Most of us who spend a lifetime of working hard, raising a family, owning a home and saving for retirement place a lot of stock in the quality of advice we receive along the way in guiding our success. Over the years a lot of noise has been made out of the financial community about the necessity to plan for our futures. To differentiate between saving and investing, to ensure that we carefully manage debt loads as we move closer toward those rewarding retirement years given the strain on social programs, the public retirement purse and the hidden costs of an aging population.

One “hidden” and potentially “ruinous” element has just surfaced to add an additional burden to one significant class of Canadians. An issue, not new to many in our industry, but has that avoided public discussion and now has caught fire in the press.

Imagine for a moment that you have been told for some time now that you as an individual have done everything correctly. You have amassed a decent amount of investments, paid off debts, helped put your children through school and now decided it was time to plan that trip you have always been told you could afford to do. A couple of weeks in London and Paris! You pop in to see your “advisor” and set it up. The cheque is cut and you’re told to come back in a week to pick up the tickets, map and itinerary.

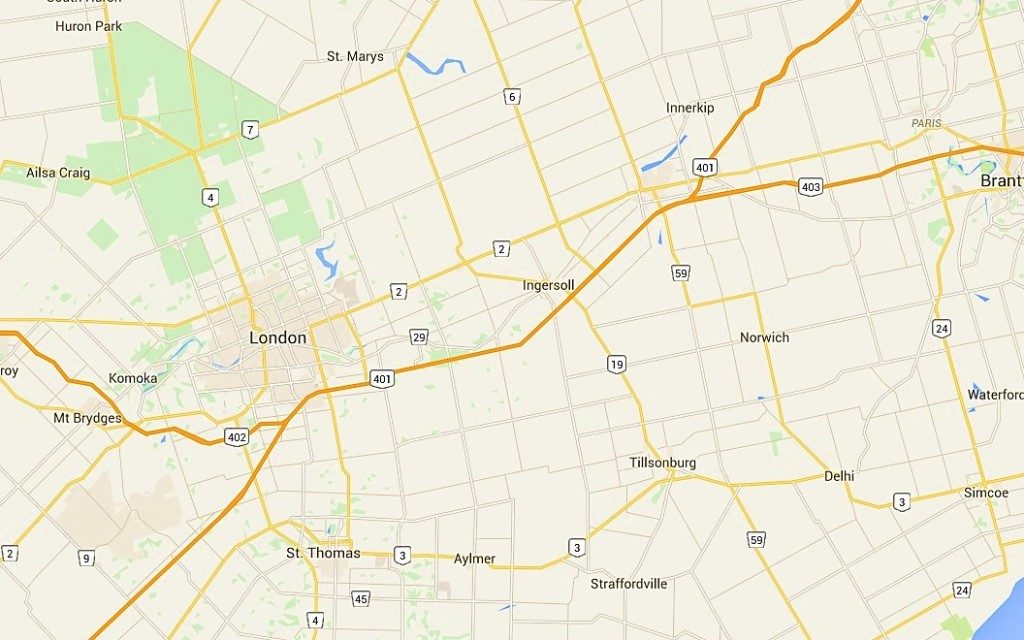

Your excitement builds and the week crawls along. You finally rip the last day from the calendar and head back to pick up the package. In your moment of enthusiasm, you pull out the map and see this:

When you were expecting this:

Map number one shows you will be traveling to lovely downtown London, Ontario and the quaint village of Paris, Ontario way over on the left hand side and not the overseas destinations you had hoped for. Why is that you wonder?

Well, it sums up what is going on in many of the large banks today in Canada. The wealth management divisions are being downsized and with it, the clients within these divisions are likely to realize a change in the “quality of advice being offered to a segment of traditional clientele”. In a piece that was penned only last week in the Globe and Mail, Scotiabank’s wealth management unit has targeted 7% of their brokerage unit and assistants as part of a cost targeting move. This is not unique to just Scotiabank. “The bank seems focused on serving the wealthiest clients and employing brokers with megabooks of business – the most assets under management – a burgeoning trend across the industry”. This should also raise serious concerns about the quality of advice being offered to a customer and given the reduction in adviser’s compensation by the banks; will this result in groups of clients having their best interests being tended to? http://www.pressreader.com/canada/the-globe-and-mail-ottawaquebec-edition/20160428/281986081747631

It should come as no surprise that the banks perception of greater profits and profitability lie with the larger and wealthier clientele. However, in the age of technology and multiple platforms, I would challenge that very assumption. Our experience has been the complete opposite. A sudden shift to a “one size fits all” mentality doesn’t work for every Canadian.

Having spent my first real working years in the hospitality industry, I learned early on never to judge “any book” by its cover. We never ask how much money the client had in his or her pocket as it was a foregone conclusion they knew prequalified their choice. They had arrived to enjoy a culinary experience, the great service and the ambience. In many ways, the same culture exists at Exponent. It’s the very reason why they end up in the “Europe’s London and Paris”. They may not always lodge in the most expensive hotels or eat at 3 star Michelin restaurants but we sure know how to be proper stewards of one’s accumulated wealth, dish up the right meals and guide you to “your objectives/expectations” and not those based on the profitability and needs of the service provider.

The message is a critical one: “Buyer Beware”, “Caveat Emptor” in the days and months ahead. The industry is about to go through a seismic shift and many of us are about to be quietly and unceremoniously downgraded. It is your legacy and that of your family’s.

Call us for an appointment if you feel this has or will now affect you. We have a table and flight waiting for you.