Executive Summary: Resilience and Recovery in Equity Markets

The final quarter of 2023 marked a remarkable period of resilience and recovery for equity markets, especially for fully invested investors. The performance contrasted sharply with the challenges of the previous year, indicating a robust turnaround. Managed accounts at Exponent Investment Management generally experienced returns ranging from high single digits to low double digits, averaging around 10%. This recovery was particularly pronounced when examined against the backdrop of the US market indices like the S&P 500 and NASDAQ.

Market Performance Analysis: S&P 500 and NASDAQ

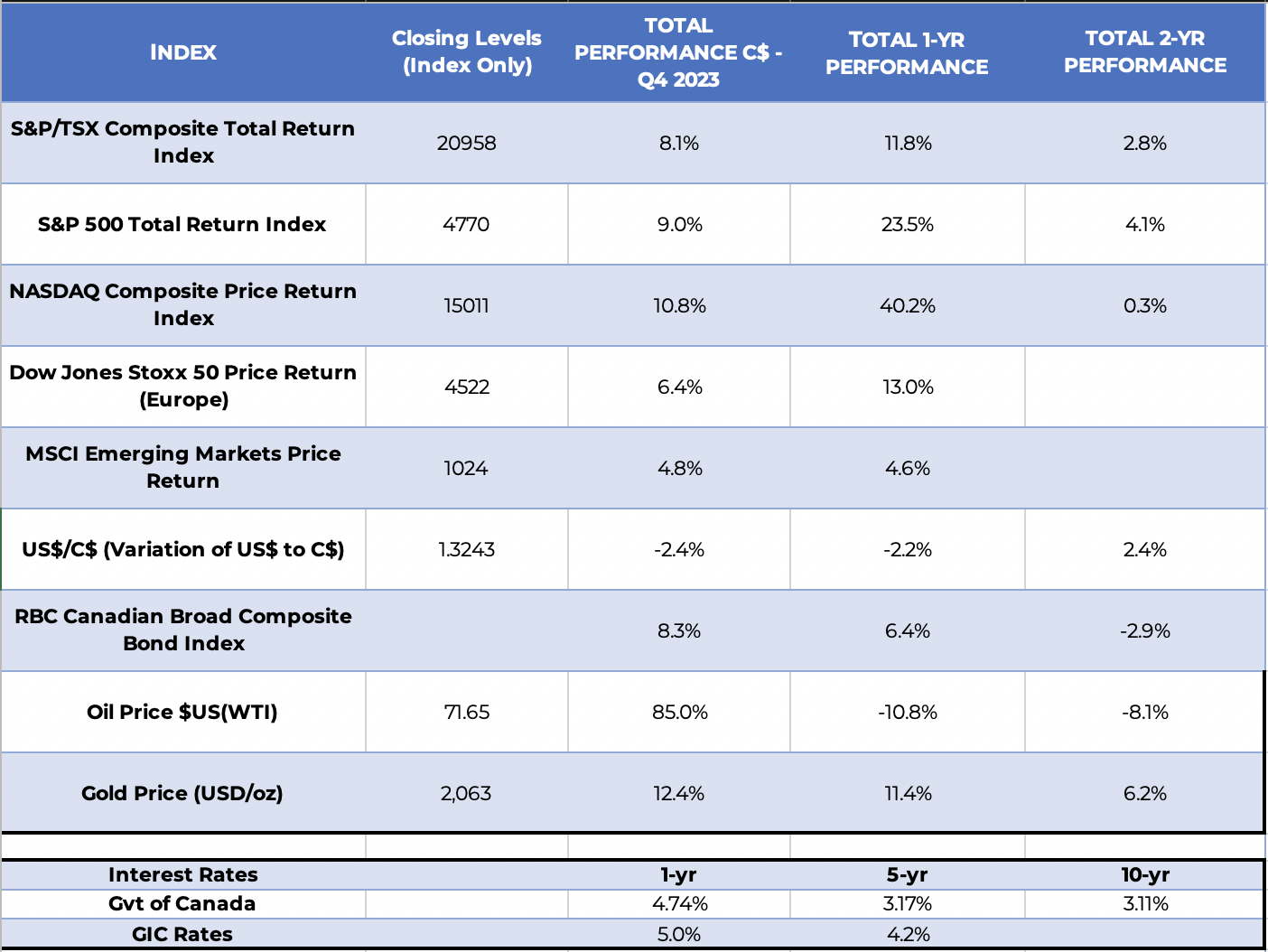

In 2023, the S&P 500 and NASDAQ demonstrated strong growth, with returns of approximately 24% and 40% respectively in Canadian dollar terms. However, a deeper analysis over a two-year span shows a varied picture: NASDAQ remained almost flat, while the S&P 500 saw a modest increase of 4.1%. This period reflected a recovery from the significant downturn experienced in 2022, underscoring the volatility and resilience inherent in the markets.

