Video

Introduction

The current market quarter has been closely watched by investors, with their primary focus on whether the U.S. Federal Reserve (the Fed) would “stick the landing” amid rising interest rates. Investors are concerned that the Fed’s actions could push the economy into a recession, making this the most anticipated recession in recent memory. In this report, we will explore the market averages, inflation trends, and investor bullishness during this quarter. Additionally, we will define inflation and discuss its impact on interest rates and economic growth.

Market Performance

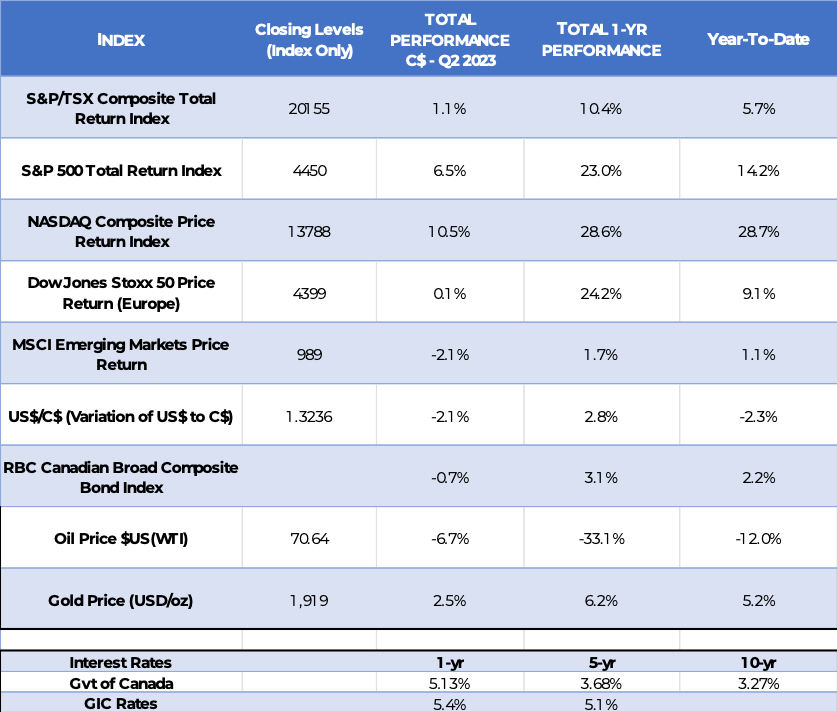

As you can see from the table above, the second quarter of 2023, the Canadian markets performed reasonably well, gaining 5.7% for the year. However, the S&P 500, which has a significant technology exposure, outperformed, rising 6.5% in Canadian dollar terms. The technology-heavy NASDAQ performed even better, gaining 10.5% during the same period.

Year-to-date, the S&P 500 and NASDAQ showcased impressive returns of 14.2% and 28.7%, respectively. In contrast, Emerging Markets, which are heavily reliant on China, struggled to generate significant returns. Bonds and oil faced challenges as well, while gold had a decent year, and interest rates continued to rise.

Understanding Inflation

To have a comprehensive view of the current economic landscape, it is crucial to define inflation correctly. Inflation refers to the general price level of goods over a specific period. In Canada, the Consumer Price Index (CPI) is utilized to track the percentage change in the price of a basket of goods and services over time. Inflation is not merely a measure of prices going up or down but rather the rate of change in those prices over time. The impact of inflation on interest rates and economic growth is an essential aspect of the current market analysis.

Inflation Components and CPI Calculation

The CPI basket in Canada comprises over 700 goods and services commonly purchased by consumers. Components like shelter, food, and transportation have significant weights in the index. While household and clothing expenses remained relatively flat, food and shelter continued to experience inflation. Notably, the increase in food input costs and the fluctuating prices of commodities, such as energy and industrial metals, have contributed to the overall inflation trends.

Interest Rates and Government Debt

With rising interest rates, investors are concerned about the potential impact on government deficits. Historical data shows that the US government has consistently operated with deficits since the 1970s, and as interest rates increase, government debt refinancing becomes more expensive. In Canada, government debt outstanding has risen significantly over the years, leading to concerns about the potential consequences of higher interest rates on debt refinancing.

Productivity and Investor Sentiment

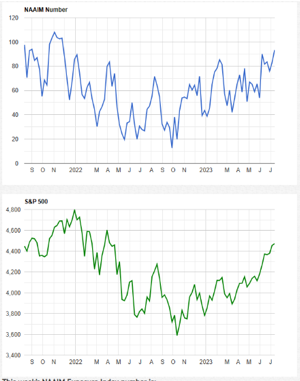

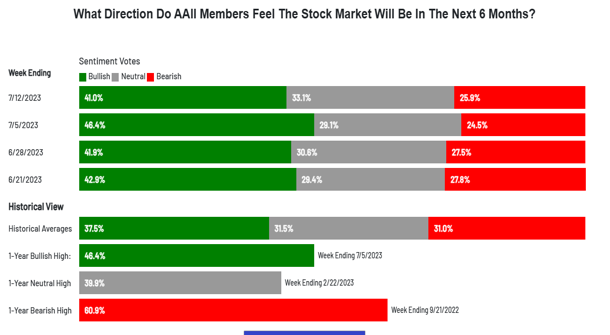

Two crucial factors in the current market outlook are productivity and investor sentiment. Decreasing productivity rates could hamper economic growth, even with full employment. On the other hand, investor sentiment is becoming increasingly bullish, with funds flowing into the markets, particularly sectors and countries offering promising growth prospects. Investors are increasingly comfortable it seems to pay more for this promise.

The Glass Half Full or Half Empty

Evaluating the prevailing winds of demographics, energy, regulations, and technology disruption, investors must assess whether their glass is half full or half empty. Commercial real estate, geopolitical tensions, and government spending are among the factors that bear scrutiny in the coming quarters. It is essential that we continue to monitor both the bearish and bullish perspectives to make well-informed investment decisions.

Investor Optimism and Market Indicators

Two market surveys illustrated above, the American Association of Individual Investors and the S&P 500 exposure index, offer insights into investor sentiment. Surveys indicate that investors are currently comfortable with equity exposure, potentially signaling a short-term market top, though not a definitive prediction. While these indicators provide valuable information, a careful balance of various tools and perspectives remains critical in analyzing market trends.

Conclusion

In conclusion, the current market quarter has been characterized by investors’ focus on the Fed’s actions, inflation trends, and the overall optimism in the markets. While certain sectors have performed well, potential risks in the form of rising interest rates, government debt, and geopolitical tensions are still with us. We remain vigilant and continue to employ a well-balanced approach to navigate the complexities of the ever-changing market landscape.