This past week I settled into watching a fascinating movie on Netflix called the Tinder Swindler. It was well done by today’s standards and in my opinion, the best takeaways were twofold:

- How society has allowed itself to replace traditional ways of gathering and transmitting information; and

- How we’ve been coached by social media to believe that a small amount of questionable information somehow makes us armchair experts.

We only have to look at the explosion of “information” during the pandemic about potential COVID-19 cures and treatments. The internet and social media have been inundated with advertising on a range of products, services and so-called scientific information that lure people into believing half-truths – only to discover the other side of the story when an event is triggered. This is the foundation of the Tinder Swindler story. (By the way, I do recommend the movie as it offers lessons on human compassion, loneliness and our desire to find ourselves.)

Passive Investing began with an index fund started by John Bogle of Vanguard Investments in 1975. That said, varying forms can be traced back to the early 1880’s.

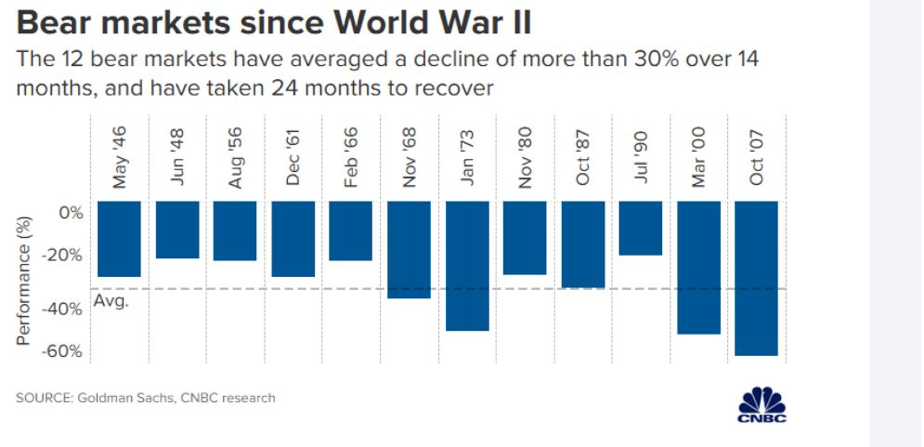

In essence, Passive Investing is a buy and hold strategy with minimal portfolio changes over time; it strives to mimic indexes like the S&P 500 and others. The theory is that long term, markets generally go higher and trying to beat the markets is a waste of time. Therefore, no decisions are made in terms of how funds are invested other than reflecting the market. This is considered a somewhat “apathetic” way of investing: no day-to-day decisions required. On the plus side, fees are generally low; however, investors surrender themselves to the daily twists and turns of the markets and forego any influence over key underlying corporate proxy voting, Where the index goes, so do my invested funds. In Tinder lingo, you can only swipe right because you are stuck with only one choice. I’m not convinced most of us want to lower our standards and date just anyone. In both the Tinder world and the world of passive investing, standards are often surrendered at the door. Does Passive Investing overexpose you to losses in a severe correction following a prolonged Bull market run?

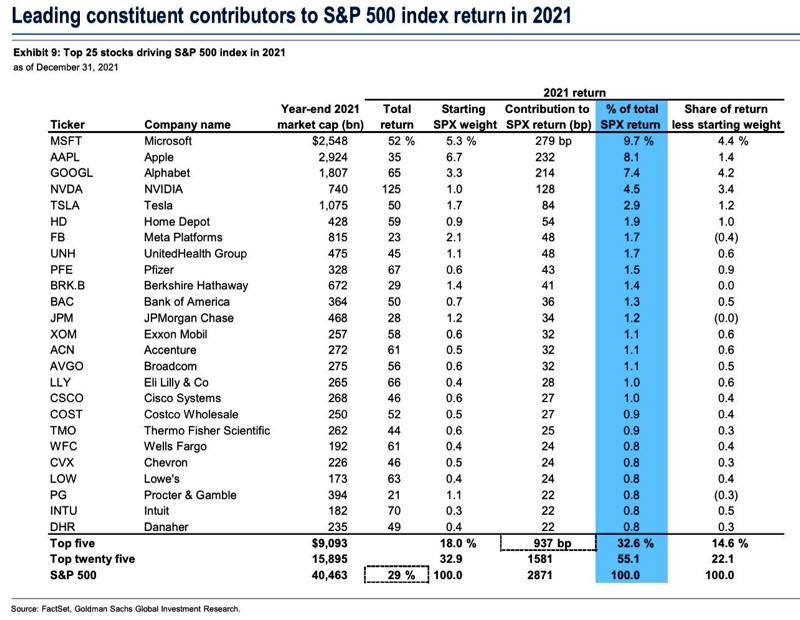

Examining the table above, your returns tied to Facebook (now Meta), Apple, Google (Alphabet) and NVIDIA which always comprise 20% of the S&P 500?

Now consider the alternative: the proven Active Investing model. Imagine turning over your wealth to a skilled Portfolio Manager who will work with you and examine your short, medium and long-term goals; and then integrate these goals into a personalized investment plan and factor in evolving market scenarios that allow your capital and on-going cash flow requirements to work in tandem. You may be retired or perhaps working towards retirement. You may have unique estate planning needs that a constrained passive investing strategy would never address. You may also have post-retirement plans that require careful and well thought out payouts that aren’t vulnerable to unexpected downturns or events. I’ve witnessed passive investors who lost 30% of their capital in 2008/2009, and waited years to recover their losses.

Invest with Confidence – Exponent, an active manager that is benchmark conscious but not benchmark motivated.

Exponent’s approach is to provide an active platform that develops solid personal relationships with our clientele. Today, many firms charge “a minimum” management fee for services rendered. Exponent chose not to follow this path, believing it was inappropriate for an investment firm to continue to be paid despite being slow to react or preserve clients’ capital during market fluctuations.

Our preference was to simply remove minimum fees and ensure complete alignment with our clients. If any account goes down, so does our revenue. If any account gains, so do we. On the upside however, we have a tapered schedule that means we get paid less on every additional $1 Million of assets under management as accounts increase and hit new milestones.

At Exponent, our Active Investment Process not only enables us to engineer value to our clients, it allows us to adjust risks, mitigate downturns and take advantage of on-going price oscillations. This investment platform is a partnership that aligns our success with your success.

If you love to swipe at random and don’t like what you see, swipe left, give us a call, and we’ll set up a date to chat!