Portfolio Performance vs. Market Indices

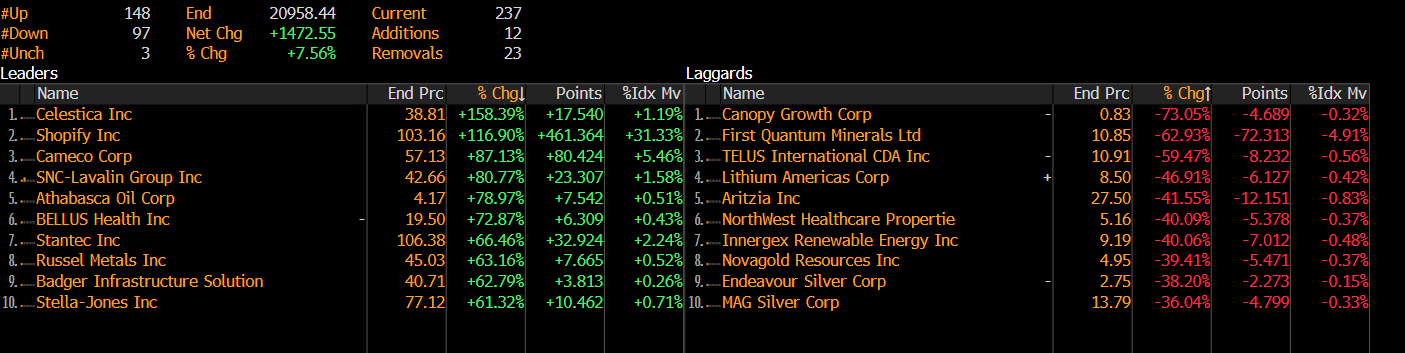

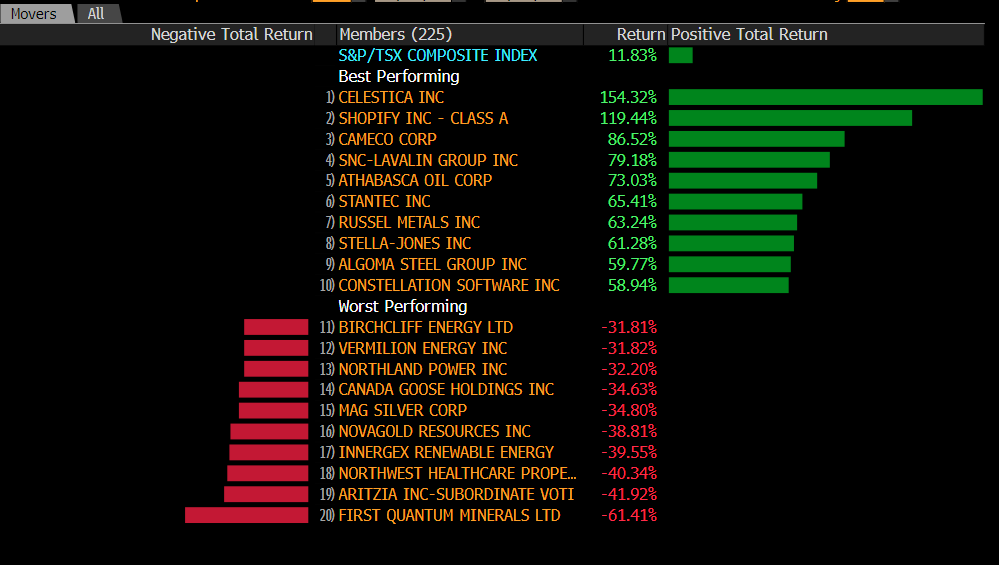

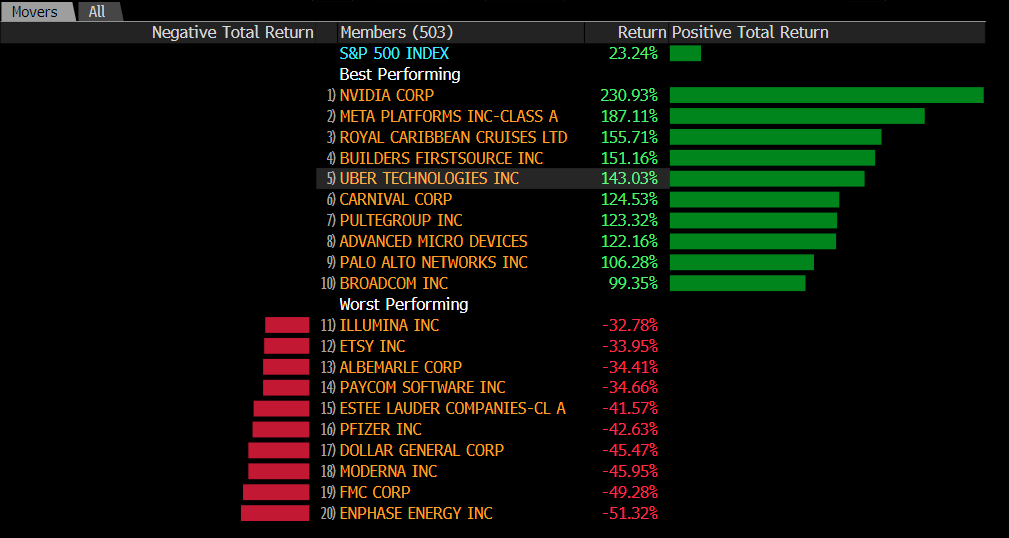

There was a noticeable disparity between individual portfolio performances and the broader US market indices. While the S&P 500, as represented by the SPDR ETF (SPY), showed a 24% appreciation in US dollar terms, individual portfolios did not always align with this growth. This variance is attributable to the specific composition and weighting within the S&P 500, where the top 10 gainers significantly influenced the index’s overall performance, contributing nearly 30% of the total return.

Insights on Portfolio Management

This divergence highlights the importance of strategic portfolio management and the role of risk management, which is often not a primary focus in the composition of indices like the S&P 500. A balanced and diversified portfolio typically avoids heavy concentration in a few stocks or sectors, leading to different risk-return outcomes compared to the index. An example of this is the equal-weight version of the S&P 500 (RSP ETF), which posted an 11.72% return, a more risk-adjusted performance compared to the SPY.

Conclusion: The Value of Balanced Portfolio Strategies

The fourth quarter of 2023 serves as a reminder of the importance of a balanced and diversified approach to portfolio management. While market indices such as the S&P 500 provide valuable benchmarks, they may not fully reflect the risk management considerations crucial to individual portfolio construction. This analysis emphasizes the necessity of understanding market dynamics and the significance of diversified, risk-adjusted portfolio strategies for long-term investment success. For further information or inquiries, please contact Exponent Investment Management.