Let us examine the unintended economic consequences of recent years, discuss the key market developments from the past quarter, and explore the upcoming events that may impact investors.

The possibility of a recession has been a hot topic of discussion, making it one of the most anticipated economic events in recent memory. Although we experienced an economic slowdown last summer, robust employment data prevented it from being classified as a recession. This quarter, we observed a rebound in stock and bond prices, raising questions about whether this is a short-lived dead cat bounce or the beginning of a new bull market.

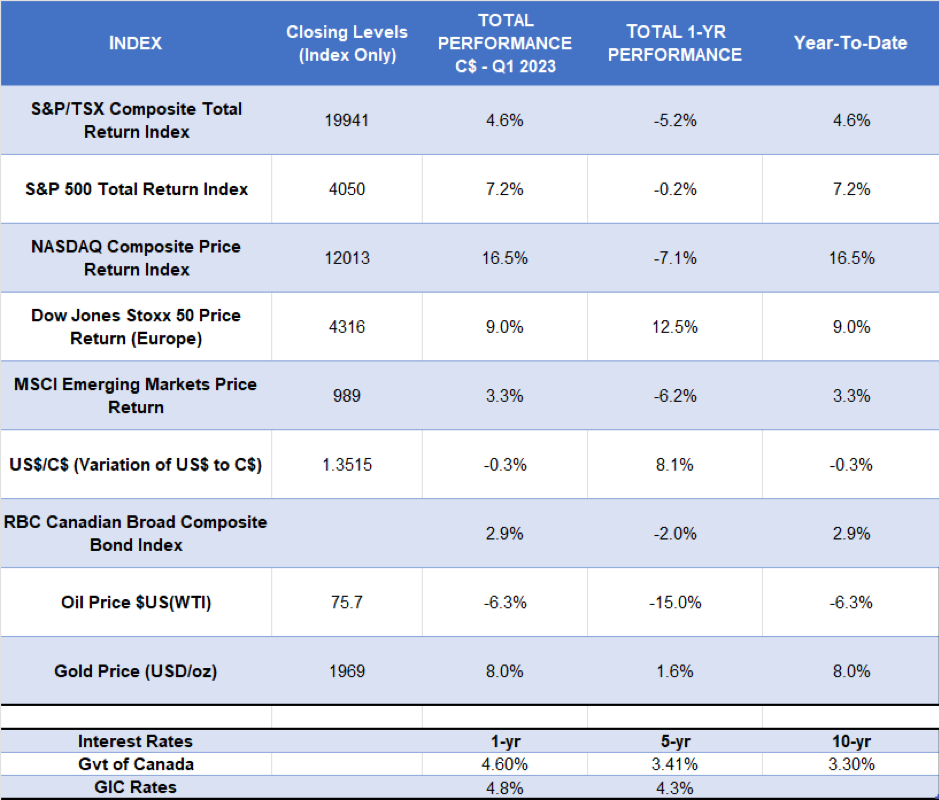

PERFORMANCE

This past quarter, the S&P 500’s performance has been particularly challenging for stock pickers like us, who select individual stocks rather than relying on index funds. Many of the index leaders are companies fall within the growth/tech sector, which is known to be highly sensitive to interest rate fluctuations. As interest rates decline, the valuations of these growth stocks tend to increase dramatically.

THREE-HEADED MONSTER

Investors are currently grappling with a three-headed monster: interest rates, slow economic growth or recession, and labor markets. As interest rates rise, the value of all assets tends to decrease. Banks, insurance companies, and pension funds also have to deal with the negative impact of these higher interest rates on their investment portfolio.

These “safe” investors – banks, insurance companies, and pension funds – must invest heavily in bonds due to their perceived lower risk than equities. However, in a rising interest rate environment, bonds may not be as safe as they seem, as bond prices fall when interest rates increase.

The recent rise in interest rates has brought serious consequences, with the current rate cycle being the shortest and most dramatic in the past 40 years. The speed at which rates have moved has significant implications for investors, particularly banks, insurance companies, and pension funds, which hold a large portion of bonds in their portfolios- in some cases, as much as a 20% decline in values has been witnessed.

RISKS OR OPPORTUNITIES?

While there are risks and challenges in the investment landscape, viewing them as opportunities for growth and profit is essential. Some of the prevailing challenges include demographic changes, shifting energy policies, increasing regulations, and the impact of inflation on consumer habits. These factors can be considered opportunities for investment ideas or monitoring existing investments.

- Demographic trends: As the Western world’s population gets older, there is a growing demand for technology, pharmaceuticals, and medical devices to address the needs of an aging population. Companies in these sectors can benefit from this demographic shift.

- Energy preferences: As the world moves towards cleaner and more sustainable energy sources, companies involved in renewable energy production, energy services, and infrastructure can capitalize on this shift.

- Regulations: While stricter regulations can be seen as a challenge, companies that can navigate and adapt to these regulations will have a competitive advantage over those that struggle to comply. This can create opportunities for businesses that excel in operating under stricter regulatory environments.

- Inflation: Brands with solid pricing power can pass on higher costs to consumers, protecting their profit margins even during inflation. These companies can be attractive investments during periods of rising prices.

When looking for new investment ideas or monitoring existing investments, focusing on companies that can address these challenges and turn them into opportunities can help position your portfolio for long-term success. By being aware of the prevailing winds and making strategic investments, you can capitalize on the changes in the market and create a strong and resilient investment portfolio.

In the face of economic uncertainties, it’s essential to remember the role of technological advancements in driving progress. Over the past 20 years, we’ve seen incredible innovations, from increased smartphone computing power to widespread internet adoption. While new technologies can sometimes be perceived negatively, viewing them as tools and opportunities for companies that can effectively harness and leverage these innovations are essential.

The barbell approach can be a helpful strategy during an economic slowdown or stagnation. This approach involves targeting companies and sectors that perform well during slow economic conditions, such as discount retailers or luxury brands that cater to a specific market segment unaffected by economic fluctuations. The barbell approach provides a balanced perspective during challenging times.

Conclusion

We have witnessed over the years that quality companies tend to prevail in the long run, despite economic slowdowns or periods of anemic growth. These strong organizations can capitalize on opportunities, such as acquiring competitors, enhancing their brands through advertising, and attracting top talent. It’s crucial to remember that bullish and bearish cases exist for every investment decision, and a balanced outlook is critical in navigating these economic challenges.