Situation: Couple dependent on savings needs to raise and stabilize retirement income

Solution: Boost cash flow with investment income, use wife’s lower age for RRIF payouts

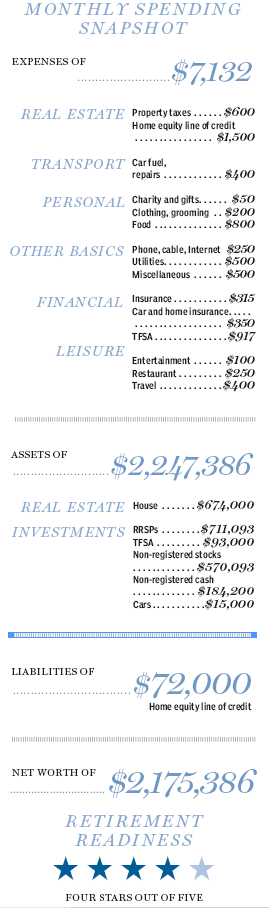

In Quebec, a childless couple – Max, 70, and his wife Phyllis, 68 – are both retired, Max from selling industrial products, Phyllis from chemical sales. Their pre-tax income from the Quebec Pension Plan and Old Age Security adds up to $2,960 a month, or $35,520 combined a year, with negligible tax. On top of that, there’s $184,200 cash in the bank, mostly from a recent inheritance. They use that cash to make up the $3,255 difference between pension income and their $6,215 monthly allocations net of savings.

Their problem is that, with no company pensions – and monthly expenses that far exceed their QPP and OAS pensions – they fear they could wind up depleting their $1.56 million in financial assets and perhaps have to sell their $674,000 house for something less expensive.

“We do not like the idea of selling our house,” Phyllis explains. “The house market here is in a serious slump and we like our place. It is spacious and in a pretty little town with easy access to Montreal. Moving into a small condo would cramp our style.”

Moving into a small condo would cramp our style

There is no immediate risk to the couple’s financial security nor need to sell their house. If nothing changes, their cash balance can continue to cover their income shortfall until they start receiving income from their Registered Retirement Income Funds when each is 72.

But there are risks, notes chartered financial analyst Benoit Poliquin, president and lead portfolio manager of Exponent Investment Management Inc. in Ottawa. “The couple likes to invest in volatile shares of companies in growth sectors like life sciences and high technology. Many pay no dividends. They are very risky. But grocery stores do not review one’s portfolio at the checkout counter. For now, the couple is asset rich and cash flow poor.”

Income management

A first step is to eliminate a $72,000 line of credit they used for house repairs. The interest is 3.5% a year, $2,520, but is not deductible from income. They are paying down the line of credit, at $18,000 a year. In four years, it will be history. They should use some of their $184,200 cash on hand to pay it off with no penalty, now, Mr. Poliquin suggests. It would save them $10,080 interest for carrying the loan four more years.

If Max and Phyllis use the value of their non-registered stocks, $570,093, and add the $112,200 of cash remaining after they eliminate their line of credit, they would have a total of $682,093 to invest. If that sum, which could be in stocks or other assets, generates a 3% return after inflation each year, then it would produce $20,470 each year in 2015 dollars before tax. That sum could be added to their current government pension income.

Before the end of the year when each turns 71, which is next year for Max and two years later for Phyllis, they must convert their $711,093 of RRSPs to a RRIF, with distributions beginning no later than the following year. In the 72nd year, it will be necessary to take 7.48% of registered assets out. That figure will climb each year to 8.75% at age 80 and 13.62% at age 90, levelling off at 20% of portfolio value at age 94 and every year thereafter.

The payments – starting at about $26,600 a year each for Max and for Phyllis, total $53,200 before tax when she starts her RRIFs – will narrow the gap between income and expenses.

Required RRIF distributions are below 9% of account value until age 82, but Max can mitigate the cost by using Phyllis’s lower age, three years below his own, when setting up his RRIF to reduce payouts by a few per cent each year. The scythe of tax will eventually reap all of their future growth and more, and bleed their non-registered cash. Taxes payable are likely to rise with distributions, though the distributable amount will vary with asset values every year.

That would make their total pre-tax annual income – consisting of $35,520 QPP and OAS, $20,470 of non-registered income and $52,200 RRIF income – add up to $108,190 before tax, or $83,300 a year after 23% average income tax. Each month they would have $6,942 to spend.

They would still have their $93,000 TFSAs, the result of maxing out their combined contribution room, $73,000 to date, and having good fortune with their investments. If they have not drawn down that account, it could, at present, yield $2,790 a year, or $233 a month at 3% after inflation in 2015 dollars with no tax. That would make total income $7,175 a month after tax and allow continuing TFSA contributions. The $1,500 monthly line of credit payments would be long gone with that cash available for travel, home improvements or further saving.

Stabilizing income

For now, the best move the couple can make is to move cash from near-zero-interest bank accounts to investment-grade corporate bonds with terms of no more than five years, or even a ladder of term deposits. They can gain perhaps 1% to 2% annual interest. They should use actual bonds, what one could call “the real thing,” which turn into cash when they mature and are thus more secure than exchange-traded bond funds that never turn back to cash. Though bond interest is less than interest on bank and utility stocks these days, the bonds would stabilize portfolio values in event of a stock market crash, Mr. Poliquin cautions.

Phyllis is an experienced stock investor with a preference for the riskier end of the spectrum. She can also mitigate risk with annuities, which provide return of capital along with guaranteed income. These days, one has to give up a lot of capital for relatively little income, because interest on bonds, the heart of annuities, is low. The couple could test the water with a small purchase of a prescribed annuity with known tax characteristics, then add to their annuities if they wish when they review their performance every few years.

Annuity payments blend interest, which is taxable, with return of capital, which is not taxable, and so help minimize clawback of applicable government benefits. The measure would create the equivalent of a defined benefit pension and stabilize their income.

“The couple must ensure a dependable income stream from investments equal to their needs,” Mr. Poliquin says. “They should make the portfolio tax efficient with growth, not only in assets but in income as well. That’s how they can keep their house and live well.”

Financial Post

E-mail [email protected] for a free Family Finance analysis