Only a mere 7 years ago, if I brought the subjects of tapering or tightening, most people would expect I was about to talk about clothing lines or haircuts. Today, the mere mention of either conjures up visions of how each tool of the Lord of Tailors, the Federal Reserve could invoke change or disruption in the markets and thus our investment portfolios. Thanks to the chatter and static in media circles, it’s no wonder this is one sort of diet we wish to avoid.

Sometimes the element of the unknown or just the need to understand what each really means can reduce anxiety and how the tailors at Exponent adjust a wardrobe to suit what the Central Bankers plan on delivering. A quick review:

Tapering is tightening

Sounds simple right? Well, when the Federal Reserve tightens monetary policy, the general belief at the table of Governors is that the economy is a tad overheated and there is a risk of inflation. The complete opposite of what happens during the clouds of a recession where rates are cut to “stimulate” the economy.

Tapering became vogue in a post-2007 collapse of Lehman Brothers and was instituted in varying stages and forms. The objective was to cut the Fed Fund rate to near zero % to support economic activity but also to sustain quality lending activity. In the first two rounds, the U.S Treasury focused solely on buying “short term debt instruments” which proved to have little effect. The next round was quick to be known as the “Operation Twist” and the buying focused on “longer term instruments”. Still a muted outcome. Usher in Quantitative Easing 3 (QE3) and the focus of buying a set $85 Billion of U.S Treasuries each month. Finally, the markets acknowledged the change and we’ve been riding that wave to new market highs ever since.

The problem is that the markets have become dependent on the monthly dose of “easy money” and sustained low rates. Now that the “tapering” has eased off, an economy growing with solid job creation, concerns about inflation, and now those handy transition lenses that have been somewhat dark for the last few years are clearing and are revealing a few scars and blemishes. Anticipating the removal of the QE punchbowl and the ensuing noise of the potential of rising interest rates, albeit minor in a global economy that I would best describe as still somewhat uneven, the Exponent tailors have completed a series of adjustments. How to recalibrate to the “potential” of “tightening”:

- Increase cash

- Avoid the smaller riskier stocks – focus on the larger cap stocks and buy on the “dips”

- Be disciplined and adjust that “risk appetite” now

- Beware of the pitfalls of selling out solid equities and running to short term bonds

That last one throws a lot of people because it goes against generally held beliefs when it comes to hedging against a Fed move. Why?

It needs to be properly framed to be understood that this well recognized asset class is NOT a “risk-free” one. Consider that when the Federal Reserve instituted their emergency actions in late 2007 -2009, they inadvertently adjusted the “risk and reward” fundamentals of all asset classes. A perfect example was the money you may have squirreled away in a bank. We all know how that worked out because inflation was still around. Thus your money, with the effect and inflation and taxes and earned zilch since then. For any of us being early or late to the game, we shifted our asset mixes to riskier assets so as to avoid losing money while the government borrowed more and more for 30 years at 3% or less. But where is the risk today of loading up on short duration bonds?

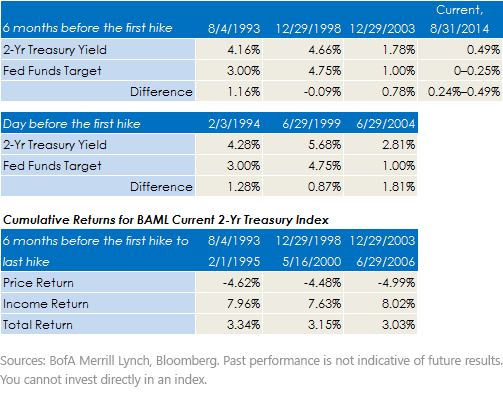

Yields and Total Returns of 2-Yr Treasury Notes during Past Tightening Periods- Yield and Rate Levels

I suppose a chart is worth a thousand words. In each of the 3 previous periods leading up to a rate hike, U.S Treasuries offered much higher yields which thus provided a bit of a cushion to offset the “losses” (bond prices drop when rates rise). Although our position is that we do not expect any aggressive move by the Federal Reserve to move rates up, the “unknown” of the exact timing and the existence of minuscule yields has a severe limiting effect on any margin of error this go around. The “total returns” in the 3rd segment of the Merrill Lynch chart validate our concerns about the greater potential of losses from shorter duration posturing during this potential tightening phase.

So if you’re concerned that your wardrobe is just hanging in a dark closest and needs an adjustment, don’t wait. Tightening, tapering, geopolitical risks, a strong U.S Dollar, China growth rates waning, Europe slowing down all have bearings on what is becoming