No one will argue that since Black Monday occurred back on October 19th, 1987, investors patience with market corrections have been tested with what feels like shorter intervals. We no sooner seem to tuck one incident away, a few years elapse and we are faced with yet another, the most recent being the decoupling of the Chinese economy and its impact of the global markets.

We all abhor uncertainty, fear and disruption. In 3 decades of navigating markets, I can attest to the ever evolving challenges of the construction and engineering of portfolios. We used to purchase bonds for income and as a defensive asset class against volatility in equity markets. The logic in this asset strategy was diminished quickly in a zero interest rate environment. We traditionally took on more risk (higher equity weights) during our pre-retirement years and increased fixed income as we approached retirement. Again, our job is not so simple in today’s stingy rate milieu. Even the old adage of diversifying outside of the small Canadian market has become an issue. Opportunities to avoid industry and sector correlation have diminished somewhat due to globalization.

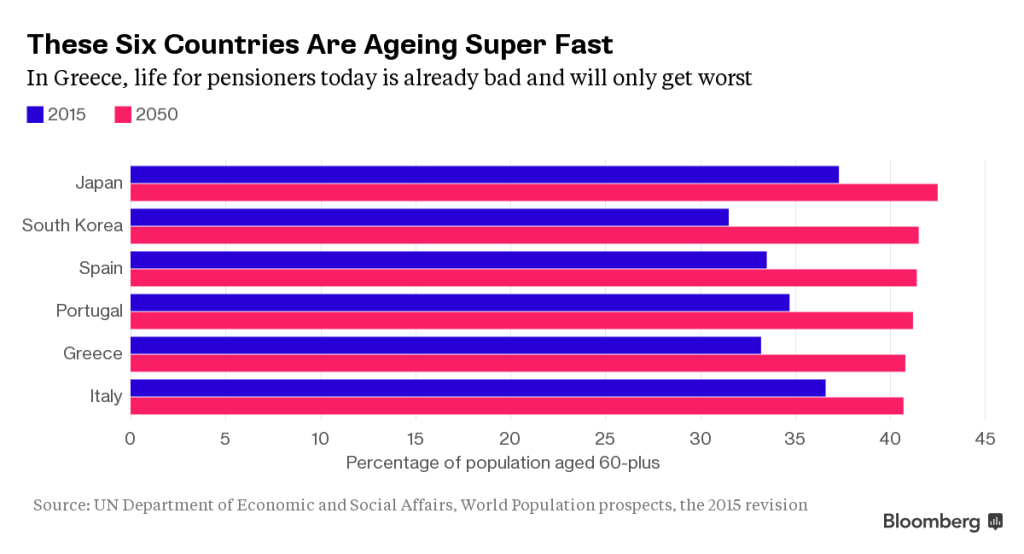

On the cusp of an upcoming election, there is yet another critical macro-economic tsunami that policymakers and market strategists in the major developed countries appear to be ignoring. We have a critical mismatch between older workers, aging consumers and few workers to replace those leaving the workforce. This has already begun in some countries:

It is estimated that by 2030, United Nations data reveals that the number of Canadian workers/retiree will drop by almost 50%! Our social system, whether it be your private pension plan, group RRSP’s, TFSA savings and the CPP/OAS are not being readied for this major economic headwind. It has the potential to affect anyone who is nearing retirement and of course anyone who has family that will be considering same during this timeframe.

As Canadians we are perhaps in a slightly better situation as our fertility rate, and focus on attracting “skilled” immigrants to Canada, will assist in mitigating the impact. However, a forward thinking investment counsellor and especially any investor will be integrating this specific dynamic into the overall portfolio construction. An equation of potential declining growth has to be considered and “where to unearth future opportunities”. Obvious standouts to avoid in economies following this demographic trend would be entities catering to young children – children’s clothing, babies needs etc.

Demographics have traditionally been a tailwind to the economic airplane but for the first time ever we are faced with a very unique new challenge in that the winds will change and become a significant headwind. If your portfolio strategy is being left on the wrong runway for takeoff, then I suggest you contact our control tower now before the wind changes course.