If you are retired, experiencing volatility in the markets can be a white-knuckle moment much like driving in a snowstorm. So how does one ‘get through it’ in one piece? The first step is to map out your journey. The next step is to get the right tools…and if you plan on driving in the winter, get a set of good snow tires. But know this, if you are shopping for snow tires during a snowstorm, you are too late. Understand the conditions and adapt to them.

Volatility is part and parcel to investing. Whether you are investing in equities, bonds, real estate or even private companies, investors’ opinion on the valuation of an asset will vary over time…sometimes violently. We all want the upside volatility, but we must live with the downside. However, you can mitigate (but not eliminate) the downside of investing. Furthermore, during the downturn, you can make it work for you. Here is how:

1. Have a financial plan.

All private investors preparing for retirement need a financial plan. End of story. If you do not have one, you will make emotional decisions during emotional times. These emotional times can be induced by life events, or by external political or economic events. We are emotional beings…we need to insulate ourselves from making long term decisions strictly based on “gut feelings”.

Retirement is about cash flow. Your financial plan should be able to tell you your liquidity needs at all times.

2. Have an investment plan.

Whether you are an index investor advocate, a do it yourself investor or you have hired out the investment decision you need to understand the course of action during good times and during the bad times. If you do not have an investment plan you will make emotional decisions you will regret.

The most important part of your investment plan is that you have ample liquidity that your financial plan calls for. You do not want to be in a position where you have to sell to pay the bills.

3. Understand what is going on.

The media is in the click business. No one clicks when it is only good news. Understand where you are getting your information, and ideally, focus on facts and not opinions. The goal is to have all the facts you can so you are able to make an intelligent decision. Understand you will not have all the facts, so focus on what you can know and keep an eye on the unknowns. The unknown unknowns (credit to Donald Rumsfeld here) are usually what get you in trouble. Be ready to pivot or change your course based on the data that comes in.

There will be lots of data points that will come in, the tricky part is figuring out what you need to ignore, and what you need to focus on. Investing is like warfare; you will be asked to make decisions based on incomplete or sometimes downright bad information. The more data you have, the better your philosophical and structured your decision making is, the better chance of making good decisions.

What I like to do.

