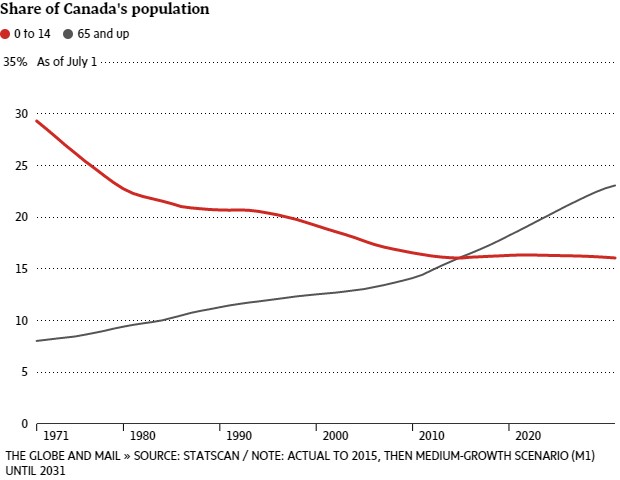

As we approach the next decade, Canadians will face a dramatic demographic shift. We call it the coming “Silver Tsunami”. The change will have serious and profound implications for the national economy, government policy and the well-being of its citizens. At the risk of sounding a tad apocalyptic, Canadians could be faced with decades of anemic economic growth, declining per capita incomes and wealth erosion. Governments could face ballooning deficits and difficult choices about the types of health care and social services that can be offered, as a shrinking pool of taxpayers must fund the rising costs of the growing numbers of seniors. We may witness widening gaps between the wealthy and poor as the adequacy of pensions and private savings are tested to their limits.

Only 18 per cent of the boomer generation has reached 65; the peak of the baby boom won’t reach that age until 2024. By then, more than 20 per cent of the national population will retirement-aged; by the mid-2030s, it will be closer to 25 per cent. Can we rely on any government to be there for this aging population? Not likely.

The Challenges:

- Only 24 % of private sector Canadians are covered by a pension plan.

- Insufficient savings and too much debt: Ipsos Reid survey of 12,000 Canadians in 2015 shows 49 per cent of people 55 to 64 say they have saved less than 10 per cent of their retirement target to date, while household debt levels average $71,815.

- Longevity risk – In reality, most people don’t know how long they will live and “average” life expectancy does not tell us who among us will be “average.”

- Costs of supplemental healthcare, retirement home or assisted living

- Prospect of continued low interest rates and challenging financial markets

The Answers:

Consider the idea of moving your defined contribution plan assets at retirement and transferring them to a “low cost” professional money manager. If you belong to a Defined Benefit Plan, ask if it is underfunded; are you certain of the company’s future viability? If not, consider taking out your accumulated value (lump sum) for investment.

- Get in and have a professional financial check-up well in advance of making the retirement decision

- DO NOT rely on CPP or OAS as the cornerstones of one’s retirement plan. These government plans should be “insurance only” and supplemental to your savings and investments.

- Have your current investments reviewed because tomorrow’s markets will NOT resemble those of today.

- Get YOUR Will updated!

Today’s investment firms have not taken the time to look out beyond a one year time horizon to plan for the way and means to restructure client’s lives sufficiently. Although everyone acknowledges the demographic shift, the key will lie in shifting your savings and investments to maintain your quality of life in the critical decades ahead. Information, knowledge, wisdom and being partnered with professionals looking beyond tomorrow unlock the formula for smart investors seeking future success.

A comfortable and worry-free retirement is about generating the income you need to lead the lifestyle you want. Gone are the simple days, with steady pension cheques, predictable world markets and outstanding health care made retirement your golden years.

As Socrates said, “The secret of change is to focus all of your energy on not on fighting the old but building on the new”. As investment professionals, time and again we can attest that one of the greatest impediments to successful outcomes when investing is procrastination. We allow the obvious to become our enemy. With so many facing retirement decisions, those now enjoying retirement and those making critical estate plans, let’s avoid making the error of waiting until we feel ready, we could end up waiting for the rest of our lives.

Make that call now to speak with the authors of this timely guide.