Those of us who have made a lifelong commitment to a specific career have no doubt discovered a few valuable lessons along the way. As I happily approach my 41st anniversary in the investment business, I’m looking back at some of those lessons. Considering the pandemic and current stretch of volatility, here are a few key takeaways I’d like to share with you.

- Market uncertainty is ubiquitous. Learn to embrace the errors you’ve made and never be ashamed to share them. They demonstrate the lessons you’ve learned, the skills you’ve developed and the decision-making processes you’ve fine-tuned.

- All risks (economic, political or social) can never be accurately forecasted nor quantified on a consistent basis. The current Russian/Ukrainian situation is a good example of the challenges faced by Investment Advisors.

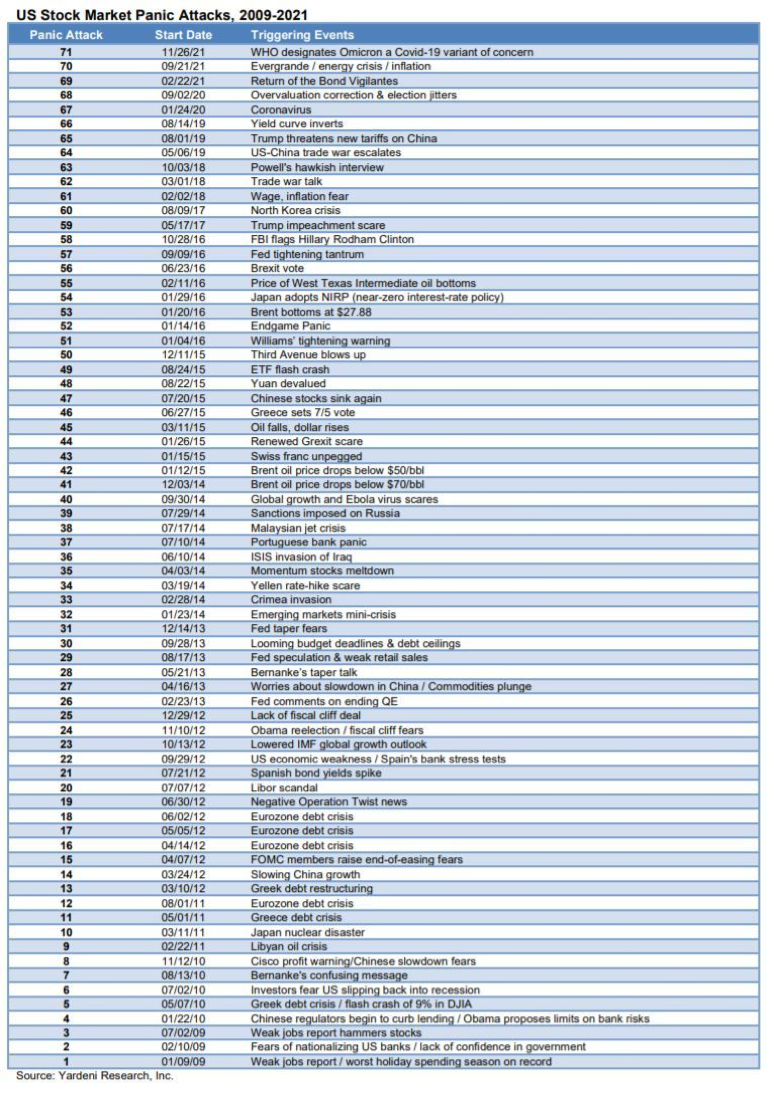

- Experienced Advisors armed with new technological tools, will always be prepared to price in uncertainty. When I first began my journey, there were fewer potholes to consider. To illustrate, there have been 71 disruptions absorbed by the market since the Great Recession of 2008-09 and the end of 2021. History has shown that retail investors quickly react to such disruptions and exacerbate market volatility.

- So why is it that experienced Investment Counsellors somehow manage to rise above all the noise and provide consistent returns that exploit these aggravating ripples?

a. First, focus on fundamentals. Avoid popular market favourites and concentrate on companies with less or modest leverage, provide unique products that are difficult to replicate, and have established records of consistent profitability during good and disruptive economic times.

b. Second, is not to confuse the short term with the longer term. Consider that few investors foresaw the 1987 market crash. Moreover, how can we forget the dot.com bubble? Few can say they were prepared for the widespread 2007 global market collapse. However, despite investor panic, markets have in fact returned an average of 10% over the last 50 years. Capitalizing on these moments of crisis is akin to waiting for opportunities to purchase assets at sale prices.

No one will ever get things right all the time; however, Exponent did pivot in late 2021 to a more defensive posture on the assumption that although the bond markets had already baked in rate increases in 2022, there still was a great deal of complacency in the equity markets. Over the last year, the U.S treasury saw a 60% increase in yield, and yet equity markets went merrily along and did not show any sign of correction.

Finally, where will the geopolitical problems of the day lead us? Will Russia back off the Ukrainian border and mothball any invasion plans? Last week China once again flexed its muscles by flying 39 jets into Taiwanese airspace. These are events that none of us can anticipate or control.

Let me leave you with these wise words from Warren Buffett in a 2009 letter to shareholders: Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”