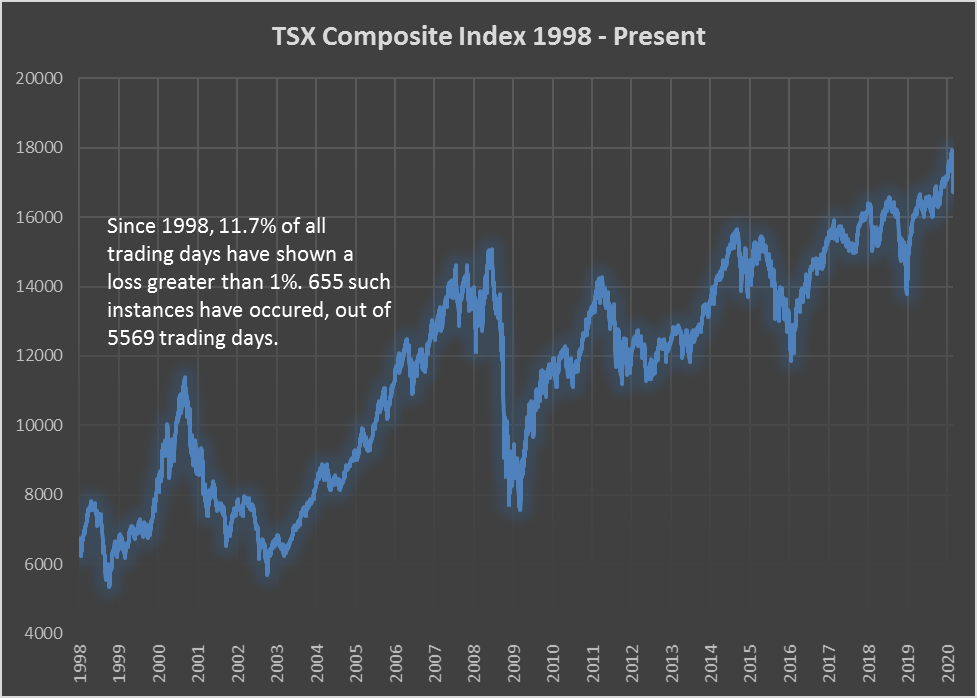

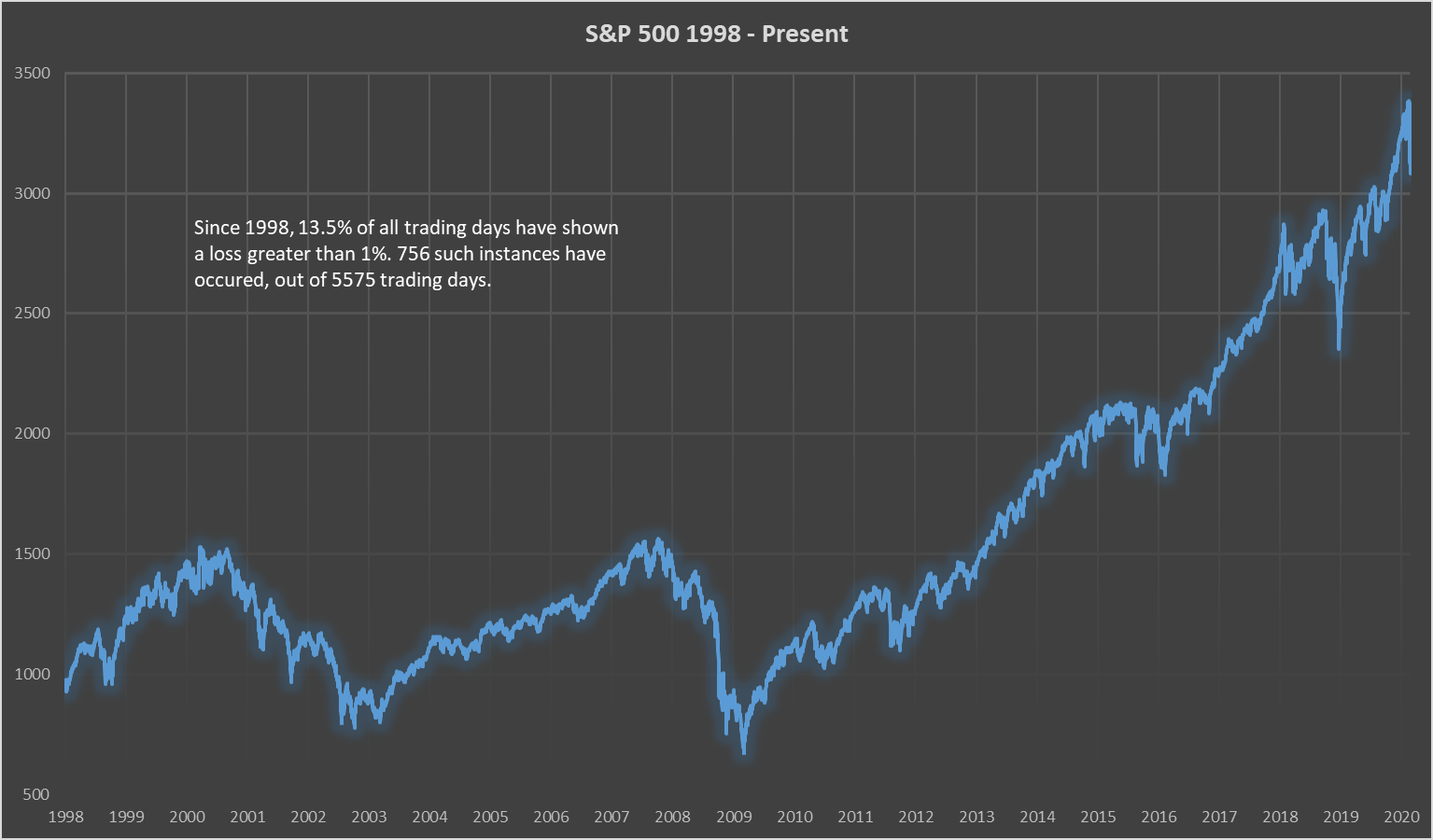

Let’s look at some data first. I have been managing money for a long time. I am privileged to be working along side portfolio managers that have even more experience. Here is the data background on downturns:

Based on this data, here is what I do know:

Current Situation:

Valuations:

Stocks in the US are/were expensive. I started selling back in the summer as stocks hit our sell prices. We purchased some stocks in the fall, but still have a 15%+/- cushion (ie cash weighting). For new clients, we were very slow in deploying capital. If you do not have cash now…as most investors like to be fully invested…that can be a problem.

