Corporate leaders are waking up to a new reality: Canadian investors have started to voice their concerns on environmental, social, and governance (ESG) issues. This has been decades in the making and this movement is gaining traction. Corporate citizenship has taken on a whole new meaning and some investment firms have just begun to integrate sustainability issues into their investment platforms.

The Evolution of Impact Investing

Exponent was established by a group of investment professionals with over 130 years of global market experience. Our strength in using qualitative analysis and grading of global firms coupled with our diversity and complimentary backgrounds, lead to us to recognize the powerful force of consumers collectively channeling their savings to effect lasting change. So why not harness available investment capital in the same manner? Imagine personal investors harnessing their mutual wealth and translating their voices and concerns about sustainability and corporate responsibility into real action. Investors are shareholders and as such become the articulation of behavioral change. The firms they invest in can use their presence in the national economy as creators of jobs and generator of tax revenue to apply pressure to governments that they would shut down or relocate if positive changes were not forthcoming. This happened in South Africa and lead to the end of apartheid.

This had a powerful influence on me and lead to the development of a platform for like-minded individuals to use their hard earned capital and give it a real sense of purpose. Today it is referred to as “Impact Investing”. I lead this offering for the Exponent team across Canada for like-minded Canadians ready to join the $2 Trillion plus currently being deployed for this purpose.

Today’s headlines seem to be inundated with stories of political unrest, changing climate effects, global strife and the influence of evolving demographics on our economies. Various polls indicate that only 1/3 of North Americans believe that governments can effectively address these issues.

How can this be done effectively?

I believe positive change can be influenced by using an effective SRI/ESG (Environmental, Social, Governance) investment platform and Exponent’s approach is to engineer a customized portfolio for like-minded investors. Nevertheless, a recent study reported in Barron’s showed that of the 153 actively managed funds with an “ESG mandate” in the U.S, 68 failed to make the Barron’s main list of sustainable funds because they did not have a high enough sustainable rating. Holding individual assets as opposed to investment funds increases transparency and provides an opportunity to participate in the learning journey of Socially Responsible Investing by acknowledging a direct ownership in each firm.

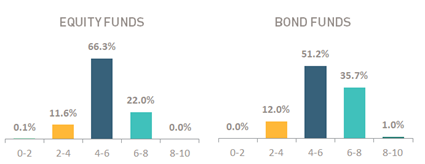

As the chart below shows, the majority of equity and fixed-income funds scored by MSCI ESG Research earned median scores. Two-thirds of stock funds scored by MSCI earned an ESG Quality Score of between 4 and 6, while 22% earned scores between 6 and 8, and 12% earned a score of between 2 and 4.

Among bond funds, 51% earned ESG Quality Scores between 4 and 6, while 36% earned a score of between 6 and 8, and 12% scored between 2 and 4.

The ESG approach is not without risk however innovation and change are necessary in the development of next generation solutions and improvements. Our clients are benefitting over the long-term by tapping into this evolving trend. Imagine investing in a well-known U.S based corporate giant making significant strides in becoming carbon neutral with a goal to go carbon negative by 2030! A company that witnessed its stock return 57.5%! Consider rewarding major oil and gas companies who are tackling the emissions challenge? Yes, it makes sense to direct investments to encourage firms embracing change.

Why? Many of the large firms are plowing millions into diversifying their assets into reducing upstream emissions by 85% by moving into renewables. Some enlightened producers who have invested in natural gas fields now acknowledge that 23% of all greenhouse gas emissions come from “flaring”. Efforts to reduce routine flaring by the large integrated oil firms are now starting to pay dividends. Big oil is beginning to listen as they need your capital and when it disappears, that sends a powerful message.

Why? Many of the large firms are plowing millions into diversifying their assets into reducing upstream emissions by 85% by moving into renewables. Some enlightened producers who have invested in natural gas fields now acknowledge that 23% of all greenhouse gas emissions come from “flaring”. Efforts to reduce routine flaring by the large integrated oil firms are now starting to pay dividends. Big oil is beginning to listen as they need your capital and when it disappears, that sends a powerful message.

Now here’s the good news: In 2019, a majority of ESG mandated funds and accounts actually performed as well as their benchmarks and in fact outperformed them so the correlation has been clearly demonstrated. As investors realize, like well-schooled Portfolio Managers, no company is perfect but those adhering to higher standards, transparency and honesty will be sought out in a changing world. These will be the core leaders of our shared future.

Investing our voices in tomorrow’s future begins today. Let us show you how you can make a difference:

https://www.investopedia.com/terms/e/environmental-social-and-governance-esg-criteria.asp