism and political nationalism around the world. These policy trends are all headwinds for global trade and growth.

2 Canadian Markets

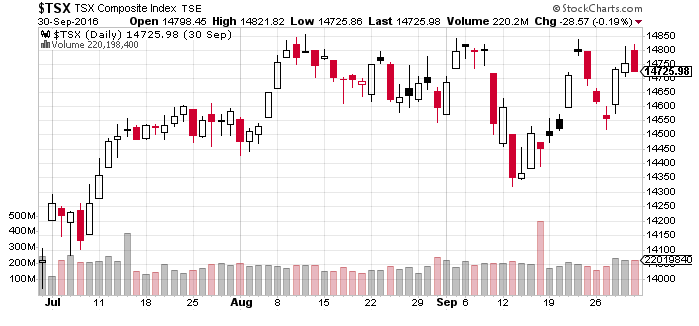

The Canadian market continued its rebound, and stands now as one of the best-performing markets in the developed world. A few points of note:

- Energy and materials were the best performing sectors again this quarter.

- Financials bounced back. However, we suspect that high real estate valuations could create problems in the future. In addition, the new federal mortgage rules and a new tax on real estate in British Columbia are slowing down mortgage originations. In fact, Genworth, one of the second-largest mortgage insurers in Canada, estimated that 30% of its loans approved in 2016 would not have met the new regulation standards had they been in effect. One can expect some disruption in the Canadian mortgage market.

- There is no doubt that these rules are a game-changer. We are seeing a local builder offer significant discounts (25%+) on homes in inventory on top of other incentives, such as financing the down payment for 3 years at 0%. The net result is that existing owners who purchased one of these same homes in last few years are now looking at a 30% price drop.

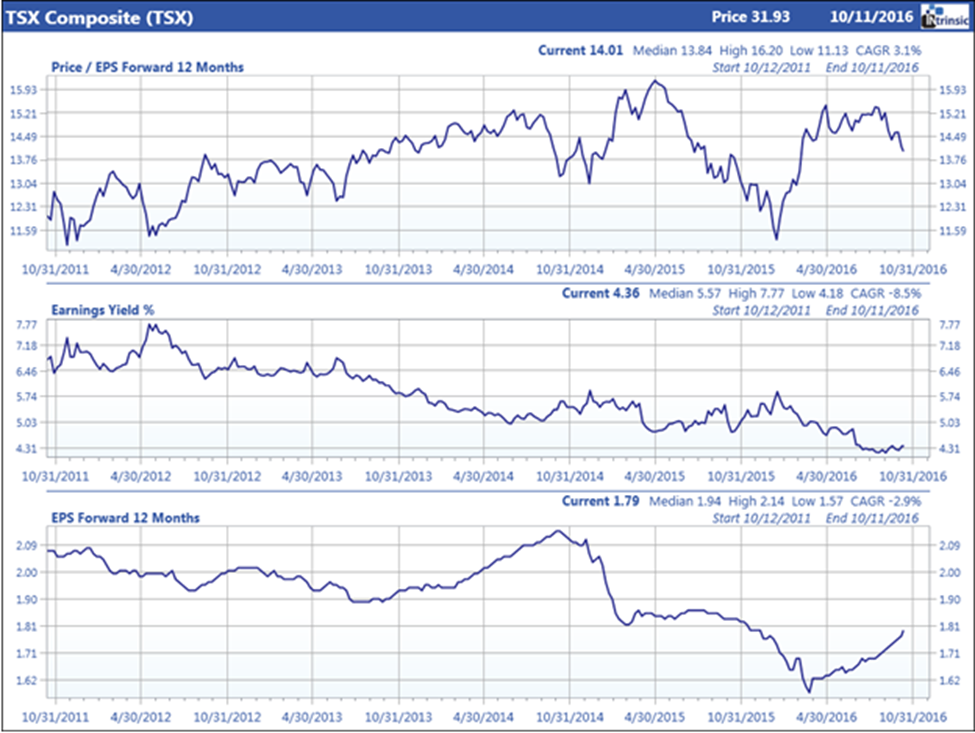

Above is our familiar look at the TSX from a fundamental level. The top pane of the chart displays the PE ratio, in other words, what investors are willing to pay for a dollar of earnings. The investment crowd is still willing to pay higher than average multiples for earnings.

In contrast, we remain pessimistic on the Canadian economy as it does not offer ideal conditions. The dollar still remains too high to provide a meaningful advantage in terms of exports. Also, despite the rebound in commodity prices, there has been no meaningful progress, and the economy does not seem to be on a permanent footing to recovery. Like with all cycles, the recent upward move in oil prices is likely a counter-trend rally within a general downward trend of our economy.

We maintain our focus on Canadian exporters or companies that have significant foreign operations. Not only do we expect the currency exchange rates to provide some relief, but we anticipate better economic results in the U.S. and even in Europe.

The middle pane shows the earnings yield of equity holders as compared to bond holders’, in Canada. Equities deliver a premium over bonds. The yield on a 10-year Government of Canada bond hovers around the 1.5% level and this trend has flattened out. This means that for stock appreciation to occur either earnings must improve or interest rate must go lower. That being said, Canadian investors have no alternatives since there are no convincing returns to be found besides stocks.