Environment:

A few things I have noticed. Rates are extremely low. Going to bonds is difficult to justify unless we are going to a deflationary economic backdrop. Central banks are working diligently to avoid this by lowering interest rates to try and increase the speed at which economies are turning over. It is not working as most economies are older demographically. Old economies do not respond to low rates in the same way as younger economies.

These low rates have driven many to invest in stocks, real estate and private companies (private equity). The last two have performed admirably, but do not offer any kind of liquidity. In retirement, liquidity is paramount. It remains to be seen how this lack of liquidity will impact the performance of these two asset classes over the long term. We do know that interest rates and demand for space (a function of economic activity) will dictate the performance of real estate. The jury is still out on private equity as there is not even a standard method to value private equity and the proliferation of the asset class in portfolios is quite new (less than 12 years) and thus not crash tested.

We do know that large investors have increased their allocation away from stocks toward real estate and private equity. I share the worry that many have that the lack of liquidity in the private equity space and real estate will drive large investors to lower their public equity exposure (raise cash) to make the liquidity requirements for the beneficiaries of the pension plans. Since real estate and private equity assets have next to no liquidity…stocks will be the go to solution to raise cash.

The other interesting evolution is the advent of passive investing. Many of these large funds have turned their equity exposure over to index strategies. An index strategy is one where you invest your assets to mimic the composition of an index. Many private investors have done the same by way of exchange traded funds. Over the past decade, this approach as been the fastest growing approach and active (read stock picking) strategies have been become less popular.

Finally, banks and brokerage firms through regulation and economic reasons have moved away from providing liquidity. In other words, pre-2008, banks could and would be buyers of securities in down days (who doesn’t like a bargain?!?) only to sell them back to the sellers at higher prices. The risk and the new rules have curtailed this practice. The net result is that you no longer have intermediaries between sellers and buyers. When sell orders come fast and furious, it can be violent.

My Playbook:

For the accounts and mandates that I am responsible for, this is the approach I have learned and developed over the years.

- Understand the situation. In my opinion, the market was expensive and “looking” for a sell off. The environment mentioned above is the powder keg…and the fuse was the pandemic scare.

- The more violent and fast the downturn, the more fast and violent the bounce will be.

- Don’t be a hero. More money has been lost trying to pick a bottom than we’ll ever know.

- Stick to your process.

Here is the process I like to use:

- Ignore the noise and stick to the facts. As portfolio managers, we read a lot. We also have the opportunity to be close to clients. Some clients will find a downturn distasteful if not downright stressful. Yes, we hear you and are very much empathetic. However, our job as the portfolio manager is to check our emotions at the door and while we need to be empathetic, it should not influence the investment process. The same goes for the headlines we all read and the talking heads. Stick to the facts.

- Inventory what we own. As markets go up, you might have to make compromises on your investment as prices are high. Those compromises might become a problem. A compromise might be the price you paid, the debt levels being higher than what you usually are comfortable with, or an industry that looked attractive at the time. Own these compromises.

- Identify and watch any of the compromises. If they get worse, sell them (even at a loss) and this will give you a chance to upgrade to higher quality names. These higher quality names are also on sale…so you should be able to come out of the downturn with a higher quality portfolio with a good chance at a bounce back. Selling to go to cash is a bad idea.

- Your job as a portfolio manager is to be on the look out for investment candidates. Most we cannot buy for various reasons. Others are simply too expensive. Now is the time to take a look at the expensive candidates. Everything is on sale….so time to go shopping. Stick to quality.

- Do not be in a rush. Investing and deployment of capital is a process. Be methodical. I like to add to the existing positions that might be down to their initial target weight in the portfolio. I will then start deploying the capital on the names I think should be added. Figure out the price that makes sense to buy. When that price hits, buy it. Don’t be a hero and try and catch the bottom.

- Stick to the valuation you are comfortable paying. You might be looking at 15 buy candidates, but only 3 or 5 will get to the valuation you are comfortable with. Take your time…this is like baseball, there is no clock!

- Keep revisiting the facts and keep tabs on what you own. Are the facts still the same?

- Remember the data points. Refer to the charts attached in this document.

If you have a plan and a process, volatility does not need to be a gut wrenching experience. A focused investor with a good process views volatility as an opportunity to profit from the mistakes of emotional investors making bad decisions. Stay focused on your plan and your retirement will continue to be all that you dreamt it to be.