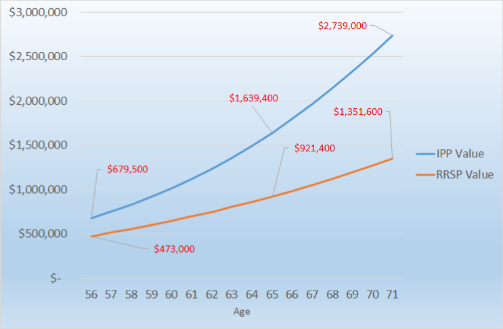

This graph shows how much faster the IPP value surpasses the RRSP value by 102.65% by age 71 due to the higher contribution limits. There is a $200,000 increase for the IPP vs the RRSP in the first year due to the past service contribution, which is a tax deductible expense to the business.

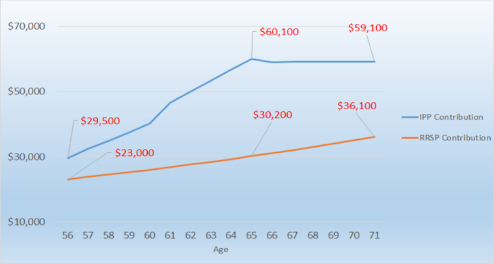

* Assumptions: 6% rate of return, 2.91% CPI (inflation), salary increase of 3% per year, investment management fees of 2.5% per year, maximum pensionable earnings each year, full past service from 1991. RRSP rolls into the IPP when the IPP is created, contribution timings are at the beginning of each year.

If you think that an Individual Pension Plan could be ideal for your situation, let us know. We will calculate the benefits of the IPP tailored to your situation for no cost or obligation. We will give you a detailed breakdown of how the IPP could work with your current situation.

An IPP is a defined benefit plan which is exactly like the plans you would be a member of if you worked for large employers such as railway companies or the federal public service. In the case of the IPP, your company is the sponsor of the plan. IPPs are specifically designed for business owners. Your RRSP would be considered a defined contribution plan. The difference between a defined contribution (where you don’t know the outcome, but know how much you can contribute every year) and the defined benefit (where your contribution will be based on your age, years of service and salary and the retirement benefit is known) is the fact that the investment risk is borne by the contributor in the case of a defined contribution plan and the risk is borne by the sponsor in the case of a defined benefit plan.

Operations Team