We have no reason to change our view that Canada remains cheap and will probably become even cheaper. At the same time, the CAD rebound relative to the USD provides an opportunity to add more exposure to international markets according to your comfort level.

3 Foreign Markets

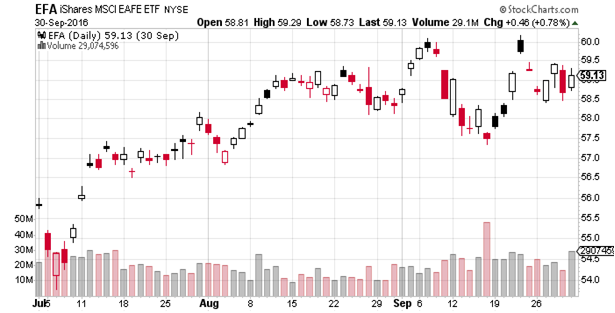

Above is the chart of the Morgan Stanley index, which is a proxy for Europe, Australia and the Far East markets. It has trended up nicely during the quarter.

However, the USD’s strength is still hindering many Asian economies, whose commodity input costs are priced in USD, and thus are not reaping the full benefit of lower prices. Furthermore, commodity prices are up. Zinc, for instance, has increased 49% this year.

Also disquieting is the high level of private and public debt issued in USD. As the greenback marched forward in 2016, interest payments in local currencies rose in step. Higher interest payments create a drag on these economies, who cannot contribute as much to the global economy.

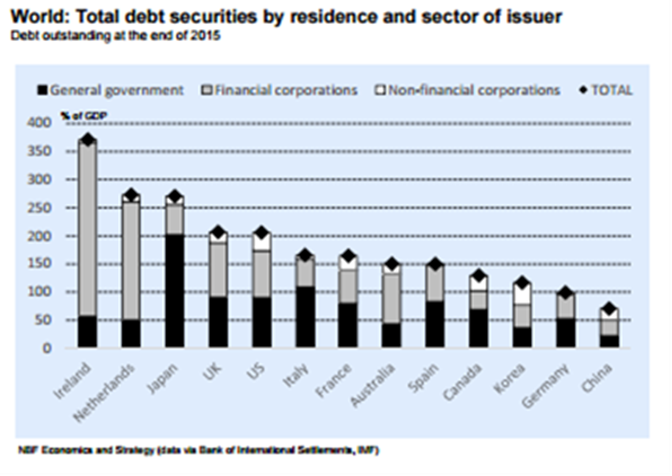

Below are two charts outlining the debt problem. This first chart illustrates the fact that the largest debtors in the developed economies are actually corporations.

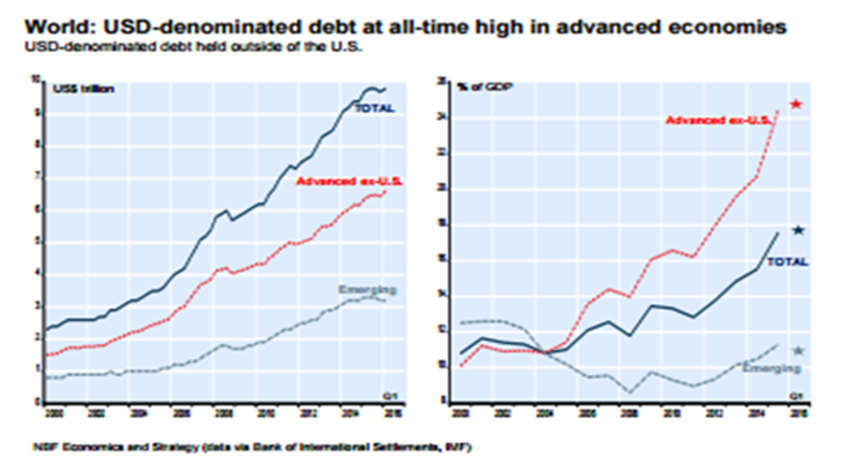

The second chart illustrates the exponential growth in outstanding USD-denominated debt. As the dollar climbs, this debt becomes gradually more expensive to finance. We view this as the largest source of potential problems. For many years, borrowers were enticed by the relative weakness of the USD as compared to the euro or the yen. Interest rates were also much lower in the U.S. than anywhere else. This situation has now reversed, and the order of magnitude of this trend is expected to increase.

