From Seed to Harvest

Despite calls for cooler temperatures and perhaps some more snow and freezing rain in the forecast, our patience and longing for the arrival of Spring

Despite calls for cooler temperatures and perhaps some more snow and freezing rain in the forecast, our patience and longing for the arrival of Spring

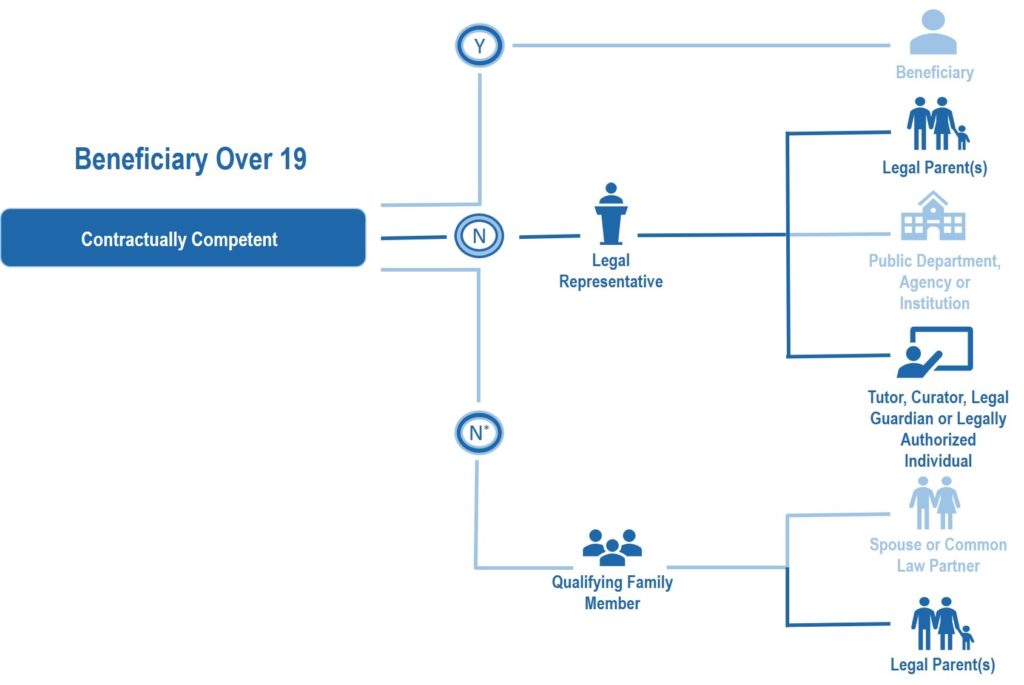

Registered Disability Savings Plans (RDSP) technically have three parties to the plan and each have their own eligibility requirements. There are three parties to an

Eligibility for the Disability Tax Credit is not based on a specific illness, condition or disability, but the degree and consistency to which the impairment

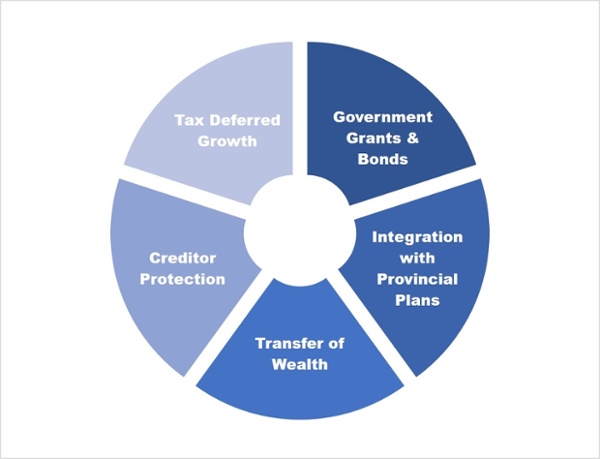

A Registered Disability Savings Plan (RDSP) is a long term investment vehicle for Canadians with disabilities. The plan is designed to build an asset pool from

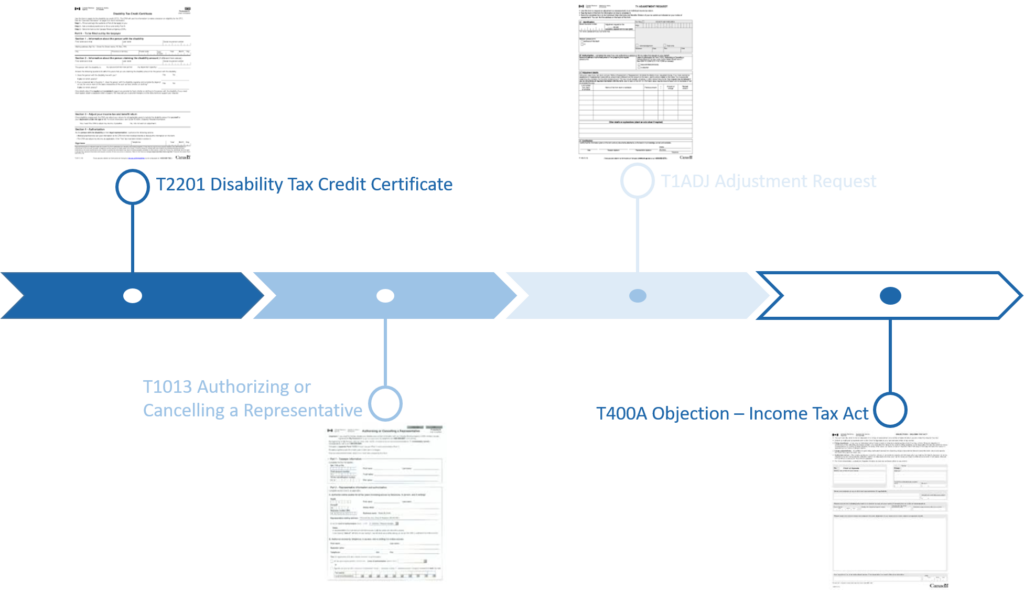

The Disability Tax Credit is an important tax credit for Canadians with disabilities, not just because of the $8,113 disability amount. The DTC allows you

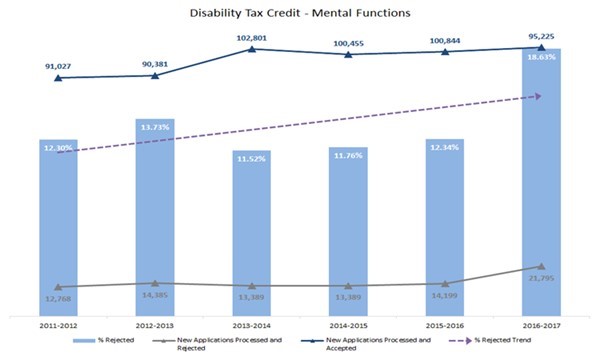

As May 7th-13th is Mental HeaIth Week I thought it timely to post about mental illness and the Disability Tax Credit (DTC). The Disability Tax Credit is

Let us begin with an introduction on OAS (Old Age Security). Canadian residents are eligible to receive a monthly annuity from the Federal Government once

Estate planning is one of those topics that many people prefer not to talk about, perhaps because it confronts us with the inevitability of our

"*" indicates required fields