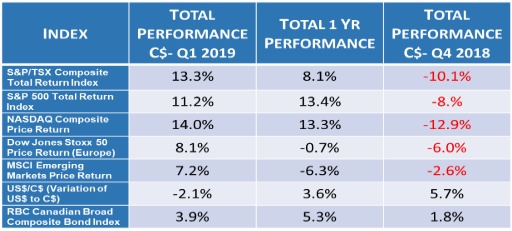

The Canadian markets rebounded smartly this quarter. Speculative stocks, such as cannabis producers, as well as certain sectors that had suffered through 2018, such as oil and gas producers and pipeline operators, had a good first quarter of 2019.

The U.S. markets followed the same narrative. Speculative sectors and maligned names that suffered through 2018 had a stellar start to 2019.

The bond markets rallied. In fact, we had an unusual situation for a few days where short-term interest rates exceeded those of longer-dated bonds. This state of affairs has since returned to a more conventional one.

The Canadian dollar gained slightly this quarter as the US dollar gave up some of its gains from 2018. Global markets rebounded as well, but global currencies were not as strong as our loonie, thus some of these gains were masked when converted back into US dollars.

The quarter’s strong performance can be explained by the fact that all the major central banks moved to a much more “dovish” stance. The previous “hawkish” stance for higher interest rates had hurt stock prices dramatically in Q4 of 2018. The result was stocks were in a severe oversold position at the end of the year. The new narrative of low interest rates caused investors to bid up prices for all assets. Stocks rebounded dramatically because of the oversold position and the new interest rate expectation.

While equity valuations remain reasonable, the meaningful corporate earnings growth that we witnessed in 2018 may prove difficult to surpass as structural employment challenges will raise employment costs. In addition, the effects of the one-time tax cuts adopted in 2017 the United States will be behind us. We expect the Canadian economy to show lacklustre growth, which will likely put a lid on corporate profits as well.

See our full 2019 Q1 Review Video below:

To follow along with our PowerPoint slides: Download them here!