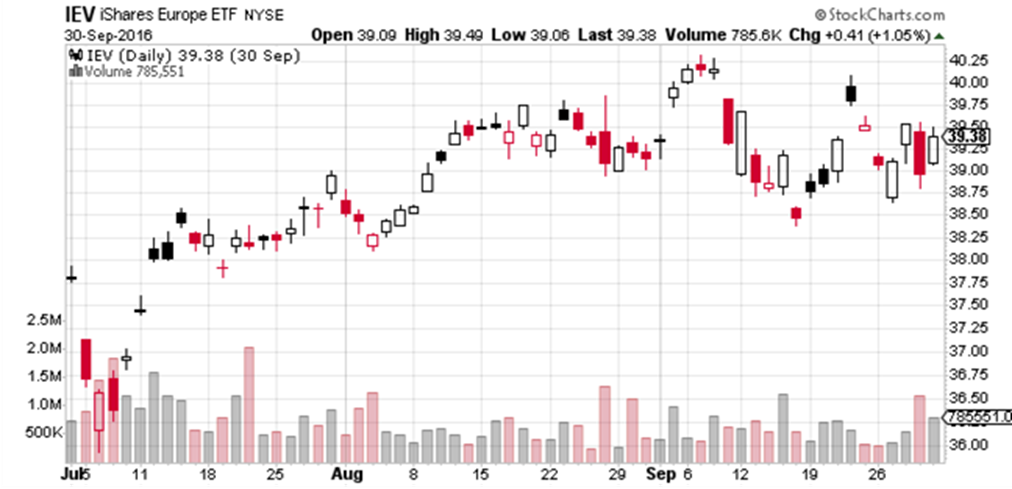

The following chart presents European equities in USD. It illustrates an upward movement for the quarter. The year-to-date figure remains negative, but this is largely due to the rise of the greenback relative to the euro.

It should be noted that European multinationals are at an advantage in this environment, since the low currency will help drive their sales and competitiveness. This may not translate immediately into much higher stock prices, but this currency advantage promises long term vigour. In addition, for many of these multinationals, the Brexit will not have a material impact on their businesses. Following the recent sell-off, their stock prices have fallen, as have all European stock prices. We still believe they represent a tremendous value.

4 Bonds and Interest Rates

The above chart of the U.S. 10-year bond shows a significant increase in yields, which hurt all bonds and bond-like securities, such as high-yielding dividend-paying stocks. At the end of the quarter, investors were locking in returns of 1.6% for ten years, when they agreed to 1.375% for the same term only 90 days ago. This move up is in fact quite dramatic.

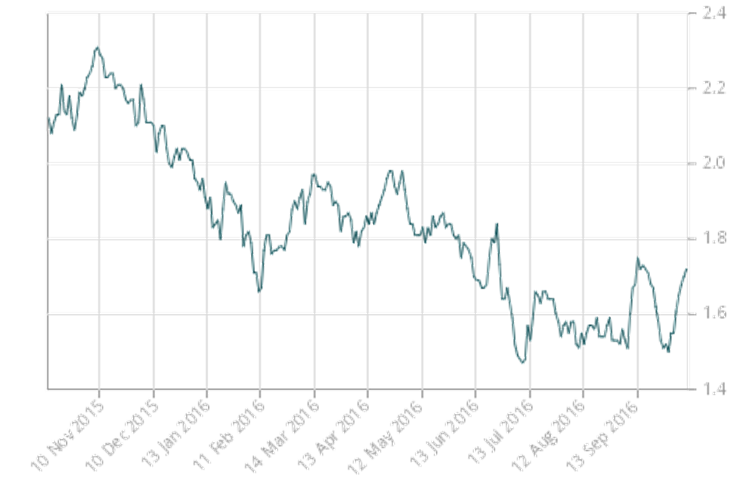

The graph below from the Bank of Canada shows bond yields for the 10-year maturity throughout the past twelve months.

The yields in 2016 for the 10-year Government of Canada bond ranged from 1.5% to a high of about 2.3%. By comparing the chart above with the U.S. Government bond chart shown earlier, we understand the reason for the loonie’s continued weakness: U.S. rates are moving up, while Canadian rates are in a downward trend.

This situation is not about to change soon, and our dollar will remain low for the near future. It would be surprising and somewhat worrisome to see our 10-year yields rise above 2% in the next year.

5 Options

The following VIX chart measures the volatility of the S&P 500 on 30-day rolling periods.

Volatility spiked again during the quarter, and significantly so. (Anytime the VIX rises above 20 signals higher-than-usual levels of investor fear.) Our strategy of selling options and collecting option premiums lets us convert market volatility into tax-advantageous income. Higher volatility means, higher option premiums to collect. More specifically, when the VIX goes above 16, we see better performance from the option accounts vis-à-vis our conventional accounts. This quarter represented ideal conditions for our conservative option strategies.

6 Our Opinion

We maintain our “cautiously optimistic” stance. We exert disciplined risk controls through our rigorous process of stock valuation. If stocks reach and surpass prices that our research demonstrates to be their fair value, we sell them and look for better opportunities.

Market volatility is not expected to abate in the near future. But for our portfolios, this translates into profit opportunities, as we take advantage of the lows to deploy capital. In this respect, we are watchful of data points such as the U.S. election and the unfolding political events surrounding the Brexit, as well as the state of the Canadian real estate market.

Given the various headwinds swirling around the world, we are comfortable holding a larger-than-usual cash reserve which is earmarked for deployment as the continued volatility uncovers attractive prices. Remember, we are working to provide tax-efficient revenue over the long term and to ensure our clients’ financial safety.