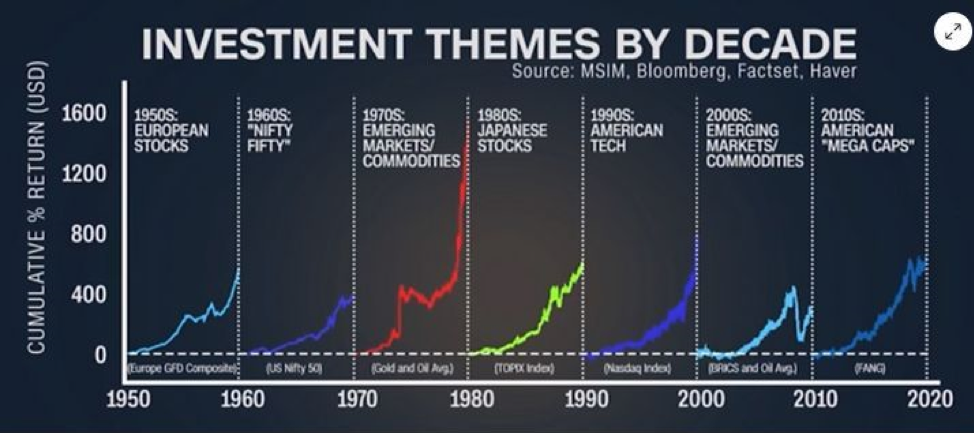

Identifying and participating in significant investment themes at an early stage is crucial for generating exceptional investment returns. Throughout the past 200 years, every decade can be characterized by a prominent trend that resulted in substantial profits for investors. For instance, during the 19th century, the establishment of canals, railroads, telegraphs, and electricity proved to be highly lucrative for investors, leading to the accumulation of substantial wealth.

In the 1950s, European stocks experienced significant growth as Europe rebounded from the devastating effects of World War II. During the 1970s, markets from developing nations also flourished, and in the following decade Japanese equities experienced a surge. The 1990s witnessed a massive bull market that reached its peak during the “internet bubble” era. More recently, the previous bull market was fueled by a select group of dominant companies often referred to as “Mega Caps,” which included FAANG (prominent American technology companies) stocks such as Microsoft and others.

Identifying emerging technologies and the impact of revolutionary geopolitical events can be relatively straightforward. It was obvious that canals, railroads, electricity, radio, and, more recently, the internet, would permanently change the world. The reconstruction of Europe following World War II is also a clear geopolitical instance.

Managing new and changing investment themes is a challenging responsibility. Many investors suffered significant financial losses during the Internet bubble due to their lack of awareness regarding the significance of short selling (the selling of borrowed stock with the intention of repurchasing at a lower price) overvalued stocks in the Internet industry. Additionally, stubborn investors who persevered through the subsequent Nasdaq crash ultimately surrendered their positions near the market’s lowest point. History repeated itself as retail investors lined up to throw money into marijuana stocks based on the publicity surrounding legalization, medical usage, and increased cash flow for government coffers only to see their investments go up in smoke. In 2022 investors learned a tough lesson about Green Energy and the pitfalls of “greenwashing” (the practice of making a product, policy or activity appear to be more envi-ronmentally friendly than it really is). While billions flowed into “green stocks,” during the 2022 correction, several organizations were exposed as having spent more time and money on mar-keting themselves as “environmentally friendly” than on minimizing their environmental im-pact. Some were significantly overvalued, and their market values subsequently plummeted by 60-90%!

Bear in mind that individual investors statistically show that 90 per cent of their trades fail to make money when trading the stock market. This statistic deems that over time 80 per cent lose, 10 per cent break even and 10 per cent make money consistently. According to the Data Science team at Capital.com, we can learn a lot about investors’ psychology from their trading patterns.

In the 18 months to July 2021, more than 70% of trades executed on Capital.com were closed within 24 hours—and nearly half (45%) were closed within 60 minutes. Meanwhile, losing po-sitions were closed 1.4 times more often within five minutes than winning ones.

“Hanging on to losing trades for too long and exiting successful positions quickly to lock in profit is often symptomatic of disposition bias, a common psychological trait which tends to affect novice traders,” explains Arty Rusetski, Head of Data Science and Artificial Intelligence at Capital.com

Currently, Artificial Intelligence (AI) is undeniably at the forefront of market trends, while other emerging areas have yet to receive the recognition they deserve: this, will become evident during the next bullish period. The primary challenge concerning AI, and other dominant investment trends, lies in identifying and understanding the risks, finding the most suitable avenues for investing and optimizing potential market gains.

Decades of thematic evolution have taught us that they are double-edged swords. Some are beneficial to societal advancement while others are misleading and warrant considerable caution before jumping onboard. It is therefore vital that the investment steward you select has the depth and tenure to recognize these evolving trends ahead of time, properly qualify and quantify their impact, and then carefully select those that will successfully navigate a rapidly changing environment.

Are you confident that your investments and legacy portfolio is correctly structured to address our post-Covid world? If you’d like to know more about this topic and ensure that your investments stand their best chance against volatility and risk, please feel free to reach out for a complimentary and comprehensive review.